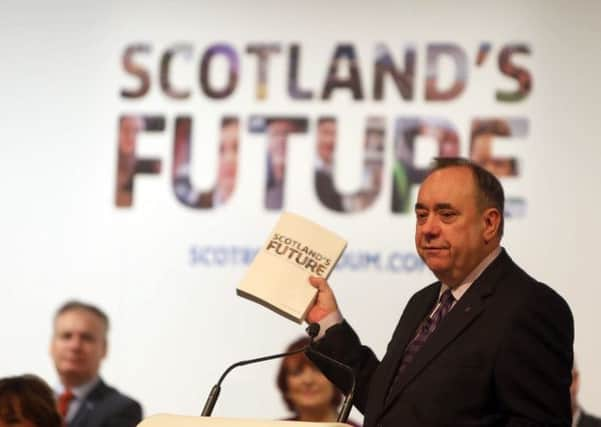

Comment: Firms can’t stay silent on independence

Business people must be asked where they stand and how they want the country to be shaped and run.

The time for sitting on the fence is over. It is up to everyone, businesses included, to join the debate and tell us all what they think.

Advertisement

Hide AdAdvertisement

Hide AdLeaving the decision “to the people” is laudable and worthily democratic, but is also an abdication of a certain amount of responsibility. Companies, after all, have a body of internal knowledge on how the proposals may affect their plans, their wellbeing and their prosperity. Only they know if one side’s intentions – whether on tax, regulation, currency and so on – are likely to impact on them positively or adversely and whether this may have profound consequences.

So it is time to say so, to share this knowledge with their employees, investors and suppliers, as well as with the wider community which may benefit or suffer as a result of future corporate decisions.

Nor should companies big and small hide behind trade bodies to speak for them. There is anecdotal evidence of some concern among the members about CBI Scotland being more demanding of answers from the Yes campaign while being less interrogative of the No lobby.

CBI Scotland also calls for greater transparency from the politicians while it throws a cloak over the thoughts and opinions of its members, shielding them from what they fear will be a backlash should they come out in favour of one side or the other.

Frankly, this debate is too important for companies big or small to keep their opinions to themselves and, in any case, it may be enriched by businesses adding their voices to it.

Lend a hand to the optimists

AT last a new year starts on an optimistic footing. So much so that it is hard to find any commentator or analyst not expecting a recovery. Welcome back, confidence, how we have missed you.

So does this mean we will stop hearing companies talk about “cautious” outlooks and “continuing uncertainty”? Not necessarily, though it will only take a few bullish predictions to swing the overall mood. Building that much-needed confidence depends so much on creating a feelgood factor that permeates the broader corporate body.

With confidence comes a greater willingness to invest, but in most cases that also means raising extra external finance. And this continues to be the fly in the ointment.

Advertisement

Hide AdAdvertisement

Hide AdAccording to the latest Bank of England figures, the amount lent to businesses in November suffered its biggest monthly fall since April 2011, inevitably raising questions about the much-heralded recovery.

Sorry to be a party-pooper, but these figures are a concern. The one caveat is that the fall was attributed to a drop in loans to big firms, while lending to smaller ones rose for the first time in five months.

So what does the data really tell us? Firstly, that the picture is far from clear. No-one really knows why there was a slump in the overall figure.

Deeper analysis reveals that businesses have been repaying debt, and in November paid off £4.66 billion, the largest single monthly payment since May 2011.

The bigger firms have also turned increasingly to the bond markets where they can access even cheaper money. Small firms, deprived of bank debt, have resorted to forms of finance such as angel investing and crowdfunding.

The banks and the business community continue to argue over the reasons for the loan log-jam – the former blaming it on a lack of demand, the latter on a tightening of terms and conditions and punitive interest rates.

Analysts will hope that refocusing the Bank of England’s Funding for Lending Scheme on businesses and away from the mortgage market will see the tide turning while helping to stop any emerging house price bubble.

That brings us back to confidence and the banks’ claims over a lack of demand for debt. If companies believe that it is worth expanding, buying and ordering because the economy is improving then they will raise capital. And, after all, a dose of optimism is probably the best stimulus the economy can receive.

Twitter: @TerryMurden1