WJM: no time like now to get your legal affairs in order

It’s safe to say we haven’t had the smoothest of starts to 2021. As Covid-19 lockdown measures persist up and down the country, and the pandemic continues to dominate our lives in one way or another, it certainly hasn’t been the beginning to the year many of us would have wanted after finally waving goodbye to 2020.

While the future still remains unclear, two solicitors from Scottish law firm Wright, Johnston & Mackenzie (WJM) discuss what we can expect, and how best to prepare for the year ahead.

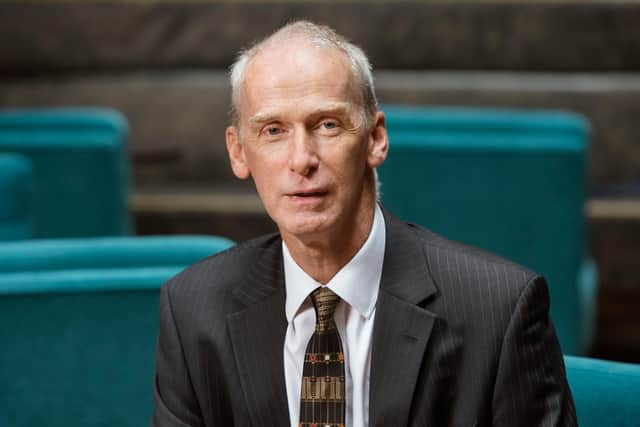

Ian Macdonald and Roddy Harrison, who both specialise in private client legal matters, including tax and estate planning, wills, and powers of attorney (POA), take a look at what 2021 may have in store.

Getting your affairs in order

Ian Macdonald notes that lockdown restrictions and a lack of face-to-face meetings need not be a barrier for anyone considering getting their legal affairs in order.

He explains: “While I can’t possibly say it is ‘business as usual’, given the ongoing circumstances we find ourselves in, it is true that a lot of the work our team does is still continuing as normally as is possible.

“We want to make it clear to our clients that while lockdown guidelines remains in place, we are completely available to them. We’ve had a long time to adapt to remote working, and thanks to all the technology we have at our fingertips, we can speak to clients in a whole manner of ways now.

“While paper documents are still required for various aspects of legal affairs, I think the industry has adapted fairly well, and there are ways of doing things virtually now that we wouldn’t have thought of doing in the past.

Macdonald continues: “For a lot of people, things remain very uncertain at the moment, so the New Year offers an opportunity to take a step back and evaluate how things are going and what they’d like to happen in the future – whether that’s in relation to their personal finances or their business.

“Taking the time to review your tax liabilities, power of attorney and will is a very sensible thing to do at this time of year, when lots of us are planning ahead and thinking about our future. It makes sense to use his period to sort through these matters.

“Many are likely to have spent more time thinking about their health over the last year than they have in the past, with the pandemic forcing us all to stop and think about this aspect of our lives we may previously have brushed to the side.

“We certainly noticed a sharp increase in enquiries from people getting their wills and power of attorneys in place or updated back in March and April time, at the start of the first wave.

“As morbid as it may sound, being confronted with the pandemic made a lot of us realise that we are more vulnerable than we may have once thought, and some things are completely outside of our control. Therefore, it’s important to have these kind of documents in place so that when the time comes, family members aren’t left with even more to worry about than is necessary.”

Harrison agrees, adding: “Lots of people make the mistake of thinking once they have a will and power of attorney in place, they don’t ever need to think about them ever again. However, you’d be surprised at how often I speak to clients who review these documents and realise they’re completely outdated.

“Power of attorneys, in particular, are very sophisticated nowadays, allowing much more flexibility than they once did. In these documents you can appoint one or more people to make decisions on your behalf, should you ever become unable to make your own, allowing you to have more control over what happens to you should you ever be in a position where you lack mental capacity.

“You can appoint various different people to look after individual aspects of your affairs, such as financial, care and welfare, and it’s not unusual for a POA to be quite lengthy now, so it’s particularly important to ensure yours is up to date and fit for purpose as your circumstances evolve over the years.”

Living wills

Harrison observes that living wills are growing in popularity, and predicts these will becoming increasingly popular this year in the wake of the pandemic.

He comments: “Covid-19 has really brought this issue to the fore. The crux of a living will is essentially giving directions as to when to stop treatment and medical intervention. Many think of them purely as a DNR [do not resuscitate order], but actually it can be much more subtle than that.

“There are so many nuances and specific details when it comes to an individuals’ circumstances, but ultimately, it all hinges on the notion of the right of the individual to choose when is the right time for them to be allowed to die.

“A living will provides a little bit of certainty for individuals that their wishes will be followed if their family have to think about these extremely difficult circumstances.

Harrison adds: “It’s an incredibly sensitive topic, but the reality is many of us have now been forced to think about how long we’d like to be kept alive should we ever be in a position where we cannot communicate our decisions. Likewise, it’s made a lot of people wonder how long our elderly relatives would want to go on receiving medical treatment, should the same happen to them.

“Living wills are already growing in popularity, and it’s certainly a concept which is becoming more prevalent, particularly as the right to die debate continues to wage.

“As with creating a will and power of attorney, it can be very difficult to think about the point in your life when these documents may be required, so many avoid it altogether. However, while it is an emotional subject matter, it’s really important to get these documents in order.”

Tax

Both solicitors agree that the potential for steep tax increases is an ongoing concern for many at the moment, following the unprecedented levels of financial support the government has provided to aid businesses, individuals, and the health service throughout the last year.

Macdonald says: “The Chancellor has rejected proposals to introduce an emergency wealth tax, however, there are suggestions that capital gains tax may be set to rise rather significantly. While we can’t predict the future, it’s probably safe to say it is unlikely to decrease, so many are choosing to take their gains this year and save themselves from the rise that is potentially on the horizon.”

Harrison adds: “It’s evident that somebody, somewhere, is going to have to pay for the vast levels of government funding given out. When and how this will happen is anybody’s guess.

“So much depends on the economy, which in turn depends on the progression of this virus and the vaccination programme, so it’s impossible to predict a timeline. However, it’s unlikely that the situation will change significantly before 1 April, so now is the ideal window of opportunity to get your affairs in order before the end of the tax year.”

Family business

While some family businesses are doing better than ever at the moment, there are some who are struggling and have been hit hard as a result of the pandemic.

Along with colleagues in WJM’s dedicated family business arm, Family Business Solutions, this is an area where Macdonald and Harrison can specialise on giving advice.

Macdonald says: “Sometimes, it can take a crisis to get a family business around the table together to hash out their plans for the future and what their next steps should be.

“If you’re a family business owner, regardless of your situation right now, the start of a New Year is an ideal time to think about your future and start putting a succession plan in place.”

If the last 12 months have taught us anything, it’s that it would be foolish to try and second guess what could happen over the coming year.

However, WJM’s team of legal experts will continue to provide guidance and support, helping clients to plan for the future and achieve their goals. Find out more at www.wjm.co.uk.