Martin Flanagan: Markets badly rattled by Brexit victory

Howard Archer, chief UK economist at IHS Global Insight, is not untypical. He has cut his UK GDP forecasts to 1.5 per cent (from 2 per cent) for 2016, 0.2 per cent (from 2.4 per cent) for 2017 and 1.3 per cent (from 2.3 per cent) for 2018.

The scale of the fall in stock markets yesterday – even if the initial 8 per cent slump in London was later pared to 3 per cent – says that the City fears Britain is heading into a self-inflicted economic slowdown at best, and downright recession at worst.

Advertisement

Hide AdAdvertisement

Hide AdThe pound fell 17 cents to a 31-year low against the dollar of $1.33 at one stage. Banks and housebuilding stocks on the stock market were hit particularly hard as those sectors are seen as being directly in the line of fire as business and consumer confidence is battered.

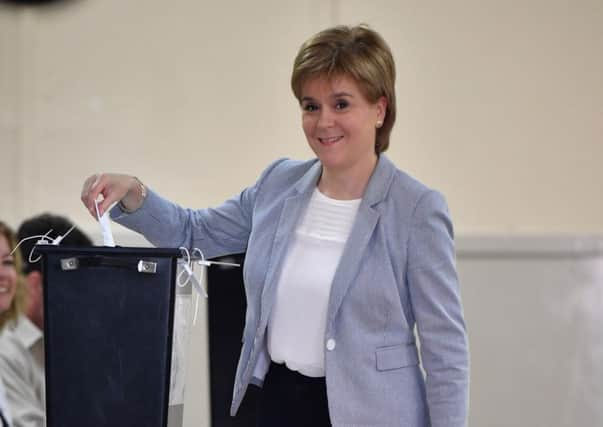

Meanwhile, the announcement by First Minister Nicola Sturgeon that a second Scottish independence referendum is now on the table plunges UK businesses back into the same climate of uncertainty that they were in just two years ago in the referendum north of the Border.

Investors are diving into the safe havens of gold and German bonds. For every market professional that tells you there is a “value opportunity” in equities at these suddenly depressed levels – ie buying when there is blood in the streets – there is another telling you we are in unprecedented times and all bets are off.

This has the scary feeling of the 2008 financial crash, but with monumental political ramifications on top. As one analyst said: “This is arguably the worst setback to European efforts to forge greater unity since the Second World War.”

About the only plus side was that analysts said the slump in the value of sterling would help UK exports, but while realistic down the line it had something of the feel of a candle in the wind in yesterday’s febrile atmosphere.