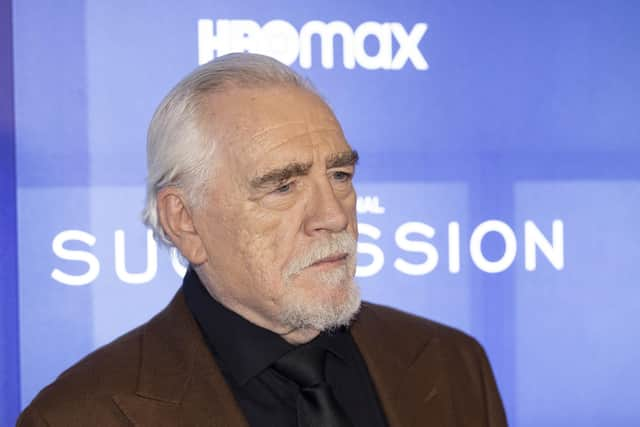

Hit TV show Succession isn't that far from the truth - Peter Shand

It’s a fictional drama whose lead character, Logan Roy, heads up a global media and entertainment conglomerate and it focuses on the power struggle to succeed him. If that sounds familiar, then look no further than the Murdoch family of Fox Corporation and News Corp fame. The perceived wisdom is that this drama series is based on Rupert Murdoch, who claims not to have seen it, although the producer was told the Murdoch family found it interesting and amusing.

My professional interest in both these families, real and fictional, was piqued by the fierce squabbles and succession planning power plays over who takes control when the titans of the businesses leave.

Advertisement

Hide AdAdvertisement

Hide AdThis is certainly not just a fictional storyline, and every lawyer will probably have too many examples of inheritance and succession disasters brought about by poor, or a total lack of, planning. Also on TV at the moment is a programme called Inheritance Wars: Who Gets The Money? This is billed, in part I suspect for dramatic appeal, as ‘a shocking series uncovering stories of families torn apart by inheritance disputes’. The only winner in these cases is often HMRC, which gathers 40 per cent of the proceeds over the inheritance tax threshold.

The first programme in this series featured a fascinating case of the legal battle between two blood brothers and their adopted brother, that ended up in the Supreme Court. It actually highlights one of the key differences between the Scottish and English legal systems.

The parents wanted to leave everything to their adopted son, but it transpired they had mistakenly signed each other’s Wills rather than their own. In the ensuing court battle the biological children won until the Supreme Court overruled that decision and everything reverted to the adopted son. It was a landmark judgement and a historic case.

Such a case would not likely have gone so far in the Scottish Courts. Here, the Succession (Scotland) Act 1964 has built-in protections for children on the death of a parent which means they cannot be entirely overlooked in a Will. These “legal rights” offer the next of kin in Scotland a safety net against disinheritance, which is a concept that is alien to England and Wales.

Thinking back to the “battle for the boardroom” business owners should consider very carefully what they do with their company shareholding, as these “legal rights” on death could lead to unintended and unwanted outcomes when the business changes hands. It is certainly possible to mitigate the risk of a collapse in business continuity on the death of its owner, but it can involve a difficult decision to restructure ownership during your lifetime, with many reluctant to cede control.

An increasing number of people are using trusts as a way of mitigating risks and retaining a measure of control in the organisation they have built up. But don’t be fooled into thinking destructive disputes only involve large estates and vast sums of money. Family inheritance wars can even centre on individual items such as grandfather clocks or pieces of jewellery.

With the root cause of such bitter disputes so varied it is more important than ever that expert advice is sought. Otherwise, you or your story might end up on TV.

Peter Shand is a Partner, Murray Beith Murray.