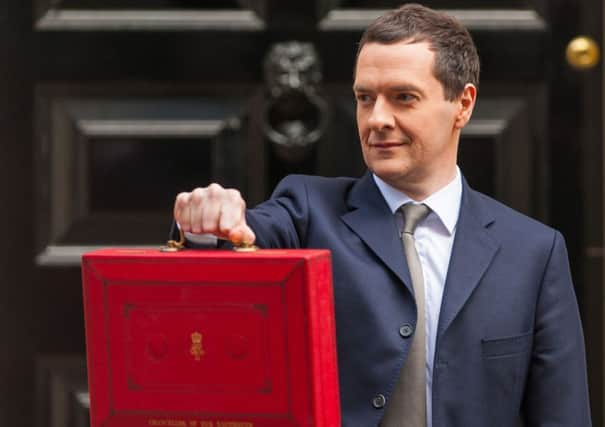

Comment: Chancellor unveils largely helpful Budget

Help for the beleaguered North Sea oil sector; excise duty cuts for the whisky industry; City Deal status pledged for Inverness and Aberdeen: Chancellor George Osborne hit several key Scottish concerns in his final Budget before the election.

Overall he has squared a difficult circle: maintained a clear direction of travel on debt and deficit reduction with no resort to obvious pre-election giveaways, while still pulling some rabbits out of the hat for savers. These are the big beneficiaries of the Budget, in particular the long overdue move to exempt the first £1,000 of savings income from tax. Greater flexibility on individual savings accounts (ISAs) and the ISA “Help to Buy” scheme are welcome innovations.

Advertisement

Hide AdAdvertisement

Hide AdAfter five years of “austerity” budgets dominated by disappointing progress on the public finances and the constant drizzle of rising debt, Osborne made much yesterday of walking on the sunny side of the street.

The budget deficit is falling steadily; debt as a share of GDP; big reductions are coming on the annual debt interest bill – and, amid all this, the economy is set for another year of growth.

The Office for Budget Responsibility forecast of GDP growth has been raised, if fractionally, from 2.4 per cent to 2.5 per cent, with 2.3 per cent pencilled in for 2016. He also made much of the latest labour market numbers showing unemployment down to 5.3 per cent with numbers in work at an all-time record. Households are now enjoying a lift in real, after tax, disposable incomes after years of falling incomes and stagnation.

His speech piled on the pre-election points. But has he really “fixed the roof” as he claimed?

Listening to the impressive trill of falling debt and deficit statistics five years out, similar recitals by former chancellor Gordon Brown sprang to mind. It was a marked feature of almost all his budgets that the deficit was forecast to disappear four years ahead, just over the horizon. It never did. The memory is a reminder of how events can wreck all such projections.

As it is, the Chancellor’s deft use of statistics conveyed the impression of a shrinking national debt. He did this by citing government debt as a percentage of GDP – a measure that can disguise less impressive debt reduction by expressing the total as a share of [rising] GDP.

You can make a lot disappear on that basis. In truth, when we look at the cash amounts, the debt total continues to rise, from £1.47 trillion in 2014-15 to £1.5tn in 2015-16 and keeps on growing to £1.63tn in 2019-20.

John Swinney, the SNP finance minister, bemoaned the continued austerity ahead, with £30 billion of spending cuts projected over the next four years. Yet total managed spending is set to rise, from £742.6bn in 2014-15 to £797.3bn in 2019-20, a 7.4 per cent increase. Public spending will be 36 per cent of GDP in 2019-20.

Advertisement

Hide AdAdvertisement

Hide AdSo how does the deficit come down? The Chancellor is dependent on big rises in tax receipts over the period ahead. For example, income tax receipts are expected to rise from £163bn in the current fiscal year to £216.5bn by 2019-20, a rise of 33 per cent. National insurance contributions are forecast to rise from £108.7bn this year to £142.7bn.

The cut in the lifetime allowance next year for pension saving, from £1.25m to £1m will cut tax relief but will not be well received by pensioners in an era of low returns on savings.

The Chancellor’s other little helpers are chipping in, too. Receipts from capital gains tax are projected to rise 72 per cent to £9.8bn and revenue from stamp duty land tax by 65 per cent to £18bn.

These gains more than make good the drastic fall in North Sea oil revenues. The UK will receive less than £1bn a year in revenues until at least 2019-20. Compare this with the Scottish Government predictions last year that £6.8bn would be generated in 2016-17 – and that was its most pessimistic forecast. Now the OBR says revenues would be only £600m, less than 10 per cent of SNP predictions.

The Budget contained a £1.3bn package including a 15 per cent cut in petroleum revenue tax to 35 per cent and a 10 per cent drop in the headline supplementary rate, backdated to January and bringing it down from 62 per cent to 50 per cent: a lifeline for the industry.

Turning to measures to help business and enterprise, there’s one change that may not be quite all it seems: the announcement of the abolition of the annual tax return.

This would surely have caused many to email their accountants: “No more annual tax returns? The gathering up of invoices, receipts and bits of paper? The constant checking of numbers? We’re dancing on the kitchen table. And all those files we have to keep for six years? We’ve got the incinerator out and the paraffin ready.”

To which the accountant will have promptly replied: “Get off the table immediately and keep the paraffin for later… You will still have to tell HMRC about all your income and at some point you will have to agree income figures are correct.”

Advertisement

Hide AdAdvertisement

Hide AdNevertheless, the thrust of announcements on help for small firms will be welcome, together with the abolition of class 2 national insurance contributions. However, both for ordinary taxpayers in Scotland and for businesses, confirmation is awaited of the Scottish rate of income tax applicable from 1 April next year, and pressure will mount for reform of business rates in Scotland with a review similar to the one announced for England.

Overall, this was a broadly neutral budget, with strong political temptations denied. Financial markets, judging by the 107-point bounce in the FTSE-100, liked it. But we will not know what voters will make of “sticking to the course” until the early hours of 8 May.

SUBSCRIBE TO THE SCOTSMAN’S BUSINESS BRIEFING