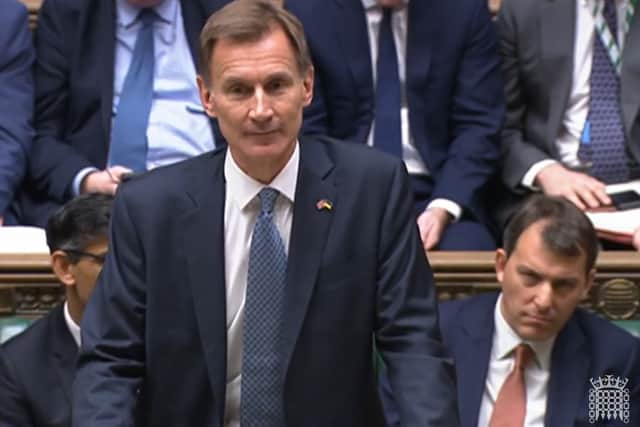

RECAP: Jeremy Hunt increases the windfall tax on oil and gas giants | Triple lock pension and living wage update | Labour says UK economy put into “doom loop”

Mr Hunt has increased the windfall tax on oil and gas giants from 25% to 35% and imposed a 45% levy on electricity generators to raise an estimated £14 billion next year.

Households will face increased energy bills, high inflation and tax hikes as the country is hit by recession.

Advertisement

Hide AdAdvertisement

Hide AdChancellor Jeremy Hunt told MPs he was having to make difficult decisions to ensure a “shallower downturn”, but the economy was still expected to shrink 1.4% in 2023.

The Office for Budget Responsibility (OBR) forecast the UK’s inflation rate to be 9.1% this year and 7.4% next year, contributing to the squeeze on living standards.

The cap on average household energy bills will increase from £2,500 to £3,000 from April.

But Mr Hunt said “this still means an average of £500 support for every household”, while there would also be additional cost-of-living payments for people on means-tested benefits, pensioner households and those on disability benefit.

Mr Hunt was setting out a package of around £30 billion of spending cuts and £24 billion in tax rises over the next five years.

His package is in stark contrast to his predecessor Kwasi Kwarteng’s ill-fated plan for £45 billion of tax cuts, less than two months ago, which spooked the markets, pushed up the cost of borrowing and contributed to the downfall of Liz Truss’s short-lived administration.

Autumn Budget LIVE as chancellor to unveil spending cuts and tax rises

“Anyone who says there are easy answers are not being straight with Brithsh people” says Jeremy Hunt

Mr Hunt has reduced the threshold at which the top rate of income tax is paid from £150,000 to £125,140.

Jeremy Hunt has increased the windfall tax on oil and gas giants from 25% to 35% and imposed a 45% levy on electricity generators to raise an estimated £14 billion next year.

Jeremy Hunt told the Commons: “I have no objection to windfall taxes if they are genuinely about windfall profits caused by unexpected increases in energy prices.

“But any such tax should be temporary, not deter investment and recognise the cyclical nature of many energy businesses. Taking account of this, I have decided that from January 1st until March 2028 we will increase the Energy Profits Levy from 25% to 35%.”

On a windfall tax on electricity generators, he said: “The structure of our energy market also creates windfall profits for low-carbon electricity generation so, from January 1st, we have also decided to introduce a new, temporary 45% levy on electricity generators. Together these taxes raise £14bn next year.”

Jeremy Hunt said his decisions lead to a “substantial tax increase” but said he was not raising headline rates of taxation, adding tax as a percentage of GDP will increase by 1% over the next five years.

On personal taxes, Mr Hunt said he would reduce the threshold at which the 45p rate becomes payable from £150,000 to £125,140.

He said: “Those earning £150,000 or more will pay just over £1,200 more a year.”

Mr Hunt went on: “We are also taking difficult decisions on tax-free allowances. I am maintaining at current levels the income tax personal allowance, higher rate threshold, main national insurance thresholds and the inheritance tax thresholds for a further two years taking us to April 2028. Even after that, we will still have the most generous set of tax-free allowances of any G7 country.”

He said he would also reform allowances on unearned income, noting: “The dividend allowance will be cut from £2,000 to £1,000 next year and then to £500 from April 2024.

“The annual exempt amount for capital gains tax will be cut from £12,300 to £6,000 next year and then to £3,000 from April 2024. These changes still leave us with more generous allowances overall than countries like Germany, Ireland, France, and Canada.”

On business taxes, Chancellor Jeremy Hunt announced: “While I have decided to freeze the Employers NICs threshold until April 2028, we will retain the Employment Allowance at its new, higher level of £5,000.

“40% of all businesses will still pay no NICs at all.

“The VAT registration threshold is already more than twice as high as the EU and OECD averages. I will maintain it at that level until March 2026.

“My right honourable friend the Prime Minister successfully negotiated a landmark international tax deal to make sure multinational corporations – including big tech companies – pay the right tax in the countries where they operate.

“I will implement these reforms, making sure the UK gets our fair share. Alongside further measures to tackle tax avoidance and evasion, this will raise an additional £2.8 billion by 2027-28.”

Jeremy Hunt said Work and Pensions Secretary Mel Stride will review “issues holding back workforce participation”, which will conclude early in the new year.

Jeremy Hunt has said he would continue to maintain the defence budget at “at least 2% of GDP”.

The Chancellor told the Commons he and the Prime Minister “both recognise the need to increase defence spending”, adding: “But before we make that commitment it is necessary to revise and update the Integrated Review, written as it was before the Ukraine invasion.

“I have asked for that vital work to be completed ahead of the next Budget and today confirm we will continue to maintain the defence budget at least 2% of GDP to be consistent with our Nato commitment.”

On overseas aid, he said: “The OBR’s forecasts show a significant shock to public finances so it will not be possible to return to the 0.7% target until the fiscal situation allows.

“We remain fully committed to the target and the plans I have set out today assume that ODA spending will remain around 0.5% for the forecast period.”

Jeremy Hunt said he will increase the NHS budget by an extra £3.3 billion in each of the next two years.