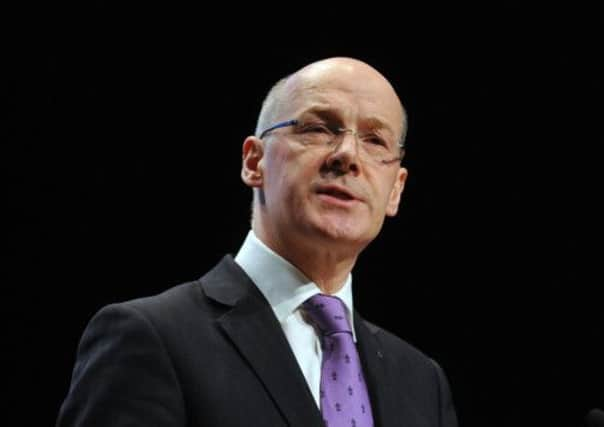

John Swinney calls for wider probe on business loans

Finance secretary John Swinney wants banking watchdog the Financial Conduct Authority to investigate tailored business loans which have been excluded from its inquiry.

Thousands of small Scottish firms like restaurants, hotels and B&Bs are believed to have lost out in the scandal. It saw firms sold a fixed rate on loans. Although it offers security if interest rates soar, it also means firms lose out in the current climate of low interest rates. Some small companies have lost out to the tune of hundreds of thousands of pounds.

Advertisement

Hide AdAdvertisement

Hide AdNationalist back-bencher Rod Campbell said yesterday: “Following on from the PPI scandal and the manipulation of Libor rates, we should not be surprised that the banks are again in the midst of another scandal. Interest rate swaps mis-selling have had a disastrous effect on a number of small and medium-sized businesses across Scotland.”

Almost 40,000 interest swaps have been sold UK-wide over the past decade. But the FCA probe is to exclude tailored businsess loans (TBLs) , on the basis of a “technicality”, even though they have the same hidden swaps which are just as “toxic” as other swap deals.

Mr Swinney called on banks to reach a “speedy resolution” to disputes with customers over TBLs and said he would ask the FCA about extending the remit of the review to include them.