Jeff Salway: Lenders' bad habits die hard in new debt crisis

One popular method was to automatically increase the limit, because they knew that the higher it was, the more they would borrow.

The most profitable customers were those who were most vulnerable, said the whistleblower. He referred to a case in which an RBS customer whose debts had spiralled out of control was found dead on a railway line next to a bag stuffed with bank statements.

Advertisement

Hide AdAdvertisement

Hide AdThat was 10 years ago. Things are different now, you would think, following the financial crisis.

Think again. Now, some eight years after the crisis, we’re taking on unsecured debt (from credit cards and loans) at a faster rate than at any time over the past decade, The Money Charity has warned.

UK adults have £3,629 of unsecured debt, on average, up from £3,171 at the end of 2013, according to the charity’s latest figures. Bank of England stats tell the same story. They show that consumer credit increased by £1.3 billion in April alone, the second fastest rate of increase since December 2005.

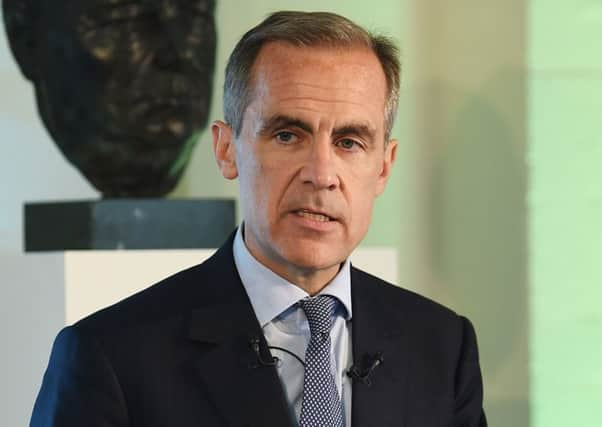

That’s why Bank of England governor Mark Carney has said that current debt levels could turn any economic downturn – such as that triggered by a vote in favour of leaving the EU – into a full-blown catastrophe.

More than £64bn is owed on credit cards alone. About two million credit card holders are in arrears or default, including 1.5 million who have missed at least three months of repayments, according to the Financial Conduct Authority (FCA).

The debt boom is also being fuelled by the return of irresponsible lending practices, such as unsolicited credit limit increases. Research earlier this year by uSwitch.com found that almost two-thirds of cardholders had seen their limit raised without them requesting it, driving nearly half into even greater debt.

Banks are supposed to lend on the basis of affordability checks, but with revenues curbed elsewhere they’re once again squeezing what they can out of their more vulnerable – and most profitable – customers.

The FCA is under considerable pressure to act, not least by introducing an opt-in requirement for credit limit hikes. Nationwide earlier this year became the first major lender to pledge not to raise card limits without asking first, but others have been slow to follow suit.

Advertisement

Hide AdAdvertisement

Hide AdWe’ve also had a price war in the zero balance transfer cards market. Some providers now offer interest-free periods of more than three years for people who transfer balances from other cards. It’s the debt equivalent of the savings teaser rate – providers know they’ll rake in handsome revenue from the extortionate interest rates they charge the large number of people who’ll stay put after the offer period ends.

If 10 years ago people were borrowing out of profligacy, now it’s more likely to be necessity. In the era of low pay, zero hours contracts, soaring rental prices and the government’s shameful assault on welfare, credit cards are increasingly used to cover essential living costs.

So we have a government building an economy on cheap debt, banks getting up to their old tricks and debt levels going up and up. All so familiar isn’t it – except the consequences of the next bust could be even greater.