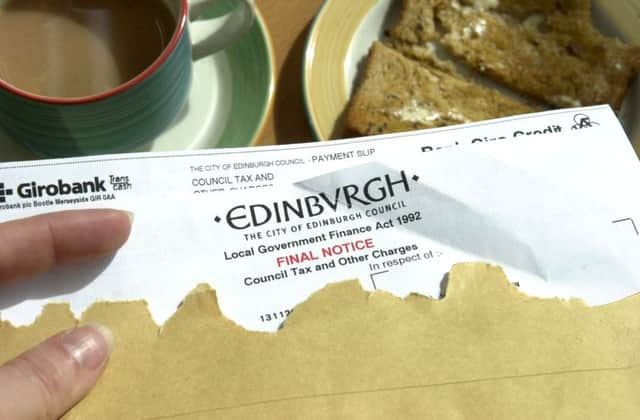

Scottish councillors require 30 reminders to pay council tax

The letters, revealed by Freedom of Information requests, were posted at a time many local authorities are facing swingeing cuts to their budget.

Glasgow City Council, which has 79 councillors, sent nine reminders, while Highland and Fife councils sent seven reminders each.

Advertisement

Hide AdAdvertisement

Hide AdFour Highland councillors were sent summary warrants after payments were still not made, with more than £3,000 unaccounted for.

Highland Council refused to name the councillors involved following an internal review, but said two were members of the SNP, one was a member of the Highland Alliance and another was an independent.

The figures were revealed by Private Eye magazine, which contacted 377 local authorities in England, Scotland and Wales that process council tax payments.

Of the councils that responded to its inquiries in full, 109 had a clean bill of health – no reminders needed to be sent.

More than twice as many – 243 councils – had sent reminder letters to at least one councillor, including 12 of the 32 local authorities in Scotland.

The exact number of reminders sent north of the border is unknown, as Perth and Kinross refused to give a figure, stating it was “fewer than five”.

Unlike in England and Wales, there is no summons for people to appear in court over an unpaid council tax debt.

Councillors south of the border can be barred from voting on local authority budgets if they have a conviction for unpaid council tax.

Advertisement

Hide AdAdvertisement

Hide AdThose who miss a council tax payment in Scotland are typically sent a reminder giving them seven days to pay the outstanding amount.

If no payment is made, a council can apply for a summary warrant, which means the individual concerned will not be given the opportunity to negotiate with the court before it is granted.

The amount due is increased as there is an automatic penalty of 10 per cent for each summary warrant has been granted.

Scotland’s 32 local authorities are due more than £1 billion in unpaid council tax. The highest total is in Glasgow, where £138 million is owed.