Analysis: Question of how Donald Trump’s Scottish resorts are financed even more urgent

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

It was revealed that Mr Trump paid just $750 (£585) in federal income taxes in 2016, the year he was elected, and the same amount in his first year in the White House. In ten of the previous 15 years, meanwhile, he paid no income taxes at all, on account of having lost more money than he made.

For a sitting president whose re-election prospects depend largely on steering the US economy out of an unprecedented pandemic, the long-awaited detail of his tax returns – and the gut-punch effect of its headline takeaway - has the potential to be hugely damaging, particularly among the blue collar voting base.

Advertisement

Hide AdAdvertisement

Hide AdIn other ways, however, the news of Mr Trump’s meagre tax exposure merely brings the US up to speed with what has long been evident in Scotland. If anything, the overarching legacy of the New York Times exposé will be to lend even greater urgency to questions surrounding the Trump Organisation’s finances.

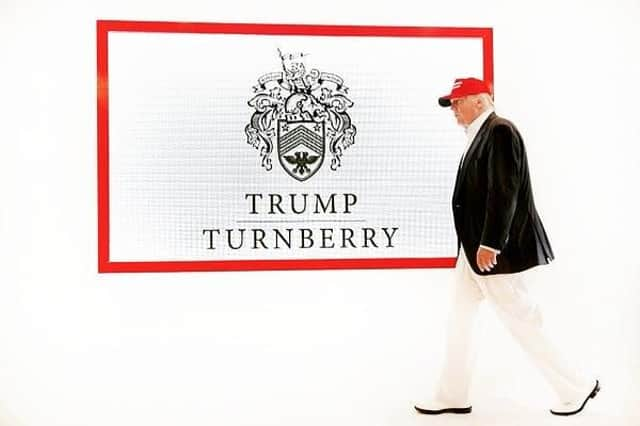

The 21 October marks the 15th anniversary of the incorporation of Mr Trump’s first Scottish company, set up to facilitate the development of his inaugural Scottish course. In the decade-and-a-half since, he has acquired Turnberry, one of the world’s showpiece golf resorts, and tried - with varying success - to expand the footprint of his Scottish firms by pursuing large-scale house building projects and retirement-style enclaves, or luxury helicopter charter services which later floundered.

One thread has remained constant. In that entire time, not a single one of Mr Trump’s companies has paid a penny in corporation tax to authorities in the UK. The reason? Not a single one has ever turned a profit.

His first venture in his mother’s homeland, Trump International Scotland, has run up cumulative losses of more than £9.4m. Turnberry, the jewel in the Trump Organisation’s crown, and a four-time host of golf’s prestigious Open championship, has fared even worse. Since he acquired the historic venue six years ago, it has lost nearly £43m.

The reality is that, even if Mr Trump’s Scottish resorts suddenly become profitable - an unlikely scenario given how the hospitality and leisure sectors have been battered by coronavirus - it will be some considerable time before they ever have to pay corporation tax.

Turnberry has a deferred tax asset of £9.1m that has not been recognised because there is no certainty of taxable profits in the future, while the Aberdeenshire firm has a potential deferred tax asset of £1.8m.

Indeed, when he acquired Turnberry, Mr Trump did not just buy the hotel and the golf courses; he acquired SLC Turnberry Limited, the corporate entity which owned them. That means he inherited the company’s tax history, including all tax losses made to date, which are considerable. There is no suggestion of illegality or abuse here. It’s simply an opportune use of how the UK’s Byzantine tax loss rules work.

As well as incurring consistent operational losses, Mr Trump’s Scottish resorts are heavily indebted. Turnberry owes the 73-year-old £115m, money he provided in the form of interest free loans. Trump International Scotland remains reliant on interest free loans provided by Mr Trump totalling £40.6m.

Advertisement

Hide AdAdvertisement

Hide AdGiven we now know, thanks to the New York Times, the Trump Organisation’s entire business lost £135m between 2000 and 2018, it begs the question of how Mr Trump has been able to provide those loans.

The corporate vehicle overseeing Turnberry, Golf Recreation Scotland Limited, owes the £115m to a New York-based state grantor trust called the Donald J Trump Revocable Trust. The company overseeing the Aberdeenshire resort, Trump International Golf Scotland Limited, owes the £40.6m to Mr Trump personally, and its accounts show it has further interest free loans totalling nearly £2.5m, owed to DJT Holdings LLC.

Thanks to a US system that allows privately-listed companies to avoid any meaningful public scrutiny, we do not know the sources of income for either the trust or the LLC. This remains a central mystery surrounding Mr Trump’s business interests. It is worth remembering that when he took over Turnberry in 2014 - a year in which he paid no federal income taxes, according to the New York Times - the £35m purchase price was settled in cash.

All of these areas are subject to ongoing scrutiny, not least by the Manhattan District Attorney, and the New York Times report will aid those investigations. Indeed, prosecutors might be particularly interested by the news that Mr Trump declared more than £1bn in losses from his core businesses in 2008 and 2009.

This time period coincided with a major spending spree by the Trump Organisation. Indeed, in November 2008, as a global recession hit, the-then Trump Organisation executive vice-president George Sorial told The Scotsman that Mr Trump had £1bn “sitting in the bank and ready to go” to finance his course in Aberdeenshire.

But The Scotsman later revealed that a month beforehand, Mr Trump wrote personally to a Bank of Scotland executive, asking the institution for a 15-year £23m mortgage and a construction loan of £15m to buy Hamilton Hall in St Andrews and turn it into a hotel. The bank refused, and the deal never came off, though that scarcely matters. What is important is Mr Trump repeatedly pursued external financing, despite the claims Mr Sorial would go on to make.

The exemplary investigation by the New York Times does not solve that conundrum, but it is a vital jigsaw piece which brings us closer to answering a persistent question posted throughout the Trump presidency, and one which may well outlast it: where did his money come from?

A message from the Editor:

Thank you for reading this story on our website. While I have your attention, I also have an important request to make of you.

The dramatic events of 2020 are having a major impact on many of our advertisers - and consequently the revenue we receive. We are now more reliant than ever on you taking out a digital subscription to support our journalism.

Subscribe to scotsman.com and enjoy unlimited access to Scottish news and information online and on our app. Visit https://www.scotsman.com/subscriptions now to sign up.

By supporting us, we are able to support you in providing trusted, fact-checked content for this website.

Joy Yates

Editorial Director

Comments

Want to join the conversation? Please or to comment on this article.