Scots forced to ‘rob Peter to pay Paul’

A similar proportion admit to hiding debt from their family and one in six has revealed that they concealed it from their partner, a survey by Payplan has shows.

And while 36 per cent would look for help if they had debts between £2,000 and £5,000, one in five said they would wait until they were more than £20,000 in the red before seeking debt advice.

Advertisement

Hide AdAdvertisement

Hide AdBut 55 per cent of Scots consider it no more acceptable to be overdrawn now than it was ten years ago, a reversal of the UK-wide trend.

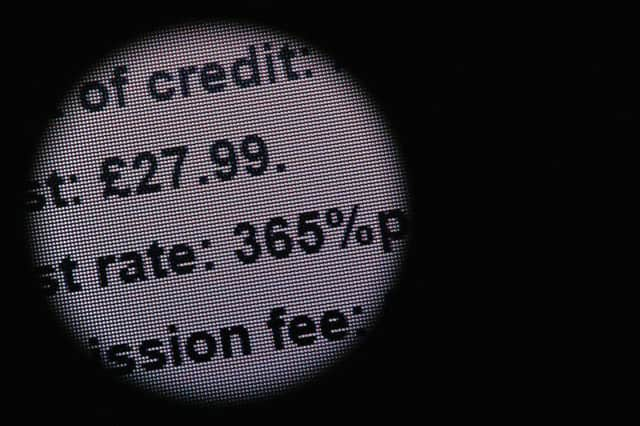

The findings are published just days before the Financial Conduct Authority takes over the regulation of the £200 billion consumer credit market.

The initial rules for the market, which come into force on 1 April, will cover payday loans, credit cards, overdrafts, personal loans and other forms of credit agreement.