Scottish independence: Consumer ombudsman planned

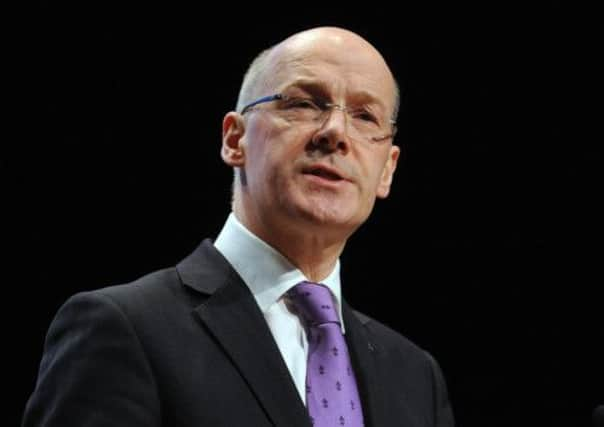

Finance secretary John Swinney has set out plans to axe 90 ombudsmen which currently operate UK-wide and replace them in an independent Scotland with a “simpler” approach to protecting customers’ rights.

A new “one-stop shop” ombudsman dealing with all complaints from

disgruntled Scots is at the heart of the plans.

Advertisement

Hide AdAdvertisement

Hide AdThere would also be a new Scottish Consumer Authority charged with providing advice and education, as well as taking on the enforcement duties which currently lie with Trading Standards.

Last night a Scottish Government spokeswoman said that the cost of the new ombudsman would be met by the firms and industries themselves, through levies which they already pay to existing ombudsmen.

“We are simplifying the system and we envisage it would be less costly to operate – it would not cost any more and we hope it would cost less,” she said.

But the proposed measures met with concerns from business leaders who warned a separate system of regulation north of the Border could push up costs.

Mr Swinney presented his report, entitled Consumer Protection and Representation in an Independent Scotland: Options, in Edinburgh yesterday. He said: “As incomes are squeezed and costs continue to increase, it is even more important that we are

protected from unscrupulous traders with those on low incomes, the elderly and the vulnerable particularly at risk of being exploited. Whether through the way we tackle nuisance calls, charges for parcel deliveries or the kind of financial loans available, the people of Scotland need a system that makes help easily available, offers practical solutions and has the power to make real changes where and when it is needed.

“The Scottish Government currently does not have responsibility for arrangements to empower and protect consumers.

“With independence, we would be able to build a simpler system which meets the needs of our people, and puts families and households, small businesses and local communities at the heart of everything that it does.”

Advertisement

Hide AdAdvertisement

Hide AdThe paper sets out more than 90 bodies – including the Furniture Ombudsman, National Caravan Council and the Carpet Foundation – which could be merged into a single all-powerful body after independence.

However, there would also be the option of having a separate ombudsman set up to cover financial services complaints.

The new ombudsman would operate along with a separate Scottish Consumer Authority, a body that would offer advice, education and information, as well as undertaking general consumer advocacy work. A distinctive Scottish system would streamline the current “cluttered and confusing approach” to take account of Scottish needs, values and geography, the paper adds.

Community hubs providing education and advice bringing together the services of Citizens Advice Bureaux, local authority advice and financial advice would also be established.

But Confederation of British Industry Scotland’s assistant director, David Lonsdale, warned the it could see firms hit in the pocket.

He said: “Scottish firms operating across the UK currently benefit from a single regulatory approach, and any fragmentation of that could add cost and complexity as businesses try to navigate differing regulatory, licensing and enforcement regimes north and south of the Border.”

Ian McKay, Scottish chairman of the Institute of Directors, also warned of the potential difficulties of creating a combined consumer and competition body.

“Is there not a danger that in centralising and creating this much more powerful single unit, that, in fact, it might lead to more difficulty in dealing with a market place which requires to be fast-moving,” he said.

Advertisement

Hide AdAdvertisement

Hide AdScottish consumers have been “disproportionately affected” by increased delivery charges in rural and remote areas, according to research highlighted in the paper yesterday. It argues that the UK government has “ignored” calls to regulate the sector and independence could allow Scotland to look at how the Universal Service Obligation could be used to ensure “fairer prices” for parcel deliveries.

A crackdown on payday loan firms like Wonga is also set out, with the prospect of a cap on exorbitant interest rates and curbs on the “rolling over” of loans, as well as restrictions on adverts which don’t make the risks clear, are also on the cards after independence.

The SNP has looked to the Netherlands to develop its idea of a single ombudsman where its “Geschillencommissie” has a broadly single unified system for consumer bodies and a separate structure for financial services.

Last night the prospect of a new regulator being established to deal with all customer complaints was welcomed by consumer body Which?

Executive director Richard Lloyd said Which? is “very much in favour of a consumer ombudsman to deal with all the complaints that currently fall outside the different existing schemes and leave consumers without the option of alternative dispute resolution in certain sectors, like travel”.

But Scottish Labour’s shadow cabinet secretary for the constitution, Drew Smith, branded the proposals a “nice-to-do” list.

He said: “On payday loans, the SNP have defended the operations of such companies as ‘fair and transparent’.

“Only now, with an eye to the referendum, do they promise to do something in the future. They could take steps now to take business away from these legal loan sharks. They have refused to act.”

Advertisement

Hide AdAdvertisement

Hide AdLiberal Democrat leader Willie Rennie warned: “Splitting regulation off from the rest of the UK could make matters worse for the consumer, not better. The SNP’s plans for parcel delivery regulation risks hitting every home and business in Scotland with extra charges for receiving delivery from the rest of the UK. Just look at how much it costs to send mail to Ireland.”