How much tax will I pay in Scotland? What the Scottish budget changed

The tax threshold for the top rate is being lowered to £125,140 from £150,000, meaning the SNP will break its 2021 Holyrood election manifesto pledge to freeze income tax rates and bands.

While many have been quick to point out that a similar change had already been announced for other parts of the UK by Chancellor Jeremy Hunt, with John Swinney describing the increase announced at the Scottish Budget as an "extra penny to enable spending on patient care in our National Health Service".

The Scottish Government changes

Advertisement

Hide AdAdvertisement

Hide AdPersonal allowance Under £12,579 - pays no tax Starter rate £12,57 to £14,732 at 19% Scottish basic rate £14,733 to £25,688 at 20% Intermediate rate £25,689 to £43,622 at 21% Higher rate £43,633 to £125,139 at 42% Top rate Over £125,140 at 47%

But how will the change impact you? Will you be paying more tax?

We take a look at the different salary brackets and the tax they will be paying in Scotland as a result of the change in Scottish tax bands.

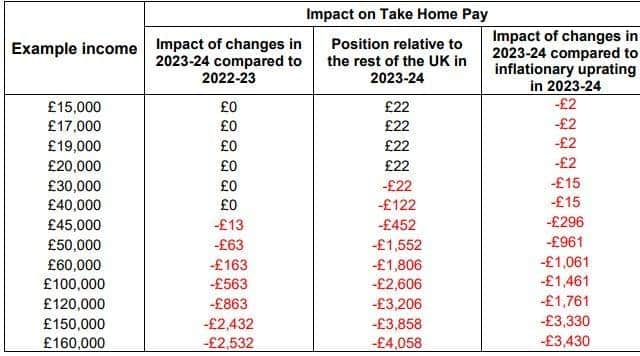

Salary brackets and the tax Scots will be paying in 2023-24 in comparison to 2022-23

£15,000 – will pay £0 more than they currently do but will pay £22 less than those in the rest of the UK.

£17,000 – will pay £0 more than they currently do but will pay £22 less than those in the rest of the UK.

£19,000 – will pay £0 more than they currently do but will pay £22 less than those in the rest of the UK.

£20,000 – will pay £0 more than they currently do but will pay £22 less than those in the rest of the UK.

£30,000 – will pay £0 more than they currently do and will pay £22 more than those in the rest of the UK.

Advertisement

Hide AdAdvertisement

Hide Ad£40,000 – will pay £0 more than they currently do and will pay £122 more than those in the rest of the UK.

£45,000 – will pay £13 more than they currently do and will pay £452 more than those in the rest of the UK.

£50,000 – will pay £63 more than they currently do and £1,552 more than in the rest of the UK.

£60,000 – will pay £163 more than the currently do and £1,806 more than in the rest of the UK.

£100,000 – will pay £563 more than they currently do and £2,606 more than those in the rest of the UK.

£120,000 – will pay £863 more than they currently do and £3,206 more than those in the rest of the UK.

£150,000 – will pay £2,432 more than they currently do and £3,858 more than those in the rest of the UK.

£160,000 – will pay £2,532 more than they currently do and £4,058 more than those in the rest of the UK.