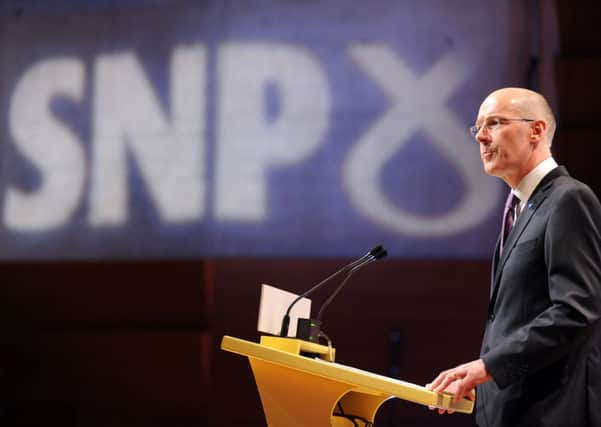

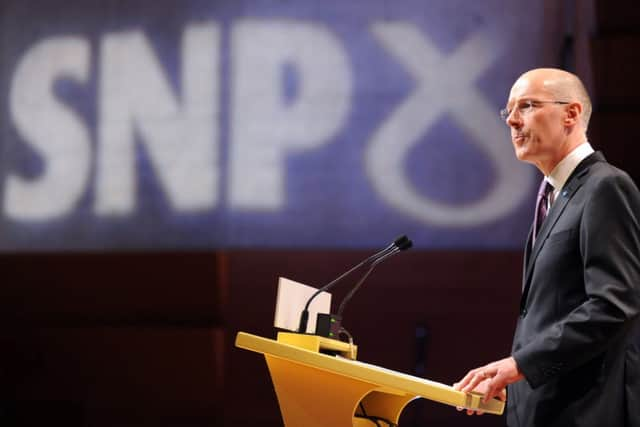

Scottish independence: No SNP 50p tax pledge

However, he said the SNP would support the reintroduction of the top rate for those earning £150,000 or more if it was brought forward in Westminster.

His comments followed a challenge from Labour’s shadow Scottish secretary, Margaret Curran, after her party pledged to reintroduce the 50p rate for those earning £150,000 or more if they win the general election in 2015.

Advertisement

Hide AdAdvertisement

Hide AdMr Swinney said: “In an independent Scotland, we will take a decision on this based on the economic circumstances we inherit at the time, and we will also take forward key policies to tackle inequality, such as scrapping the bedroom tax and ensuring a fair minimum wage that rises at the very least in line with inflation.”

In a letter to Mr Swinney, Ms Curran said the SNP had to come off the fence over the 50p rate and clarify what it would do.

“We believe it is fair that in tough economic times, those with the broadest shoulders should bear a little more of the burden for reducing the deficit,” she wrote. “Over the weekend, SNP representatives appeared to distance themselves from Labour’s proposals.

“I would welcome some clarity from you about whether your party supports the reintroduction of the 50p tax rate and if you will join us in calling for it across the UK.”

Mr Swinney replied that the SNP was opposed to scrapping the 50p rate “as it was unfair at a time of recession, and if there is a vote on it now we will vote for its restoration”.

He pointed out that under the new income tax powers for Holyrood, the Scottish Government had to vary all the rates by the same amount, which meant it could not restore the 50p rate without adding 5p to the lower bands.

But Labour pointed out that the richest companies would see corporation tax levels slashed in an independent Scotland.

Labour’s shadow business minister, Edinburgh South MP Ian Murray, said: “The SNP are failing a key test of fairness in their plans for independence by not committing to ensuring tax fairness, while giving significant tax cuts for the largest companies.”

Advertisement

Hide AdAdvertisement

Hide AdThe pledge to restore the 50p rate made by shadow chancellor Ed Balls was met with scorn by Prime Minister David Cameron, whose Tory/Lib Dem coalition has reduced the rate to 45p.

Mr Cameron accused Labour of putting “political convenience” above good economics by pledging to restore the 50p top tax rate, but he avoided questions over whether he backed London mayor Boris Johnson’s proposal to slash it again to 40p.

Mr Cameron said: “We’ve cut the top rate of tax from 50p to 45p. I always knew it wouldn’t be particularly popular, but I thought it was the right thing to do because I want to take steps that are going to encourage investment, jobs, growth.”

Business groups warn that Labour’s proposal could hit investement. Lloyd’s of London chairman John Nelson said: “The confidence level is a brittle thing. We’ve got a number of policies that have been announced recently which could affect business and the economy in a serious way.”

Kingfisher boss Ian Cheshire and Neil Clifford, chief executives of footwear retailer Kurt Geiger said: “We think these higher taxes will have the effect of discouraging business investment in Britain. This is a backwards step which would put the economic recovery at risk.”

But Mr Balls insisted: “I don’t think this is an anti-business move, I don’t think it’s bad for Britain. I think it is a fair way to get the deficit down.”

SEE ALSO