SNP demands tax powers to match Northern Ireland

Around 34,000 businesses in Northern Ireland are set to benefit from a cut in corporation tax after the UK government tabled a bill devolving powers to the Stormont Assembly, which will allow it to set its own tax rate from April 2017.

CONNECT WITH THE SCOTSMAN

• Subscribe to our daily newsletter (requires registration) and get the latest news, sport and business headlines delivered to your inbox every morning

Advertisement

Hide AdAdvertisement

Hide AdMinisters said the change could be “transformative” for an economy which for years has been over-dependent on the UK state. The legislation introduced in Westminster yesterday is expected to be completed before May’s general election.

However, the move from Chancellor George Osborne and Northern Ireland Secretary Theresa Villiers led to fresh calls from the SNP for the power over corporation tax rates to be devolved to Scotland.

The Smith Commission, which agreed a package of further devolution in the wake of the referendum, resisted the SNP’s demand for Holyrood to be able to vary corporation tax.

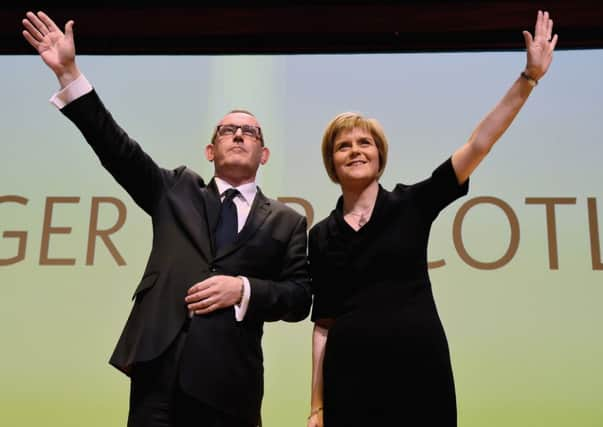

SNP deputy leader Stewart Hosie said there “was no good reason” why Holyrood should not be handed the same power as Northern Ireland.

The row came as Alex Salmond said the SNP’s general election campaign would be about forcing the pro-UK parties to deliver “real home rule” for Scotland.

Mr Salmond said there was “massive evidence” that Scotland wanted home rule, which he described as being the full devolution of all domestic matters and taxation, with just foreign affairs and defence reserved to Westminster.

Mr Osborne, announcing the new tax powers for Stormont, said there was a longstanding “strong case for devolving a corporation tax rate-setting power to Northern Ireland”.

However, Mr Hosie – the SNP’s Treasury spokesman at Westminster – said a failure to deliver the same devolution settlement to Scotland by the time of the general election would be “duplicitous and utterly reprehensible”.

Advertisement

Hide AdAdvertisement

Hide AdHe said: “With Northern Ireland set to be given powers over corporation tax – in addition to the control they already have over air passenger duty – this further proves that there is absolutely no good reason why Scotland should not have these powers in the interests of growing our economy.”

Danny Alexander, Chief Secretary to the Treasury, said Northern Ireland had “unique” needs due to the economic competition it faces with the Republic of Ireland.

He said: “This government is committed to devolving powers across the UK where there is a strong argument for doing so, from giving Scotland control over income tax to today’s corporation tax announcement for Northern Ireland.”

SCOTSMAN TABLET AND IPHONE APPS