Scottish Budget 2017: How SNP tax reform affects you

The changes, which are included in the Scottish Budget and will take effect from April, will see a new 21p “intermediate rate” apply to anyone earning over £24,000.

People who currently pay the higher and top rates will be the hardest hit, with both set to rise by 1p to 41p and 46p respectively.

Advertisement

Hide AdAdvertisement

Hide AdThe proposals were announced by Finance Secretary Derek Mackay as he presented his draft Scottish Budget at the Parliament in Edinburgh.

The effect of the new intermediate rate on lower earners will be minimised by the creation of a “starter rate” of 19p, applying to incomes of between £11,850 and £13,850.

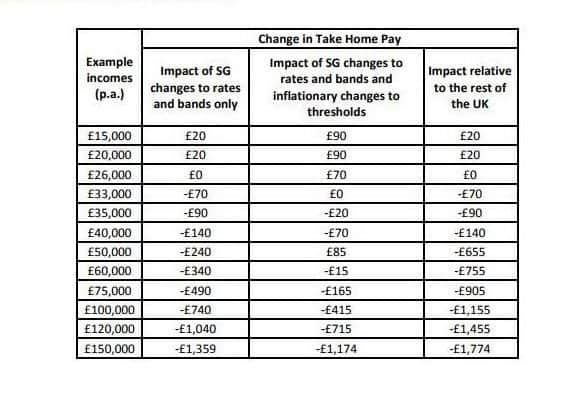

The SNP said only Scottish taxpayers earning more than £33,000 would be affected by the rises, while a majority of people (55 per cent) would pay less tax next year than if they lived elsewhere in the UK.

“These measures combined with our investment in the NHS, the economy, infrastructure, education and essential public services ensure that in the year ahead Scotland will be the fairest taxed part of the UK, providing the best deal for taxpayers,” Mr Mackay said.

The tax rises in the Scottish Budget were first signalled by Nicola Sturgeon in September, with the First Minister arguing that the nation needed more money to pay for public services.

The Scottish Government has also published a table showing how people on various incomes will be affected (pictured).

This story first appeared on our sister site iNews.