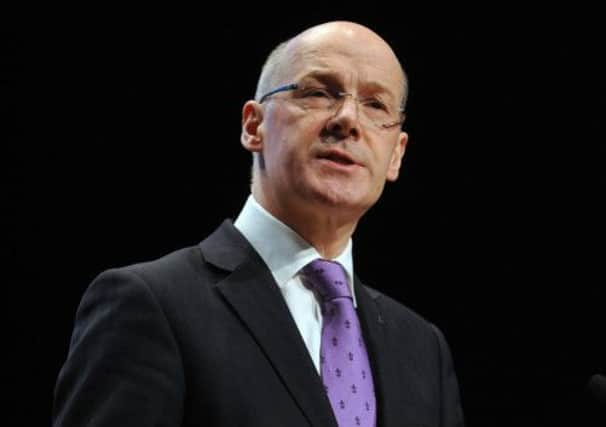

John Swinney outlines Scottish budget for 2014/15

In his annual statement setting out the Scottish Government’s £35 billion spending plan, the SNP finance secretary delivered a muted budget plan for 2014-15 which he claimed was “constrained by significant cuts”, imposed on him by Westminster.

Holyrood funding for Scotland’s 32 councils will be slashed for the next two years, with a real terms reduction of £624 million by 2015-16, his proposals revealed.

Advertisement

Hide AdAdvertisement

Hide Ad

They also showed that the hole is to be filled by an 8 per cent rise in the amount collected by business rates over the next two years, to more than £2.8bn.

It prompted claims last night that firms across Scotland struggling to overcome the effects of recession were being forced to “bail out” Mr Swinney’s costly commitments.

However, the finance secretary insisted he was sheltering councils and firms from the worst of the cuts.

Instead, he sought to focus his statement on a centrepiece announcement to provide £20m for this financial year which councils can use to help people hit by the under-occupancy charge, or “bedroom tax”.

The sum is half what Labour said was necessary to pay all those affected. They accused the SNP of “playing politics” with people, as the Nationalists argued that only independence would allow the controversial tax to be abolished.

The finance secretary – unveiling his seventh spending statement – also announced fresh deals on pay for public sector workers. He will allow 1 per cent pay rises for civil servants on more than £80,000, following a lengthy period where no pay rises have been permitted for senior staff. The Scottish Government will also keep “progression payments”, the automatic rises given to public sector workers recently scrapped by Chancellor George Osborne, who described them as “unfair”.

Mr Swinney also revealed that the Scottish Government will make full use of new borrowing powers when they come into force in 2015, and will ask the Treasury for an extra £295m to spend on building projects.

However, the statement stopped short of explaining the new tax rates ministers plan to impose on the replacement for stamp duty, which will come under the Scottish Government’s powers from 2015.

Advertisement

Hide AdAdvertisement

Hide AdMr Swinney’s statement for the year 2014-15 is the last before the independence referendum on 18 September next year.

It comes amid protests from Holyrood opposition parties that the country is “on hold” until the vote is over, and amid warnings that Scotland’s public sector faces a round of fierce further cuts over the next five years.

Mr Swinney insisted an independent Scotland would have been able to present a budget that put all of the country’s “economic strength” to the wheel. “Instead, as a result of Westminster’s decisions, I must today present a budget constrained by significant cuts,” he told MSPs.

His documents showed that, at today’s prices, the government’s grant to councils will drop from £7.18bn this year to £6.5bn in 2015-16. Over the same period, the income from business rates – which goes to councils – will rise from £2.4bn to £2.8bn.

Mr Swinney said afterwards that much of the business tax increase could be accounted for by inflation, economic growth and technical changes. However, business figures last night said they feared the predicted income was “optimstic” and could herald a further raid.

It comes after the SNP introduced the so-called “Tesco tax” on large retailers.

A spokesman for CBI Scotland said: “Our fear is that any shortfall in revenues may lead to further new rates levies being introduced, which is why we were disappointed at the lack of a moratorium on any additional rates levies in the Budget.”

Mr Swinney went on to confirm that the SNP’s “free” offers on tuition fees, prescription charges and bus travel would remain paid for by the state. The council tax freeze will also remain in place. On welfare, he said the Scottish Government would spend £68m in each of the next two years to “mitigate” the impact of reforms to the system imposed by the Westminster government.

Advertisement

Hide AdAdvertisement

Hide AdCentral to those controversial reforms has been the “bedroom tax”, which cuts the amount of housing benefit given to social housing residents who have a spare room.

With Labour demanding he find an extra £40m to offset its impact, Mr Swinney announced he would divert £20m this year to local authorities so they could assist those hardest hit by the reduction in income.

The funding package does not apply to next year, however. Mr Swinney said afterwards that he wanted to “maximise the pressure to abolish the bedroom tax”, saying that a longer-term funding pledge would “let the UK government off the hook”.

SNP figures last night declared that the £20m deal was an example of their current constitutional “limitations”.

SNP MSP Kenny Gibson declared: “We need the powers of an independent Scotland to do away with the bedroom tax altogether instead of being forced to simply manage and mitigate Westminster’s mistakes.”

Mr Swinney said legal rules prevented him from giving more money to councils in the form of discretionary housing payments. However, Labour last night accused him of playing politics with the matter.

Finance spokesman Iain Gray said: “Now we know the poorest, most vulnerable, disadvantaged Scots will be left on John Swinney’s hook just so he can make a political point.”

A Cosla Spokesman said: “These are the figures we were expecting, so no surprises. Everybody knows the state of public finances and that we are living in times of austerity.”

Analysis: Long-term danger could be sting in tail

Advertisement

Hide AdAdvertisement

Hide AdInevitably, the headlines around yesterday’s budget announcement for 2014-15 have revolved around short-term measures, but some of the biggest impacts are best seen via a longer term perspective.

The principal trend to bear in mind is that 2014-15 is a relatively “easy” year within the eight-year run of public sector austerity that started in 2009-10. In cash terms, it is the third in a series of four years (2012-13 to 2015-16) when the total departmental spending limits budget actually increases, although in each year by less than inflation. However, on current plans, there is a sting in the tail after the next UK election and independence referendum vote, when deeper cuts re-emerge that will be far more challenging to meet than those announced yesterday.

A particularly strong long-term shift comes with respect to local government funding. When the council tax freeze was introduced in 2007-8, local business taxes and the council tax brought in similar amounts, about £1.9 billion. By 2014-15, business taxes will have risen by 40 per cent, while council tax revenues are unchanged. This is a political choice, and a similar one has been made by the UK government, but its logic is difficult to fathom. The council tax freeze does not benefit the poorest in society, most of whom do not pay it, but does help the better-off. Meanwhile, the rise in business taxes could make an economic recovery more difficult, even though successive budgets are described as “to boost economic growth”.

There is clearly a trade-off implicit in the big rises in business rates that are needed to shore up the local government budget, with the cost of potentially hampering economic and jobs growth.

As well as council tax payers, the next big beneficiary of successive budgets has been the NHS. Since 2009-10, its budget for day-to-day spending will have increased by over £1bn by 2014-15. This may or may not be justified, but it’s a lot of money in such austere times and without much in the way of trying to identify what benefits we are getting for this. On pay, despite the protestations by John Swinney, the policies are not very different from those of the UK government; a recommended

1 per cent pay rise for most public service workers, including for the first time those on higher pay levels in Scotland, is at the heart of both governments’ policies. In the UK this is amended with attempts to get tougher on ‘pay progression’ awards, while in Scotland this is being left to individual employers like the NHS to decide.

Overall, this is another Budget that has been gotten through without any drama, which is probably what was intended, prior to next year’s referendum.

• John McLaren is from the Centre for Public Policy for Regions.

Local authorities join in bid to wrest more powers

Advertisement

Hide AdAdvertisement

Hide AdCity councils have discussed proposals to join forces in an attempt to secure more powers from the Scottish Government.

Local authority leaders looked into a report by the Cities Alliance group, which wants Glasgow, Aberdeen, Edinburgh, Dundee, Inverness, Perth and Stirling to gain more devolution.

The report, discussed in Glasgow, recommends the establishment of “Scottish city deals” as the first step towards greater devolution.

Money spent by development agencies Scottish Enterprise, Highlands and Islands Enterprise and Skills Development Scotland would be given directly to councils. The report argues: “This would enable democratically elected and accountable local authorities the ability to shape services and ensure that programmes and initiatives are complementary.

“It would reduce duplication and genuinely empower cities to control every aspect of the skills agenda within their area.”

A Scottish Government spokesman said: “The powers of independence will finally provide the opportunity for a new relationship between government and local authorities to properly address problems of employment and poverty in the city and provide real incentives to invest and grow businesses, creating more jobs.”