Budget 2015: Anti-poverty campaigners slam ‘con trick’

But anti-poverty campaigners warned the new £7.20 per hour rate fell well short of the Living Wage as understood up until now and unions branded the Budget a “beautifully crafted con trick”.

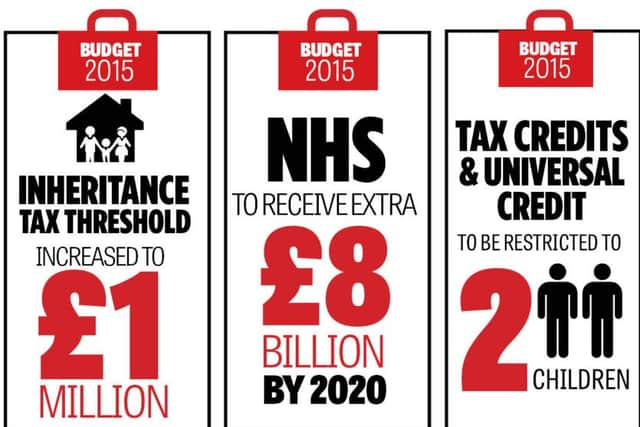

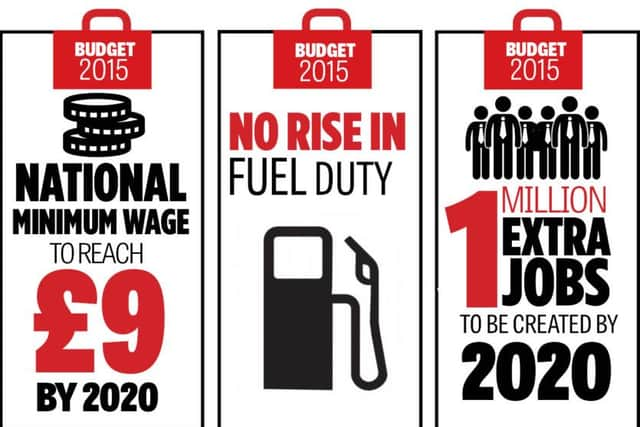

Mr Osborne announced that from April next year all workers over 25 will be entitled to £7.20 an hour - rising to £9 by 2020. He told MPs: “Britain deserves a pay rise and Britain is getting a pay rise.”

Advertisement

Hide AdAdvertisement

Hide AdBut the Budget also included £12 billion of cuts in welfare spending. Families will now only receive tax credits and Universal Credit payments for the first two children.

People under the age of 21 will no longer be automatically entitled to housing benefit.

All working age benefits will be frozen for four years. And there will be a new lower benefits cap of £20,000.

The so-called National Living Wage was meant to be Mr Osborne’s “rabbit out of the hat” at the end of his Budget speech in the Commons yesterday. The Scotland Office later claimed around 140,000 low wage workers in Scotland were expected to benefit directly.

But Edinburgh East SNP MP Tommy Sheppard said on Twitter: “Osborne has renamed national minimum wage as national living wage and Tories think it’s a great ruse. Bet they couldn’t live on £7.20 per hour.”

The Scottish Trades Union Congress said the move was a deliberate attempt to undermine the efforts of trade unions and others to secure a proper Living Wage and pointed out the £7.20 rate was well below the current independently-calculated £7.85 Living Wage.

Peter Kelly, director of the Poverty Alliance, said: “What George Osborne has done is adopt the rhetoric of the Living Wage without the policy falling into place.

“The Living Wage is quite clearly defined and the important thing is it’s based on what people need to get by.

Advertisement

Hide AdAdvertisement

Hide Ad“Plucking a figure of £7.20 out of the air and saying that’s a living wage, it’s not the case.”

The current minimum wage of £6.50 an hour is due to increase to £6.70 in October.

The Living Wage is currently £7.85 per hour but will also increase in November.

Mr Kelly said the Budget as a whole - with the rise in the threshold for inheritance tax to £1 million and the further corporation tax for big business - would make the UK a more unequal society. “It’s difficult to interpret the budget in any other way,” he said.

“In-work benefits are being frozen not just for the two years planned, but for another two years on top. Tax credits are being quite drastically cut back and the lower tax threshold will not make up for that. Many people in low-paid jobs already pay no income tax, so they can only lose out through the reduction in tax credits.”

Shadow Scottish Secretary and Edinburgh South MP Ian Murray said the Chancellor had cut vital support for working families while slashing inheritance tax for the richest.

He said: “No amount of Tory spin can hide the fact that this is a bad budget for working families, our most vulnerable and our young people.

“Labour fought for and introduced the minimum wage and we welcome any increase but the Chancellor is giving with one hand and taking away with the other. Cuts to tax credits will mean many working people will be worse off, and with under-25s not benefiting from the increase in the minimum wage, this will have a disproportionate impact on employees in low paid sectors.

Advertisement

Hide AdAdvertisement

Hide Ad“This political budget is George Osborne’s CV for getting into Number Ten. It’s not the budget of a Chancellor in Number Eleven.”

David Birrell, chief executive at Edinburgh Chamber of Commerce, welcomed the further reductions in corporation tax but said the new National Living Wage had come as a surprise to businesses.

He said: “Businesses aspire to do the best for their employees and most already pay this rate or more. However for some, especially smaller businesses in key sectors such as retail and hospitality, wages of this level do not fit within current commercial models. Businesses need assurance from Government that their genuine concerns over transition to the new scheme will be listened to and acted upon accordingly.”

Andy Willox, of the Federation of Small Businesses, also called for help during transition. He said: “We know that low pay isn’t a big business or small business problem but an issue for certain sectors such as retail and care. “We’ll need to see governments in Edinburgh and London support firms making any transition, ensuring rogue operators and foreign competitors don’t get the better of them.”

Fuel duty was frozen and the Chancellor announced a new banding system for road tax. In England the revenue from this will go into a fund for roads. Scotland will get its share of the cash under the Barnett formula but it will be up to the Scottish Government how to use it.

ANALYSIS

By John Swinney, Cabinet Secretary for Finance, Employment and Sustainable Growth

The Chancellor delivered his much-expected austerity budget yesterday. It has once again failed to deliver for the people in Edinburgh and was yet another opportunity missed.

It will be the households throughout Edinburgh that will now bear the brunt of austerity cuts. The Chancellor continues to cut from the poor whilst paying out to the rich, he is short-changing those on low incomes whilst giving tax breaks to the

better-off.

Advertisement

Hide AdAdvertisement

Hide AdThe reality is this budget is an attack on the low-paid, the young and those entering the jobs market.

This will only exacerbate the emergency situation faced by many.

And people should not be fooled by the increase in the minimum wage. I support a meaningful living wage paid for by business – one that pays what people need to live, not one that fails to compensate for cuts to valuable tax credits.

I’m disappointed to see that the Chancellor has not even promised to meet the current living wage rate of £7.85 and again the under-25s will face the brunt of cuts but receive no increase in wages.

The Scottish Government is committed to protecting and promoting public services throughout Scotland and we will continue to invest in our services and the people who work in them, using the powers and finances available to us.

The reality is there has been no easing up on austerity – the UK Government have simply shifted the balance of cuts from public services to the public themselves.

The Scottish Government has faced a ten per cent cut in our overall budget for the last five years and the Chancellor said deficit reduction would take place at the same pace in the future. Overall the scale of austerity being imposed by this UK Government remains unchanged.

Austerity hasn’t worked and the UK Government simply cannot go on ignoring the fact that their broken programme does little more than hit the most vulnerable the hardest.

GOVERNMENT SET TO SELL OFF MOST OF RBS STAKE

Advertisement

Hide AdAdvertisement

Hide AdThe Treasury has revealed plans to sell off at least three-quarters of its 78 per cent stake in Edinburgh-based Royal Bank of Scotland over the next five years.

The move is intended to raise at least £2 billion in 2015/16, as part of George Osborne’s plans for a record £31bn privatisation of state assets in the current year.

Mr Osborne announced last month that the Government was to begin selling off its holding in RBS, seven years after it was bailed out by taxpayers.

Details of how quickly the sale will proceed were revealed in the Red Book published alongside the Budget.

It said: “Over the course of this Parliament, the Government will dispose of at least three-quarters of its stake in RBS.”

James Leigh-Pemberton, executive chairman of UK Financial Investments (UKFI) - which manages taxpayer stakes in bailed-out banks – said: “I believe that realising a total of at least £25bn from the sale of RBS shares – representing over three-quarters of the Government’s stake in the RBS at the current market price – is feasible in the period to May 2020 while delivering value for money for the taxpayer.”

Mr Osborne admitted in his Mansion House speech to the City that it stands to make a loss of £7bn if the entire stake is sold off in one go. But he cited an analysis by Rothschild finding there would be an overall profit of £14bn if the Government’s remaining shares in all the bailed-out banks were sold.