SNP to consider raising Scots income tax next year

The move has echoes of the SNP’s “penny for Scotland” in the first Holyrood election in 1999, where they lost heavily to Labour after proposing to raise income tax.

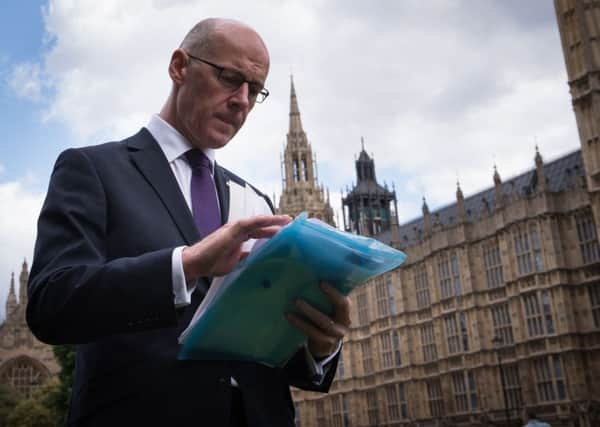

Following a summit in Whitehall with Chancellor George Osborne, the deputy first minister said that he could be prepared to use powers handed to Holyrood from the 2012 Scotland Bill to set a Scottish income tax rate above that of the rest of the UK.

Advertisement

Hide AdAdvertisement

Hide AdAn increase of 1p in income tax north of the Border would, according to the Scotland Office, raise £330 million for the Scottish Government. The news came as Mr Swinney was told by the Treasury that the cuts announced last week will not hit Scotland as hard as expected, with a £107m drop in budget compared to what had been first reported as a £176m fall. Mr Osborne also confirmed that any decreases could be postponed until 2017 if the Scottish Government needed time to adjust its budget, an offer which is not available to Whitehall departments.

Nevertheless, Mr Swinney condemned the “unacceptable” behaviour of the Treasury in first not warning him of last week’s announcement, and then only advising him of the change in the amount an hour before his meeting with Mr Osborne yesterday.

He went on: “The cut of £107m is substantially lower than the UK government’s original estimate but is still too bitter a pill to swallow.

“This comes on top of an overall budget cut of 9 per cent since 2010, including a 25 per cent cut to the capital budget.

“It is completely unacceptable for reductions to be imposed in this financial year to the budget that has already been agreed by the Scottish Parliament.”

Mr Swinney also made it clear he told Mr Osborne that he “does not have a mandate in Scotland”, with the Conservatives winning just one seat and suffering the lowest proportion of votes since 1865.

Asked by The Scotsman if he would raise taxes to offset austerity cuts, Swinney said: “We’ll consider all these questions as we prepare our budget.

“What we will consider is how we can best take forward investment in our public services given the fact that we’ve had a further reduction in the budget that we expected from the Chancellor.”

Advertisement

Hide AdAdvertisement

Hide AdHe added: “We will have the powers, the question is whether we decide to change the tax arrangements of the UK and we will give the answer to that during the budget process of the Scottish Government.”

However, Mr Swinney warned that the Calman Commission proposals, which come into force next year ahead of what is due to be agreed by MPs in this parliament, meant that a change to one tax band had to be replicated in the other bands.

And he said he was unhappy that this would mean having to increase taxes on basic taxpayers “who are suffering the most because of the Tory cuts”.

Under the Calman powers, the Scottish Government is obliged to set a Scottish rate of income tax which equates to the second 10p in the current 20p rate but it can increase the rate by as much as it wants.

Under the original tax variation powers, agreed when the Scottish Parliament was set up in 1999, Holyrood could vary the tax rate by up to 3p, but this power was never used after the SNP ran the failed “penny for Scotland” campaign in 1999.

The all-party Smith Commission tax proposals, agreed after last year’s referendum and currently being debated in parliament, would increase the powers further and mean that a Scottish Government could have different increases or decreases for the different tax bands.

But the threat of an increase in tax was condemned by the Scottish Conservatives, whose leader Ruth Davidson has made a pledge that her party would try to block tax rises in the next parliament after the Holyrood elections.

A spokesman for Ms Davidson said: “The new tax powers for the Scottish Parliament should not mean higher taxes for the Scottish people.

Advertisement

Hide AdAdvertisement

Hide Ad“The Scottish Conservatives have pledged to ensure that taxes will not be higher as a result of the devolution of these powers.

“There is no reason why John Swinney should not be able to issue the same assurance to families and businesses in Scotland.”

Mr Swinney and the Chancellor mostly discussed the financial arrangement for the Scotland Bill that will increase tax powers for Holyrood and identify who will pay the Scottish rate of income tax. Mr Swinney said: “The Chancellor and I also discussed the funding framework for the Scotland Bill, which will ensure the Scottish Parliament has the right tools to manage the new powers.

“We agreed that our governments would immediately start work to ensure the process is collaborative, transparent and delivers the principles of Smith.

“We are aiming to finalise Scotland’s new fiscal framework by the autumn alongside the Scotland Bill’s passage through Parliament and I will meet the Chief Secretary regularly over the coming months to discuss the details.”

The row over funding for Scotland follows the general election campaign where the Tories promised to bring in an extra £30 billion of cuts but the SNP won 56 of Scotland’s 59 seats after opposing austerity and promising to force an increase in government spending of £180bn over five years.

When the cuts were announced last week, Mr Swinney accused the Tory UK government of “not listening to Scotland”.

However, after the meeting yesterday, Greg Hands, the Tory Chief Secretary to the Treasury, made it clear that the Scottish Government would be expected to use new tax powers if it wanted to spend more money.

Advertisement

Hide AdAdvertisement

Hide AdHe said: “If the Scottish Government want to increase spending they can increase Scottish taxes, without increasing UK borrowing overall.”

But he promised there will be a businesslike and constructive relationship with SNP ministers.

He said: “The deputy first minister, Chancellor and I agreed we will immediately start work on the framework to ensure the Scottish Parliament has the tools it needs to manage its significant new tax and spending powers.

“This is a crucial part of devolution which will mean, for the first time, over half of the Scottish Parliament’s funding will come from Scottish tax.”