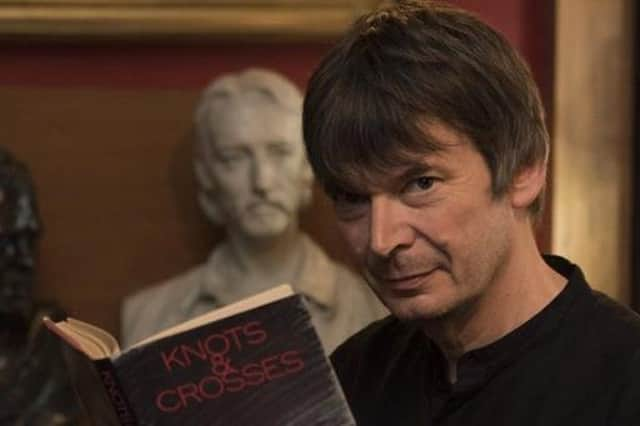

Ian Rankin reveals he partied with Fred Goodwin at RBS HQ after doomed takeover deal which led to its collapse

Now crime writer Ian Rankin has revealed how he partied with Sir Fred Goodwin and his staff at a lavish celebration at its vast new Edinburgh HQ following its takeover of Dutch bank ABN Amro.

Speaking in a new BBC Scotland documentary, Rankin recalls thinking how the Gogarburn HQ was "almost a city in itself" after venturing inside.

Advertisement

Hide AdAdvertisement

Hide AdHe describes how Goodwin and his senior executives appeared like the cast of Reservoir Dogs as they were applauded by staff and VIP guests.

The final part of the series The Years The Changed Scotland recalls how the dramatic collapse of RBS in 2008 led to the bank having to be bailed out by the then Labour Government after the company warned it was hours away from running out of money.

The collapse of the bank was widely blamed on the decision to buy up ABN Amro during a mounting global financial crisis, with some commentators branding it one of the worst takeovers in history.

Goodwin, who had overseen the creation of the bank’s £350 million headquarters at Gogarburn, was forced to resign following the bank’s near collapse in 2008 and was stripped of his knighthood in 2012.

The rise and fall of RBS is charted in the final part of the Kirsty Wark-fronted documentary, which will be shown on the BBC Scotland channel on Tuesday.

It features footage of the official unveiling of the Gogarburn headquarters, which were unveiled by the Queen and also featured a Formula One car racing through its grounds and an RAF flypast.

Rankin recalls: “I was at a party there the night of the ABN Amro takeover that was going to make them one of the biggest banks in the world.

Advertisement

Hide AdAdvertisement

Hide Ad"It was almost a city in itself, a shiny edifice with its own coffee shops, supermarkets and hairdressers so the staff never needed to leave the premises.

"Sir Fred Goodwin and his senior staff walked into this party. It was almost like the start of Reservoir Dogs. They were almost walking in slow motion with a soundtrack playing, suits and ties, all walking in.

"We all clapped, we all applauded, because we thought it was great for Scotland and great for Edinburgh.”

The documentary features footage of Goodwin boasting: "Why we are so successful is we know the risks to take and we know how to manage the risks.”

Then Labour Chancellor Alistair Darling recalls how RBS’s expansion drive was led to its downfall.

Mr Darling said: “In 2008, it was the biggest bank in the world and it was about the same size as the entire British economy.

“When I got a call in October 2008 from the then chairman who said that they hemorrhaging money and what was I going to do about it, I said: ‘How long can you last?’ He said: ‘We’re going to run out of cash this afternoon.’

Advertisement

Hide AdAdvertisement

Hide Ad"This was the biggest bank in the world and it was going to run of out cash in a few hours time.”

Rankin adds: "We were a world financial powerhouse and suddenly that all appeared to be built on sand.”Darling says: "Why did it happen? They took on risks they simply didn't understand. They got over-confident.”

A message from the Editor:

Thank you for reading this article. We're more reliant on your support than ever as the shift in consumer habits brought about by coronavirus impacts our advertisers.

If you haven't already, please consider supporting our trusted, fact-checked journalism by taking out a digital subscription.

Joy Yates

Editorial Director

Comments

Want to join the conversation? Please or to comment on this article.