Michael Watson: Time to invest in making society better

This article contains affiliate links. We may earn a small commission on items purchased through this article, but that does not affect our editorial judgement.

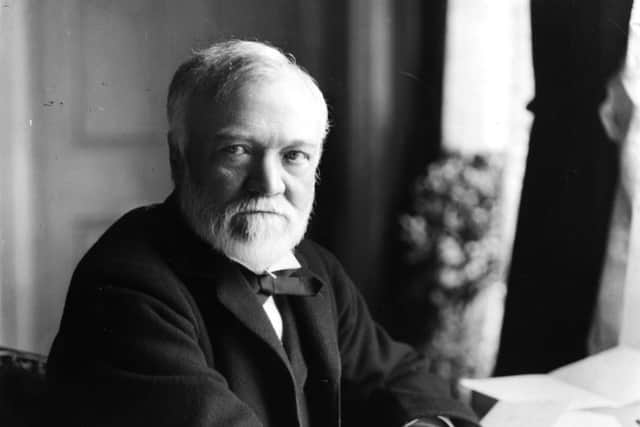

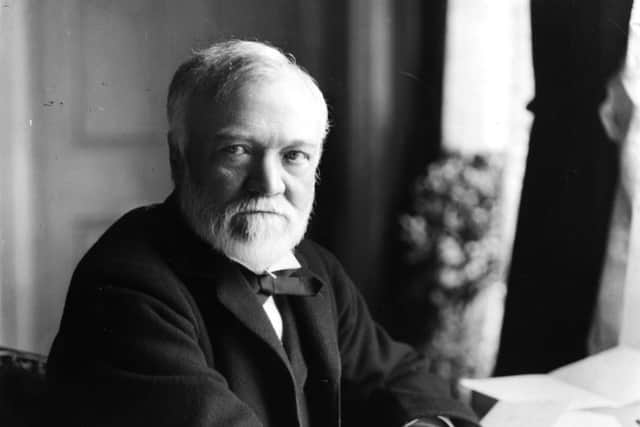

True to his word, in the last 18 years of his life Dunfermline-born Carnegie gave away 90 per cent of his fortune to charities, foundations and universities.

It is fitting that tonight some of our foremost philanthropists and business leaders will gather in Edinburgh to welcome another champion of philanthropy to Scotland for the first time – the 44th US President, Barack Obama.

Advertisement

Hide AdAdvertisement

Hide Ad

Hosted by Sir Tom Hunter’s The Hunter Foundation, there is little doubt the audience at the Edinburgh International Conference Centre will hang on every word of the charismatic politician, who gave away more than $1 million to charity during his presidency. All proceeds from the event will go to charities helping young people in Scotland.

It is encouraging that Scotland is not short of successful business people who devote time and resources to philanthropic projects. Sitting alongside The Hunter Foundation in that category is The Wood Foundation, set up by oil and gas entrepreneur Sir Ian Wood and The Gloag Foundation, founded by Ann Gloag of Stagecoach Group.

It will be something of a relief to put aside any thoughts of the impending general election and Brexit-related discussions to listen to a genuine statesman who, I expect, will remind us of our responsibilities as global citizens, especially against a backdrop of increased geo-political tension, fake news, and ongoing constitutional upheaval across Europe and the US.

Arguably, there has never been a more crucial time for blue-chip corporates and wealthy individuals to invest time, skills, knowledge and finance in infrastructure projects which benefit the most disadvantaged in society and support developing and emerging economies.

Social impact investment supports the core elements of a modern society which many of us take for granted – an accessible and secure energy supply, efficient roads and transport infrastructure, modern hospitals and health care, and education systems which bring out the best in our young people and nurture the next generation of leaders.

Advertisement

Hide AdAdvertisement

Hide AdEffective and considered investment will reduce inequality and drive inclusive economic growth globally. Once a niche market, impact investment is now mainstream with global investors keenly aware of the vital role they can play to help address the world’s environmental, social and economic challenges.

An impact investor survey by the Global Impact Investing Network estimated that almost $26 billion will be invested this year across 9500 investments, up from $22.1bn and 7950 investments last year. These are impressive figures but to put this in context, The Rockefeller Foundation points out that there is an estimated $2.5 trillion funding gap to achieve the Sustainable Development Goals (SDG) in developing countries alone.

In these somewhat uncertain political times it is vitally important that business and individuals don’t lose sight of the need to be relevant to the global economies, social and economic inclusion, and inclusive growth.

Tonight, Mr Obama will experience the best of Scottish hospitality with entertainment from Annie Lennox, for example. However, I suspect the performance of the night will come from Glasgow schoolgirl Mila Stricevic, 13, reading her inspiring poem If I Ruled Scotland, in which she says: “If I ruled Scotland I would invest in our schools, to ensure rich or poor, our kids all had the tools, to pursue their own dream regardless of class, and make Scotland a nation where no one comes last.”

Fine words, which fit nicely with the objectives of social impact investment and will resonate with Mr Obama – to provide the tools which will harness ambition irrespective of background.

• Michael Watson is partner and head of finance and projects group at legal firm Pinsent Masons