A history of Scotland's stock exchanges

Companies with transferable shares had existed in Scotland since the 17th century, with the majority of share transfers taking place either between the two individuals involved or through a public auction.

But as the amount of trading increased, so did the need for intermediaries that specialised in dealing, so three stock exchanges – in Aberdeen, Edinburgh and Glasgow – were formed during 1844 and 1845, enabling people to trade more easily in the likes of Bank of Scotland, Clydesdale Bank and Royal Bank of Scotland.

Advertisement

Hide AdAdvertisement

Hide AdIn 1879, Dundee followed suit, and by the following year 12 companies were trading on its exchange. In comparison, Glasgow’s stock exchange had 114 members – up from 49 in 1845 – while Edinburgh had 40 and Aberdeen just 14.

According to Graeme Acheson, professor of finance at the University of Stirling, and John Turner, professor of finance and financial history at Queen’s University Belfast, the development of the Scottish stock market during the second half of the 19th century was “transformed” by developments in the emerging field of telephony.

“Not only did these new technologies speed communication and increase choice across markets, it improved the parity of stock prices between markets, reducing the risks associated with buying in one market and selling on another,” they write in a paper examining the behaviour of Scottish bank shareholders during that period.

In 1888, the markets in Aberdeen, Dundee, Edinburgh and Glasgow were joined by the Greenock Stock Exchange, which was created to “afford facilities to those persons who being possessed of railway shares, consols, harbour stock, or any other kind of stock were desirous to realise or invest and also those who wanted to buy”.

“Essentially it was to provide an investment service for shareholders of local shipping and associated companies, certainly not for speculative business,” according to the 1973 book The Provincial Stock Exchanges by William Arthur Thomas.

By 1959, the Greenock exchange had 16 members, while the number of companies traded on the Aberdeen market had fallen to nine, and to 11 in Dundee. In Glasgow, the number of members stood at 136 – having reached 265 in 1914 – while Edinburgh had 54.

Advertisement

Hide AdAdvertisement

Hide AdHowever, in 1962 the Jenkins committee on company law recommended “some rationalisation” of the 20 markets recognised by the Board of Trade – not including the London Stock Exchange – “perhaps by the amalgamation of some of the smaller ones”.

The committee’s report stated: “We recommend, therefore, that the Board of Trade should re-examine the existing list of recognised stock exchanges with a view to reducing their number and increasing their size; and that the Board should satisfy themselves, as a condition of recognition, that stock exchanges have, or will have within a reasonable period, suitable arrangements for the compensation of investors who suffer loss as a result of default by members.”

Thomas writes that the Scottish markets were quick to respond to this threat, “and it was eventually agreed that the exchanges should aim at a common floor which would bring dealing advantages and lower administrative costs”.

He adds: “It was found however, that the suggestion for a common floor was not practicable at that stage but an acceptable alternative would be common membership and a unified daily list. Following lengthy discussions proposals were agreed on for the creation of the Scottish Stock Exchange, with a total membership of just over 200, consisting of Glasgow, Edinburgh, Aberdeen and Dundee.”

The new arrangements came into force in January 1964, but the Greenock exchange did not join and it was wound up the following year.

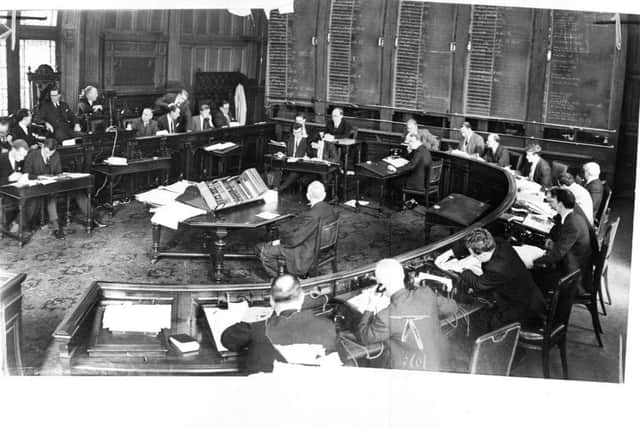

Scotland’s four remaining stock markets continued to operate as before until April 1971, when all share dealings were centralised on the new trading floor of the revamped Glasgow Stock Exchange building on St George’s Place – renamed in 1986 as Nelson Mandela Place.

But in 1973 the Scottish Stock Exchange closed, along with the UK’s remaining “regional” markets, having been absorbed into the London Stock Exchange.

Advertisement

Hide AdAdvertisement

Hide AdSince then there have been sporadic calls for the resurrection of a dedicated stock market for Scotland, although the Scottish Government’s white paper on independence did not contain any proposals along those lines, pointing out that companies north of the Border would still have been able to float in London following a Yes vote.

The 670-page document, published in November 2013, said: “Independence will have no impact on Scottish companies’ ability to make a public share offering. Companies from any country can be listed on a stock exchange provided that they meet the criteria of that exchange.

“For example, around 2,500 companies from over 70 jurisdictions are listed on the London Stock Exchange.”

A report by Paul Marsh of London Business School and Scott Evans of Walbrook Economics in the run-up to the September 2014 independence referendum said: “Over the last 25 years, most countries that have achieved independence have set up their own national stock exchanges. It might seem odd if Scotland, with its long history of financial services and markets, and its established body of listed companies, were to be an exception.”

But they added: “It would make more sense for Scotland to continue to rely for its ‘stock market services’ on the London Stock Exchange and Alternative Investment Market. To the extent that Scotland feels this still leaves an ‘equity gap’, resources would best be devoted to encouraging a vibrant venture capital and private equity industry in Scotland.”