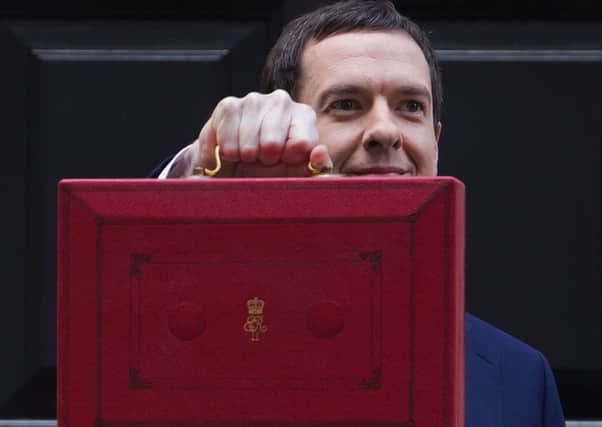

Budget 2016: Key points at a glance

Oil and gas

Addressing the slide in crude oil prices, the struggling North Sea oil and gas sector will benefit from £1 billion of tax cuts with the halving of the supplementary charge on oil and gas from 20 per cent to 10 per cent.

Petroleum revenue tax is set to be “effectively abolished”.

Levy on soft drinks

Bending to pressure to tackle obesity, the Chancellor has announced a ‘sugar tax’ on soft drinks to be introduced in two years’ time. It will raise £520 million in a two-part levy on companies; one for drinks with a total sugar content above 5g per 100ml and one for those with more than 8g per 100ml.

Fresh juice and milk are exempt.

Alcohol and tobacco

Advertisement

Hide AdAdvertisement

Hide AdDuty on beer, cider and whisky will be frozen in the coming year.

Tobacco duties will rise to 2 per cent above inflation, however.

Tax allowance

The threshold before being taxed will be raised to £11,000 by next April with the target to reach £12,500 by April 2020.

The Chancellor also announced an increase in the 40p tax threshold to £45,000 from next April.

Fuel duty

Drivers are set to save on average £75 with the freezing of fuel duty at 57.95p per litre for the sixth consecutive year.

Climate change

£730 million will be ploughed into renewables and will increase the climate change levy from 2019, a tax for non-domestic users to encourage a reduction in energy consumption. However, the Chancellor has abolished carbon reduction commitment energy efficiency scheme - a complicated reporting regime which only came into existence in 2010.

Austerity cuts

The Chancellor has outlined further austerity cuts to the tune of £3 billion in 2019/2020 despite leading financial experts saying there are no need for them while the economy is recovering. These include cuts to disability benefits.

Deficit

The UK’s finances will be in the black with a surplus of £10.4 billion by 2019/2020 with a target of £11 billion the year after.

Advertisement

Hide AdAdvertisement

Hide AdThe economy is still forecast to grow by 2 per cent in 2016, and predicted to continue growing at a rate of 2.1 per cent in 2017/2018, faster than any other Western economy.

Corporation tax

Corporation tax - the tax paid by businesses operating in the UK - will be reduced to 17 per cent by April 2020. Critics of the Chancellor’s ‘pro-business budget’ will likely point out that while businesses are paying less money into the treasury coffers, welfare will be hit harder.

Flood defences

The government was heavily criticised for under-funding flood defence projects after a particularly wet winter led to severe flooding in regions across the UK. In the 2016 Budget, flood defences will receive a £700 million increase.

Homelessness

£115 million has been earmarked to reduce homelessness but little was alluded to in terms of how the money will be used to achieve its aims.

Infrastructure

The Chancellor announced future infrastructure projects, including £60 million for the HS3 railway between Manchester and Leeds and the commissioning of Crossrail 2.

Libor

Libor bank fines will be used to pay for community facilities in Helensburgh and for naval personnel at Faslane.