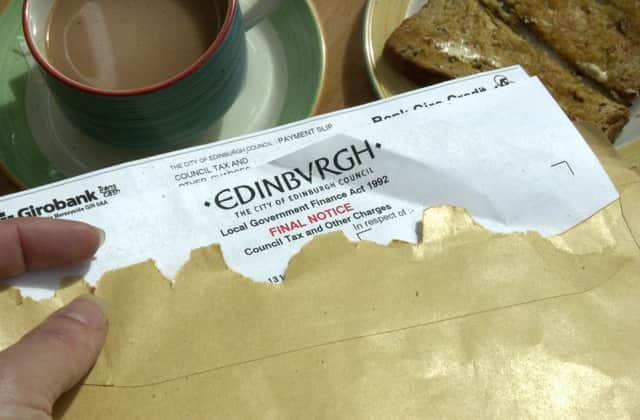

Review ‘should examine council tax flaws’

The Scottish Association of Landlords (SAL) will give evidence to the Scottish Government’s Commission on Local Tax Reform today setting out four key areas for reform.

The commission, announced by First Minister Nicola Sturgeon in November, is tasked with examining a fairer way of funding local government services.

Advertisement

Hide AdAdvertisement

Hide AdSAL wants to see empty furnished properties entitled to the same six-month full council tax exemption that unfurnished properties qualify for, as long as they are being repaired, upgraded or marketed for new tenants.

The organisation also said that it was “unfair” that the exemption for unfurnished properties is not re-set when a property is sold.

It called for the system to be changed so that landlords cannot be pursued for outstanding money when tenants in a house in multiple occupation have agreed to take over liability for the council tax.

SAL also wants a two-year cut-off after which local authorities cannot pursue property owners for council tax when a tenant has been responsible for paying.

Chief executive John Blackwood said: “We have no fixed view concerning what form of local tax should replace the council tax but we do believe this is an opportunity to fix flaws in the current system.

“In particular, we feel there are disincentives which mean landlords might be dissuaded from investing in upgrades or non-emergency repairs because of the lack of council tax discounts available to other groups.

“By ending these practices, landlords would be able to invest more easily in their properties and provide a better service for tenants.

“A strong private rented sector providing value for money for tenants is not only of benefit for landlords and our customers but also to the local authority by adding to the high-quality housing stock in a given area.”