New tax powers for Scotland ‘unworkable’ warns IFS

The Institute for Fiscal Studies (IFS) also says Scotland wouldn’t escape the impact of an income tax rise south of the border - even though this is being devolved to Holyrood under the plans.

‘Many difficult issues remain to be addressed,’ the IFS says.

Advertisement

Hide AdAdvertisement

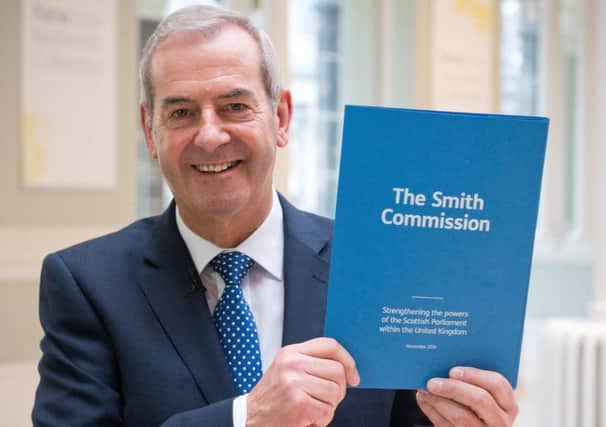

Hide AdThe Smith Commission plans were unveiled last month and agreed by all five main political parties in Scotland.

It will see Scotland get full control over the rates and bands of income tax north of the border.

But if tax rises in Scotland lead to a ‘knock-on’ budget hit for the rest of the UK, or vice versa, the Smith agreement says budget transfers should be made to compensate for this.

But calculating these would be “inherently difficult”, the IFS says.

CONNECT WITH THE SCOTSMAN

• Subscribe to our daily newsletter (requires registration) and get the latest news, sport and business headlines delivered to your inbox every morning

It adds: “It is important to recognise that such compensating transfers will be practical only in a few simple cases - otherwise the system could quickly become unworkable.”

Problems will arise if the UK Government decides to raise income tax to fund greater defence or pensions spending - which would benefit Scotland as well.

The IFS says it has been told by the Treasury that any tax change like this should not affect the amount spent ‘for the benefit of the people of Scotland.’

Advertisement

Hide AdAdvertisement

Hide AdThe IFS states: “This means if the UK Government did use income tax as part of its response to such UK-wide issues, the amount of money given to the Scottish Government, via the block grant, ought to change.

“Its block grant would have to be reduced.”

SCOTSMAN TABLET AND IPHONE APPS