House prices in Scotland rise by more than UK average

Analysis from the Office of National Statistics (ONS) found that the average house price in Scotland reached £180,000.

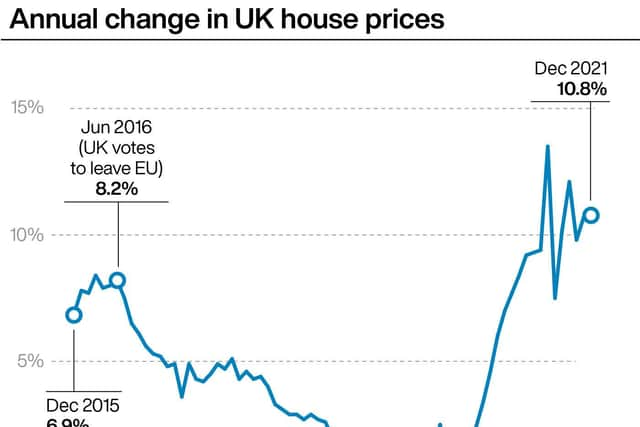

Across the UK generally, house prices increased by 10.8% over the year to December 2021, according to the UK House Price Index.

Advertisement

Hide AdAdvertisement

Hide AdThe ONS found that the average house price across the whole of the UK reached record levels in the month of December, with the average UK house price increasing by £27,000 last year, ending 2021 on a record high of £275,000, according to official figures.

ONS head of Inflation Mike Hardie said: “House prices in the UK all reached record levels this month, with the average UK house price at £275,000 in December 2021, £27,000 higher than this time last year.

In Scotland the average house price increased by 11.2% over the year to December 2021, and while lower than the 12.1% increase in the year to November 2021, average price increases were recorded in all 32 local authorities across the country.

The largest increase was in Fife where the average price increased by 16.0% to £166,836. The smallest increase was recorded in Aberdeen, where the average price increased by 3.5% to £148,251.

Edinburgh remained the highest-priced area to purchase a property with the average price sitting at £312,459.

In contrast, the lowest-priced area to purchase a property was East Ayrshire, where the average price was £121,488.

Commenting on the house price figures in Scotland, Registers of Scotland (Ros) Business Development Director Kenny Crawford said: “The average price of a property in Scotland in December was £180,485, slightly lower than £183,876 reported in November 2021 which was the highest reported for any month since January 2004, from when Scottish data for the UK HPI was first available.

“Over the year as a whole, from November 2020 to the end of October 2021, the number of transactions has picked up following the reductions caused by COVID-19 measures and cumulatively is now 67% higher than the previous year.

Advertisement

Hide AdAdvertisement

Hide AdFigures in the current year to date are also 15.5% higher than pre-COVID-19 figures from November 2018 to October 2019.”

According to RoS figures detached properties showed the biggest increase out of all property types, rising by 16.7% in the year to December 2021 to £330,461. Flatted properties showed the smallest increase, rising by 5.9% in the year to December 2021 to £122,189.

A separate ONS report also released on Wednesday showed that private rental prices paid by tenants in the UK increased by 2.0% in the 12 months to January 2022 – representing the sharpest annual growth rate since February 2017.

Excluding London, private rents increased by 3.0% year on year.

Nitesh Patel, strategic economist at Yorkshire Building Society, said: “A key challenge in the current housing market is the lack of supply of homes for sale whilst demand continues to remain strong.

“For most of last year the stamp duty holiday had provided a boost but even after that ended prices have continued to rise. Low borrowing costs and a strong jobs market are key drivers but in the coming months a further deterioration in household finances may take some of the heat out of the market.”