Brian Monteith: Covid-19 crisis is a wake-up call for SNP and Europhiles

In the week since I last wrote my column our world has changed beyond recognition, and it shall change even more in the next few weeks. Our government has taken economic decisions that it believes – correctly in my view – are required to ameliorate the economic calamity that now faces us. This crisis is the result of decisions taken to manage the mortal threat coming from the coronavirus pandemic – decisions that will result unavoidably in mass unemployment and a credit crunch, and from those twin evils a collapse in public finances and possibly some banking failures.

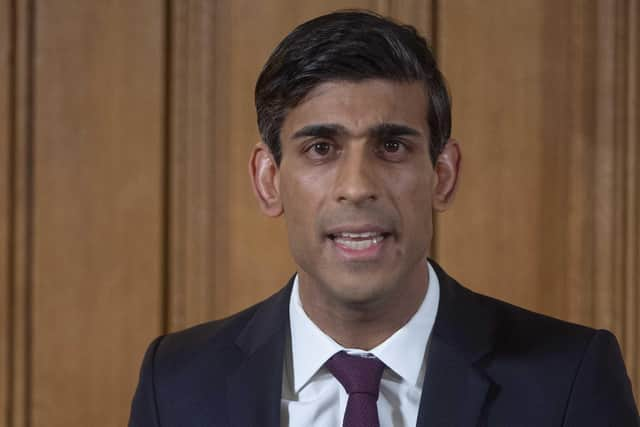

When I argued that Chancellor Rishi Sunak’s Budget figures could not hold for long, I did not expect to be proven right so quickly. The deficit was being put at £60 billion but I argued that it could rise to £100 billion; now, following the further announcements to help businesses and employees, the deficit could climb to £200-£300 billion – with following years having similarly large numbers. By the time the pandemic and its economic consequences have passed, it is not beyond the limits of possibility that another trillion shall have been added to the national debt – all stemming from the government’s efforts to try to maintain a productive economy.

Advertisement

Hide AdAdvertisement

Hide AdBad though the situation is, it could actually be worse – we do not yet know how bad the pandemic will be and it might yet require further repressive decisions that will make economic activity even more difficult. The financial damage could therefore still turn out worse than the UK Government’s revised estimates anticipate.

This is at a time when the Bank of England base rate has been reduced to 0.01 per cent – were it to begin to climb, the costs of the debt would be crippling. The UK is not alone in facing these difficulties, and in some respects other countries face worse prospects. For instance, those in the European Union do not have the flexibility of response or their own central bank that the UK has. If we had the euro for our currency, we would not be able to put our national interests first and respond to our needs with a tailored approach. In this emergency the concerns of the Republic of Ireland or Portugal, never mind Greece, simply count for nought. What Germany believes is necessary is what will matter.

Even the scale of the European Central Bank’s quantitative easing – at some £750 billion euros it is relatively muted compared with what the UK has been able to do – and the ECB has not had the headroom to cut interest rates as we have because its rate is already at zero.

With the huge Italian banking debt that other eurozone banks, such as the French, are tied into, there is a risk the eurozone’s precarious house of cards will come tumbling down. As investors look as usual for a safe haven in the dollar, it is not surprising that sterling slides against it. That sterling slides against the euro is frankly incomprehensible. At some point the euro must face a day of reckoning – but as a political rather than an economic project it requires an existential threat to pull it down. And the pandemic could be the existential threat that is beyond even the ECB and the EU Commission to repel.

Moving from the economics to the politics, when we look at the tragic number of deaths in Italy it only serves to provoke an air of unreality that the number of deaths reported by the Chinese government is smaller. I cannot be the only person wondering if there is a great game being played out at a diplomatic level that we are not yet privy to and may yet escalate. In this respect the branding of coronavirus by President Trump as the Chinese virus should be viewed not as some dog-whistle to redneck voters, as is being portrayed by his critics, but as a signal to the world that there is much more to yet be revealed. Political decisions, be they at mere council level or the grander international stage, usually have both an open and a hidden motive. It remains to be seen what is being hidden from us despite great claims of transparency by our political leaders.

While we wait for such murkiness to clear there are already political lessons from the last fortnight’s developments, but two are already quite obvious. First, the massive scale of financial intervention by the UK Government could not have been replicated in Scotland had we voted for independence in 2014 – or were we to vote to secede at any referendum now or in the near future. Notwithstanding the existing dire state of Scottish public finances, the tanking oil price that would make them worse day by day and that the Scottish Government has been borrowing to the max already – there simply would be no resources to act in the generous manner the UK Government has (and it may yet go further once Sunak works out the practicalities of helping the self-employed). An independent Scotland’s credit rating would be junk and we would be heading into the perfect storm in a sieve. At times like these the UK is by comparison a lifeboat and we would do well to remember that fact.

The second takeaway from this crisis is that if you ever wondered what it would be like to adopt the policies being advocated by members of Extinction Rebellion – and their fellow travellers in student unions and Holyrood – this bears a pretty close resemblance. Discouraging economic activity that involves international transport for tourism or trade, shutting down a significant number of airline flights, altering our lifestyles to reduce economic activity, driving costs up and incomes down – all of it reversing economic growth into negative territory – is what the various “Green deals” would bring about.

It is undoubtedly progressive to advocate protecting and improving the environment but it is regressive to the point of being anti-human to advocate policies that would make the vast majority of us poorer and cost lives as cash-strapped public health services deteriorate.

Advertisement

Hide AdAdvertisement

Hide AdAs an antidote to my untypical pessimism, let me finish by commending the efforts of all those who are working in hospitals, pharmacies, supermarkets and other providers of health and sustenance. Great kindness and sacrifice is already being witnessed – and much more will be seen and should be applauded.

•Brian Monteith is editor of ThinkScotland.org