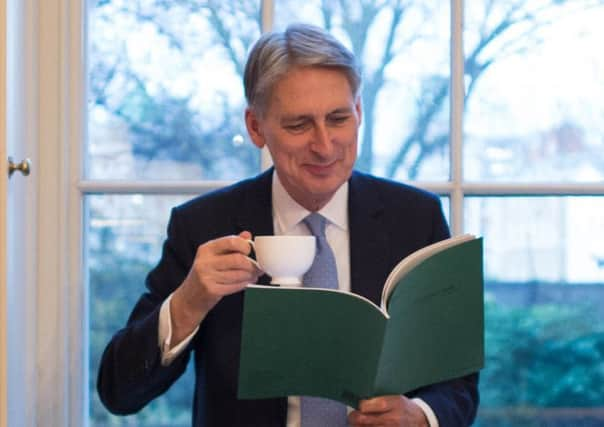

Autumn Statement: Hammond to push ahead with tax cuts

Announcing a suite of measures designed to help “ordinary working-class people”, Mr Hammond will ease the impact of cuts to income support for the lowest paid, while the minimum wage will rise by 30p next year to £7.50 per hour.

However, government forecasts are expected to confirm that the vote to leave the European Union will hit growth from next year while rising inflation is set to erode living standards.

Advertisement

Hide AdAdvertisement

Hide AdThe Chancellor will deliver on a promised tax cut for the middle class, raising the threshold for the 40p higher rate of income tax to £50,000. He will also take more low-earners out of income tax altogether by raising the personal allowance to £12,500 by 2020.

The Chancellor received a boost on the eve of his first major fiscal statement, as official figures showed the government borrowed a lower-than-expected £4.8 billion last month. But today’s economic figures are likely to make difficult reading and set the scene for years of increased borrowing until the next election.

Official forecasts in March from the Office for Budget Responsibility (OBR) – which provides the official independent forecasts of the government’s performance – predicted growth would hit 2.2 per cent in 2017 before settling at 2.1 per cent until 2020.

The OBR’s latest set of figures are expected to be significantly lower in the mid-term, with predictions by independent analysts suggesting GDP growth could slide back to 1.3 per cent next year, 1.5 per cent in 2018, and 1.8 per cent in 2019.

Mr Hammond had promised a “reset” of fiscal policy, but a blow to the public finances of as much as £100bn by 2020 means today’s announcement is not expected to contain any major surprises.

The director of the respected Institute for Fiscal Studies think-tank warned Mr Hammond would have limited room for manoeuvre in a “watch and wait” Autumn Statement.

Paul Johnson said: “We are uncertain about quite how big the effect on the economy of the Brexit vote will be in the short run, we don’t know what our relationship with the European Union will be in the long run and that will have a big effect on our growth.

“The Chancellor will be waiting to see what some of these decisions are, and where the economy comes out in six or 12 months, and then make big decisions on spending and tax.”

Advertisement

Hide AdAdvertisement

Hide AdIn an attempt to deliver on Theresa May’s pledge to support so-called Jams, families that are “Just About Managing” in low-paid work, Mr Hammond will deliver a modest boost for low-paid workers on income support by easing the penalty that discourages them from seeking additional hours to increase their pay.

Those receiving Universal Credit currently keep just 35p of every additional pound they earn over a permitted “work allowance”, as in-work benefits are withdrawn. This will rise by 2p, in a move that hands an estimated £700m per year to three million households.

However, the announcement is set to disappoint the opposition and anti-poverty campaigners, who called on Mr Hammond to roll back £3bn of cuts to work allowances announced by George Osborne last year.

Shadow chancellor John McDonnell said: “It would appear that this Autumn Statement is set to fail our first test to provide actual support for those on low and middle incomes. He said: “If, as reported, all the Chancellor is offering is a 2 per cent change in the taper rate, then it will be too little, too late for those working families who have had to bear the brunt of six wasted years of failed Tory economic policies.”

The SNP said the Chancellor’s announcement would only “tweak” the circumstances of struggling families.

The party’s welfare spokeswoman, Dr Eilidh Whiteford, said: “Changing taper rates won’t on its own mitigate the impact these cuts will have on low-income families. Instead the government should reverse cuts to the work allowance in full so that working parents in low-paid jobs don’t lose out.”

The Liberal Democrat work and pensions spokeswoman, Cathy Bakewell, claimed the government was expecting the low paid “to thank someone who cut off your arm for giving you a sticking plaster”.

“This is a cynical move from a Prime Minister and Chancellor who last year marched through the lobbies in support of huge cuts that hit the poorest working families.”