SNP back tax cuts worth £3.6bn and tax rises of up 10% for middle earners

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

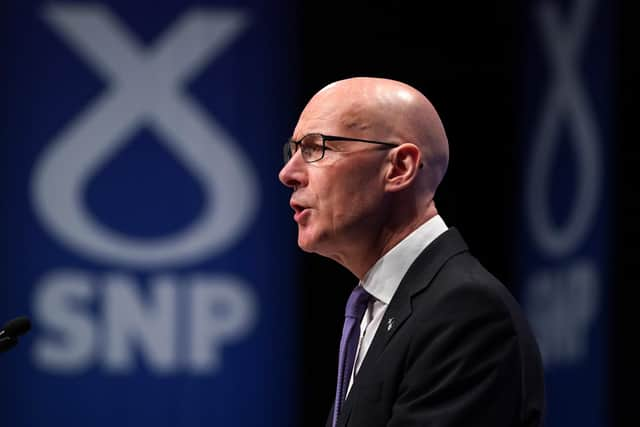

The policy, passed unanimously and with no speakers against, calls on John Swinney to introduce a nominal tax rate to the equivalent of a full time worker earning the living wage, around £21,000 per year.

Income tax is predicted to raise £13.6bn, with the Fraser of Allander Institute’s initial findings on the policy suggesting it would lead to an estimated revenue hit of £3.6bn.

Advertisement

Hide AdAdvertisement

Hide AdThe plans, which effectively raises the personal allowance for lower earners, would take 900,000 people out of paying tax altogether under SNP plans, the FAI said.

Members backed the policy on the grounds it would be “revenue neutral”, forcing significant tax hikes for anyone earning over at that figure.

The FAI said such a policy would require tax hikes of around nine or ten percentage points for middle earners.

John Swinney, the interim finance secretary, told journalists he would need to “listen carefully” to the resolution, but said the government must “carefully reflect” the balance between the tax burden and funding public services.

The policy is not binding but ministers will be expected to work towards the policy’s main goal.

Income tax is predicted to raise £13.6bn for the Scottish exchequer for 2022-23, Scottish Government figures show.

The policy would effectively lift more than half of the population out of paying tax altogether, as the majority of Scots pay either the starter, basic, or intermediate rate of tax.

The resolution passed by SNP delegates also states the threshold should rise in line with the living wage to “address fiscal drag” and maintain the fairness of the system.

Advertisement

Hide AdAdvertisement

Hide AdThe resolution states the policy would result in “tax rates for those earning above the new threshold will rise”.

It adds: “The party adopts a policy of introducing a nominal tax rate between the current UK tax threshold and the equivalent of a full timer earnings on the living wage, effectively lifting those below this level our of income tax.

"In addition, the tax threshold in subsequent years should continue to rise in line with changes to the living wage.”

It adds: “Conference accepts that a Revenue Neutral approach means that if fewer pay income tax then tax rates for those earning above the new threshold will rise, but this can be done fairly, while insuring that income tax is reduced for the majority of Scots.”

The policy does however give the Scottish Government a way of not following what is now official SNP policy, allowing them to make “non-revenue neutral adjustments to the tax code as they see fit”.

The scale of the tax hikes for middle and higher earners required to plug the gap would likely be significant, though no costings were attached to the resolution.

Lowering the tax bands for the lowest earners by just one percentage point, in line with recently announced UK Government policy, would cost the Scottish exchequer £400m.

Under existing arrangements, those on the starter and basic tax bands pay between £369 to £1,508 per year in income tax, rising to £2,249 for intermediate tax rate payers.

Advertisement

Hide AdAdvertisement

Hide AdThe starter rate of income tax covers earnings between £12,571 and £14,732 and effectively be abolished.

The number of solely basic rate taxpayers, around a quarter of the population, would also plummet due to the band covering earnings between £14,733 and £25,688.

Mr Swinney said “the party is obviously free to express its opinions on all of these questions.

Asked if he was happy the policy had been passed by members, the deputy first minister said: “The party has taken its conference decision about these points and obviously the government will reflect on those issues.”

He added: “We believe in progressive taxation, we believe there needs to be essentially a relationship between people’s income and their contribution towards taxation.

"But we also believe in fiscal sustainability around our public services so we have to make careful judgements to balance out the extent of the tax burden and where that falls and the ability to afford public services of a level that we would want to have in place.”

Scottish Conservative public finance spokesperson, Douglas Lumsden, said the motion was a “huge rebuke” to the SNP leadership and a “rejection of their own tax policy”.

He said: “If this proposal was enacted it would mean tax rises for the majority of Scottish workers, including many earning below the average salary.

Advertisement

Hide AdAdvertisement

Hide Ad“The SNP’s eagerness to widen the tax gap between Scotland and the rest of the UK is precisely what has undermined Scotland’s growth and competitiveness.

“If SNP ministers persist in manufacturing difference and division for the sake of it, Scotland runs the risk of falling even further behind, when our priority should be encouraging more people to live and work here.”

All episodes of the brand new limited series podcast, How to be an independent country: Scotland’s Choices, are out now.

It is available wherever you get your podcasts, including Apple Podcasts and Spotify.

Comments

Want to join the conversation? Please or to comment on this article.