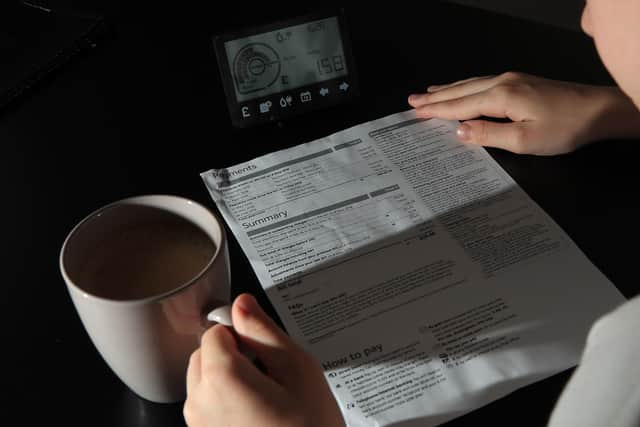

What is the energy price guarantee, how does energy price guarantee work and what will happen to bills in April 2023?

Called the Energy Price Guarantee (EPG), the cap kept prices to around £2,500, and came in response to soaring energy costs following the Russian invasion of Ukraine.

Now despite demands from opposition parties, Chancellor Jeremy Hunt has confirmed that from April 1, 2023 the EPG level will rise to an average of £3,000 and continue for 12 months.

Advertisement

Hide AdAdvertisement

Hide AdThis means the typical household will see an annual bill increase of £500, but the EPG is only the average amount each household has to pay, so bills will still vary depending on energy usage.

But what is going to happen to bills and why are they changing?

What is the current energy price guarantee?

The UK Government introduced the guarantee to help consumers with their increasing bills, by limiting how much suppliers can charge per unit of energy used.

Starting in October, the amount was automatically limited in Britain to £2,500, and in Northern Ireland around £1,950 a year.

It is worth noting this is only the average amount each household has to pay, not the cap – bills will still be higher or lower depending on how much energy is used. The Government then compensates energy suppliers in exchange for cutting household energy bills.

Why are energy bills going up?

Mr Hunt announced in his Autumn Statement the scheme would continue past April, but offer less support.

The average bill will increase from around £2,500 to about £3,000 from March 31, with the Government then reducing compensation to energy companies.

Speaking to reporters on Tuesday, the Chancellor explained the cut was down to a lack of money raised from windfall taxes. He said: “We always look at what else we can do, but we also have to be responsible with public finances.

Advertisement

Hide AdAdvertisement

Hide Ad“At the same time as energy prices have come down, so too have our receipts from the windfall taxes. So we have to look at everything in the context of what is responsible for public finances, because if we don’t, we’ll just see interest rates go up and then everyone who has a mortgage up and down the country will face a different kind of cost.”

The Government argues if prices return to how much they cost in late August last year, the Treasury would need to borrow an extra £42 billion and raise taxes to fund the current level of EPG support.

What impact is this likely to have?

Fixed price energy customers could see standing charges soar 100 per cent, regardless of whether they use any energy.

Last year, the fee for electricity was raised by more than 80 per cent, and now accounts for up to 16.5 per cent of the annual bill for a household earning £15,200.

Martin Lewis, creator of the Money Saving Expert website, warned the rise would damage people’s pockets and their mental health.

He explained: “To put this national act of harm of increasing the price guarantee for just three months, to throw another 1.7 million people into fuel poverty taking it to 8.4 million, it seems unnecessary".

Mr Lewis argued instead ministers should make these changes in July when the price cap is expected to fall anyway.

Comments

Want to join the conversation? Please or to comment on this article.