Doubts raised over ex-RBS man's plan for Scottish stock exchange

Scotland on Sunday can reveal that Martin Bosman, a one-time senior executive with the bank’s NatWest Markets investment arm, is looking to raise millions of pounds from investors to set up an Edinburgh-based exchange, known as SPX, which will publish a Scottish counterpart to the FTSE 100.

Subject to regulatory approval, it is hoped the venture will be up and running by next May, allowing it to woo firms from Scotland and further afield.

Advertisement

Hide AdAdvertisement

Hide AdBut doubts have emerged surrounding key figures said to be involved with the budding exchange, which would be the country’s first since the demise of the Scottish Stock Exchange in 1973.

A Scotland on Sunday investigation has found that, Scotex, the company behind the new exchange, told potential investors that Lord Campbell of Pittenweem, the former leader of the Liberal Democrats, was advising its work and would ultimately helm its advisory board, providing “informed guidance” and “superior corporate governance.”

However, when contacted by this newspaper, the life peer said he had no knowledge of any such roles, and had only met Bosman, the founder of Scotex, on a single occasion around two years ago. Having heard nothing since, he assumed the enterprise had simply “died a death.”

Lord Campbell has subsequently consulted Tom Wilson, the registrar of Lords’ interests at the Palace of Westminster for advice on the matter.

All mention of the veteran politician was removed from Scotex’s online literature on Wednesday. The company’s website went offline altogether the following day, replaced with a holding page for a web hosting company.

In the wake of Lord Campbell distancing himself from Scotex, it remains unclear if the timetable for SPX’s introduction has been impacted.

The exchange proposes using the disruptive blockchain technology underpinning cryptocurrencies such as Bitcoin in order to clear and settle trades.

Bosman told Scotland on Sunday SPX would be the “exchange of the future.” Unlike traditional exchanges, where trades can take at least two working days to be settled, he said his near real-time model of SPX - using what is known as distributed ledger technology - would allow them to be completed within 15 minutes, giving it a “hugely significant advantage” over the London Stock Exchange.

Advertisement

Hide AdAdvertisement

Hide AdBosman, who is not registered with the Financial Conduct Authority, is due to launch what is known as an initial coin offering (ICO) for Scotex next month, an unregulated fundraising model where investors can buy tokens, or digital currency, in the undertaking, which will also serve as equity.

In a 30 page white paper prepared for potential investors, Scotex - founded by Bosman - said the exchange could replace a “a 50 year-old system developed in a world of paper-based systems without computers and the internet.”

The firm also said it would compile and publish a Scots-30 index, similar to the FTSE 100, which would attract investors and provide firms with “much needed UK media exposure.”

The white paper was also explicit in how it defined Lord Campbell’s involvement, stating: “Lord Campbell of Pittenweem, former leader of the Liberal Democrats, is an advisor to Scotex and will head up the advisory board.”

The only other advisor cited is a technologist called Jim McDonald. Companies House records show he is the director of Weald Technology Trading Limited, a dormant company. He was also director of Cognis, a software firm, which was dissolved last year. McDonald was not available for comment.

Speaking to Scotland on Sunday, Lord Campbell, who served as MP for North East Fife for over a quarter of a century, said: “This has certainly taken me by surprise. Martin Bosman got in touch with me and came up to Edinburgh to meet me, where we had a general discussion about it. That was around two years ago, then he went away and I’ve never heard another thing about it. I didn’t even know there was a website.

“We discussed the possibility of my acting in an advisory capacity, but there was nothing ever in writing, and there’s been no contact since that general discussion. I thought this thing had died a death.”

Asked initially if Lord Campbell was involved with Scotex, Bosman said the 76-year-old’s “expertise will come into its own once we have built the technology.”

Advertisement

Hide AdAdvertisement

Hide AdWhen it was pointed out to him that there was no agreement for Lord Campbell to take up an advisory role, he said there was “no formal agreement, rather a verbal one.”

Bosman was then asked why all mention of Lord Campbell had been excised from Scotex’s website. He replied that the veteran politician “will not be a part of this attempt at getting Scotex off the ground,” adding: “Please consider only myself and Jim to be part of this.”

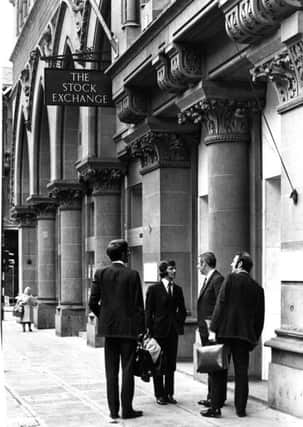

As recently as 1964, Scotland boasted no less than five exchanges across Edinburgh, Glasgow, Aberdeen, Dundee, and Greenock.

The last, the Scottish Stock Exchange, based in Glasgow, was amalgamated into the London Stock Exchange in 1973.

The prospect of a revived exchange has long been a topic of discussion in Scottish financial circles, particularly around the time of the referendum on Scottish independence.