Tax return deadline: Covid crisis means firms should be given more time – Andrew Morrison

The latest round of UK-wide restrictions mean January will be significantly more bleak than we’d all hoped just a few months ago.

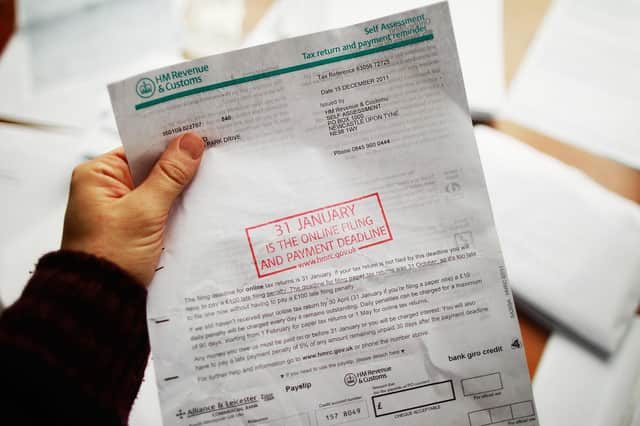

But there is one thing the government could do to lift some of that gloom and give small and medium-sized firms much-needed breathing space – extend the self-assessment deadline.

Advertisement

Hide AdAdvertisement

Hide AdJanuary tends to be a fraught month for companies anyway as they scramble to get everything together for the dreaded tax return.

Many use the festive period to gather receipts, meet accountants, and collect data from offices to ensure they don’t miss the deadline.

But for thousands across the country that won’t have been possible, especially for those who’ve been forced to self-isolate or, like I was a few months back, unwell with Covid-19 itself.

For business owners who are shielding, using public transport to deliver documents to an accountant would be out of the question, which could be another impediment to a timely submission.

It’s also been a struggle for those businesses who are running operations from the bedrooms and lounges of their respective staff members – they simply haven’t had the time and resources to muster the necessary information.

Both the Scottish and UK governments have worked together well to help out firms struggling through the pandemic, but now HMRC could step in with further assistance.

Extending the deadline by a couple of months would be a much-needed fillip for thousands of small businesses, and wouldn’t have any material impact on the public purse.

In fact, it may even prove cost-effective. Last year around 700,000 people in the UK missed the deadline for self-assessment, each facing a hefty fine.

Advertisement

Hide AdAdvertisement

Hide AdIf we leave the deadline this year for the end of January, that total is likely to be far higher given what we’ve all just endured.

Remember, many of these will be perfectly respectable businesses who’ve never missed a payment before, and would likely launch very credible appeals against any penalties imposed.

HMRC will listen to all appeals which include ill health, postal issues, bereavement, IT difficulties or the occurrence of a natural disaster. This year, all of those reasons could be linked to coronavirus.

Dealing with all those appeals in itself would cause an administrative nightmare for them some months later, something which they should be working to avert now.

After all, when HMRC is already processing furlough and other job retention schemes, does it really need to invite more work upon itself?

There’s some precedent for this too; Companies House has already granted a three-month extension for those firms who need to file accounts with the Registrar of Companies.

Over these past 10 months, the world has become used to events being cancelled and milestones delayed, from local town galas to the Olympic Games.

Handing 60 days grace to small and medium-sized businesses across the UK after the year they’ve just had would be a welcome and uncomplicated move, and one that should be announced as a matter of urgency.

Andrew Morrison is director of MCC Accountants

A message from the Editor:

Thank you for reading this article. We're more reliant on your support than ever as the shift in consumer habits brought about by coronavirus impacts our advertisers.

If you haven't already, please consider supporting our trusted, fact-checked journalism by taking out a digital subscription.

Comments

Want to join the conversation? Please or to comment on this article.