Tax harmonisation is critical for Scotland - Betsy Williamson

Chancellor Kwarteng’s “mini budget” views cuts as the way to kick-start a new era for the UK economy, focused on growth.

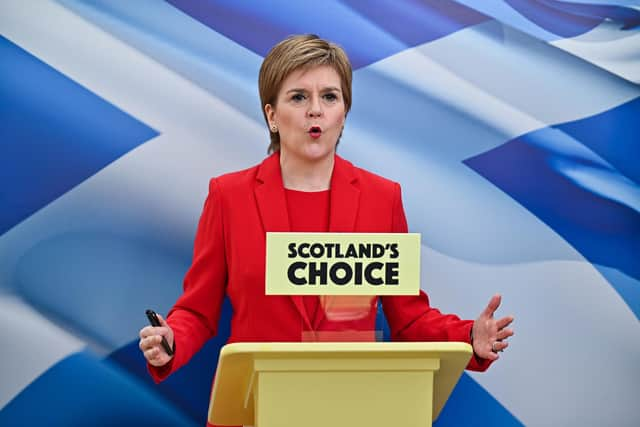

With the spotlight firmly on whether Holyrood will respond, Sturgeon has been swift to quote the Institute for Fiscal Studies and suggest the changes only benefit the rich, while describing the budget as reckless.

Advertisement

Hide AdAdvertisement

Hide AdThat said, she’s caught between a rock and a hard place. Should the Scottish Government decide not to match the new tax framework this means workers in Scotland earning more than £14,732 will start paying more than those on similar salaries in the rest of the UK from April.

This gap increases the more a person earns, with someone on £35,000 becoming almost £300 worse off, and those on £45,000 being hit to the tune of £763. At the very top end, individuals earning £200,000 next year in Scotland would pay £6,045.80 more in income tax than counterparts in the rest of the UK.

There is a lot at stake. In March 2022 the Scottish Government unveiled Scotland's National Strategy for Economic Transformation. The strategy sets out the priorities for Scotland’s economy as well as the actions needed to maximise the opportunities of the next decade to achieve our vision of a wellbeing economy.

To quote the opening paragraph: “Scotland has extraordinary economic potential. Our natural resources, heritage, talent, creativity, academic institutions and business base, in both established, and emerging sectors, are the envy of many across the world.

The Scottish Government’s Economic Transformation program consists of 18 projects and 77 actions which the Government claims will allow us to achieve their vision of building a stronger and more successful economy.

Despite global headwinds, and the impacts of Brexit and Covid, the strategy labels the next 10 years as the "decisive decade".

The Strategy paper states a skilled population is fundamental to business productivity and economic prosperity. Those businesses here, in Scotland, with Government support must “provide rewarding careers and meet the demands of an ever-changing economy and society” that employers must “invest in the skilled employees they need to grow their businesses”.

Attracting businesses to invest in Scotland is therefore a key driver of our long-term economic wellbeing and prosperity.

Advertisement

Hide AdAdvertisement

Hide AdUltra-mobile global businesses play a key role in Scotland’s economy, giving us access to global technology, talent, markets and investment. They support the building of globally recognised “market clusters” and the development of local supply chains.

They create high-value jobs for the economy. This means we need to focus on an evidence-led approach to identifying Scotland’s strengths, aligning these to current and projected investment flows, before setting out a series of actions to attract further investment to Scotland.

Recruitment and retention of the types of individuals required to meet the Scottish Government’s National Strategy must be key. How are we to attract global businesses and strengthen local supply chains to these businesses when taxation of business leaders acts as a clear disincentive?

To allow our country to grow and prosper we must attract and more importantly retain, the best talent nationally, and in some cases globally.

If we are to meet the Scottish Government’s National Strategy for Economic Transformation and also hit targets on net zero carbon emissions and renewable energy, Scotland needs to be recognised as a business environment able to compete on a world stage. Tax harmonisation is critical to achieving this goal.

Whether the First Minister wants to accept it or not, the only way to meet the Government’s own plans for growth and stability is to remove hurdles in attracting and retaining the entrepreneurial spirit locally while attracting global businesses.

If we cannot compete with the rest of the UK, the very people we need to lead and create the businesses the economy needs for future growth will look elsewhere and Scotland will become the equivalent of Nokia Vs Apple. Obsolete.

Holyrood may be caught at a very understandable ideological crossroads. But now is not the time for intransigence.

Betsy Williamson is the founder and Chief Executive of Core-Asset Consulting, Scotland’s leading recruiter for the financial services sector.

Comments

Want to join the conversation? Please or to comment on this article.