British Gas, Octopus Energy and Shell Energy: Direct debits have doubled after energy increase as Scottish Power boss issues stark warning

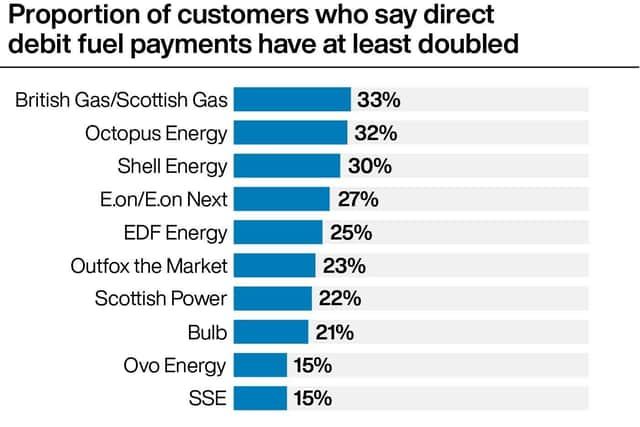

The website, founded by Martin Lewis, said at least 30% of customers with those companies, who were in credit and on a price-capped tariff, reported their direct debits increasing.

Across all companies, 25% of customers in this situation said their direct debits had doubled or more.

Advertisement

Hide AdAdvertisement

Hide AdEnergy prices have rocketed in the last year, and last month the energy price cap was increased by 54% for the average household.

The results were gathered from a survey carried out by MSE between April 26 2022 and May 3 2022, with 41,000 responses.

It added that the survey was self-selecting, so some people may have responded more frequently.

However, it said that even if the proportions are “skewed”, the results show a material number of people reporting their direct debits doubling.

The survey also found that those coming off fixed deals saw their direct debits rise the most.

The boss of Scottish Power warned that millions of customers face an horrific winter unless there is a major government intervention in energy firms.

Keith Anderson, chief executive of Scottish Power said that another expected rise in energy bills in October to between £2,500 and £3,000 a year could see huge losses for suppliers and many customers unable to pay their bills.

He added: "We need to be realistic about the gravity of the situation - around 40% of UK households, potentially 10 million homes, could be in fuel poverty this winter,"

Advertisement

Hide AdAdvertisement

Hide AdMSE said this is to be expected as they were likely on the cheapest tariffs and are now moving to the price cap.

It will be reporting its results to energy market regulator Ofgem, the Department for Business, Energy & Industrial Strategy (BEIS) and the Business Committee of the House of Commons.

Mr Lewis said: “Fixed monthly direct debit is how up to 80% of those in England, Scotland and Wales pay for energy bills.

“The theory is a good one: your annual cost is divided by 12 so you pay the same amount each month, smoothing out high-use winter and lower-use summer costs.

“Yet for months I’ve heard from people shocked to be told their direct debits are increasing two- or threefold.

“Scarily, for some people this is reasonable.

“Those coming off cheap fixes, moving to expensive fixes, or who are in energy debt would expect to see their direct debit rise by more than the already hideous 54% increase in the energy price cap.

“So to test what’s really happening, we analysed responses only from those in credit who were on, and remain on, a price-capped tariff, as they should only be seeing rises in line with the price cap, roughly 45% to 65%.

“Yet even then, on average many report higher rises, and a quarter say they were told to pay double what they were paying previously.

“That smells wrong to me.

Advertisement

Hide AdAdvertisement

Hide Ad“While a higher direct debit doesn’t mean you pay more in the end, any overpayments are ultimately due to be repaid, it does mean far too much cash flowing from accounts now, which is often a nightmare amid the cost-of-living crisis.

“Yet under firms’ licence conditions you have a right to a fair direct debit.

“So if you’re in credit, have been on a standard variable (price-capped) tariff for six months or more, and your direct debit has gone up by far too much: submit an up-to-date meter reading first, then speak to your supplier and politely ask it to justify the rise.

“If it can’t, request that it is lowered.

“If it refuses, make a formal complaint and take it to the Energy Ombudsman.”

In response, Octopus Energy told MSE its own analysis of customer account data showed only 0.84% of those in credit who had been on its standard tariff for over three months have seen their monthly payments double, with a median increase of 59%

Meanwhile British Gas told the website the higher-than-average increase could be down to the fact it offered an option for customers to freeze their direct debits at their existing levels last winter.

An Ofgem spokesperson said: “Protecting energy customers is our top priority – and never has this been more important than now, during mental health awareness week, as we all face difficulties with the cost of living.

“At Ofgem, we regularly engage with all domestic suppliers to ensure they are billing accurately and treating customers fairly.

Advertisement

Hide AdAdvertisement

Hide Ad“We recently wrote to suppliers to alert them that we are commissioning a series of market compliance reviews to ensure, amongst other things, that they are handling direct debits fairly, and that overall, they are held to higher standards for performance on customer service and protecting vulnerable customers.

“Once Money Saving Expert provide us with this data, we will examine it as part of this crucial review.”