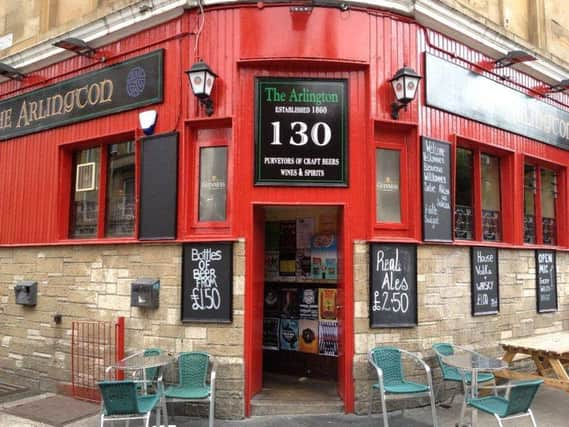

Scotcoin Scottish digital currency trialled in Glasgow pub

The 150-year-old pub has been taking Scotcoin as payment for pints of The Arlington’s own Stone of Destiny lager since St Andrew’s Day on November 30.

Kenny Low, the manager at the Arlington, will accept the crypto-currency for the beer from Monday to Thursdays.

Advertisement

Hide AdAdvertisement

Hide Ad“It would be too ambitious to accept it for everything, so we decided to go with one product to see how it goes,” said Lowe.

“One of the key determinants of the referendum was that [the pro-independence argument] didn’t have its own currency – but there is a crypto-currency. Bitcoin is the big daddy of the crypto world, in the way that the dollar is the big daddy of the established world.”

Scotcoin was founded in 2013 by venture capitalist Derek Nisbet and can be traded directly for better known digital currency Bitcoin.

Both Scotcoin and Bitcoin operate on a not-for-profit basis and have no associations with banks or governments, as is the case with traditional currency.

While currently considered a novelty, the wide use of digital currencies like Scotcoin may become the norm in Scotland as soon as 2016.

A report by thinktank New Economic Foundation from September recommended the creation of a Scottish Government-backed digital currency, theoretically known as ‘ScotPound’. This would be used alongside pound sterling, rather than replacing it.

Lead researcher on the ScotPound report, Duncan McCann, said: “Most of our money now is just data. Our current monetary system is inherently unstable - it’s almost solely dominated by commercial banks who create over 97 percent of money. Because this money is created through loans, it requires people and governments to get into debt, so acts as a huge driver on inequality. The bottom 80 per cent of earners are giving money to the top ten per cent of earners.”

The ScotPound report’s findings suggest that the use of a digital currency would increase purchasing power, thus, boosting the economy.