Bill Jamieson: What’s the real cost of uncertainty?

Over the past week, a deceptive quiet has fallen over Scotland’s financial services sector. Its representatives have barely featured among the fervent audiences in TV studios or in vox-pop street interviews. But, as the referendum battle has intensified and the polls have pointed to a knife-edge result, concern is growing.

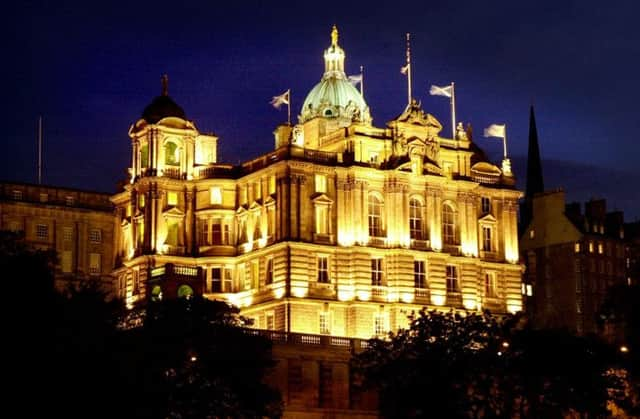

Over the past two days, I have spoken to fund management companies and financial institutions representing more than £500 billion under management. This is a critical sector of Scotland’s economy, contributing to our status as a leading European financial centre second in the UK only to London. The industry overall – spanning banking, asset servicing, life assurance and pensions as well as fund management – accounts for close on one in every ten jobs in Scotland, more than 200,000.

Advertisement

Hide AdAdvertisement

Hide AdThe sector has not figured prominently in the meetings held in village halls and community centres, or in TV debate audiences.

Typical these audiences may be, but not wholly representative. And this matters when so much is being said on tackling income inequality in an independent Scotland and that those “with the broadest shoulders should bear the greater burden”. What happens when the shoulder padding disappears?

The number of people in Scotland liable for the 50p tax rate is just 13,000. And the “wealthy” are overwhelmingly those in their 50s and early 60s who have built up retirement savings and are anxious that these are not prejudiced.

A financial exodus would be of acute concern, whether the result is Yes or a close No. Indeed, the chilling spectre for Scotland’s financial services is of an ever more prolonged period of uncertainty, and one likely to stretch well beyond the mooted March 2016 date for the completion of negotiations between the Scottish and rUk governments.

Already the biggest headache is the inability of financial sector firms to give clear and reliable advice to savers and investors because arrangements over tax and regulatory status are simply unknown. This maddening limbo in itself could prove corrosive of investor confidence.

So what is the mood as we head towards an ever more likely neck-and-neck result? The fall in the pound in the wake of the YouGov poll on Monday gave an indication of what might be in store not just in Scotland but across the UK if the vote is for break-up.

For now the “Keep Calm” line is holding. There is no evident rush for the exits at this stage. But the escape doors are being quietly opened.

Advertisement

Hide AdAdvertisement

Hide AdOf that circa £500bn, I would say that a large majority – certainly those speaking for £350bn of funds under management – have put in place arrangements or are now doing so for the transfer of funds and the domicile of client accounts.

Large investment companies such as Aberdeen Asset Management and Baillie Gifford deal predominantly with institutional clients around the world, with assets held outwith Scotland. But firms dealing with retail clients are making arrangements for those anxious about a possible change in currency and in regulatory protection.

Among firms that already have offices south of the Border or are making arrangements to establish such offices are Alliance Trust, Standard Life, Baillie Gifford, Aberdeen Asset Management, Brewin Dolphin, Investec, Aegon, Fidelity, JP Morgan and F&C. To this list many more could be added. They are reluctant to add “on the record” to what they have already said in public. And for investment trusts, changes in incorporation and asset registration will prove especially complex and costly.

Of particular concern are bank deposits and the future of the £85,000 deposit guarantee scheme. In the event of a Yes, Scottish banks may be vulnerable to an exodus of depositors. A Reuters report this week, quoting unnamed sources, suggested Lloyds Banking Group is considering having its registered office in London, with Bank of Scotland operating from Edinburgh as a foreign division. This speaks to the concerns of many Lloyds customers south of the Border.

Turcan Connell’s Haig Bathgate expects that the two major Scottish banks with extensive government ownership – Lloyds and RBS – “will come out with statements about their plans immediately after a Yes vote. There is a risk of a run on these banks if depositors are not clear on the way forward. We’d expect the Bank of England also to come out with a statement to calm the situation down.

“Some of our clients have taken pre-emptive actions to set up bank accounts south of the Border.”

These concerns are shared by Tim Wishart, director of Psigma which has recently opened an office in Edinburgh: “Depositors will need to see that £85,000 guarantee. There will be a rush from Scottish banks unless there are assurances.”

To give an idea of the complexity of issues opening up, a recent report by Edinburgh-based investment management concern Rathbones warns that Scottish-based fund platforms with UK investors holding Self Invested Pension Plans (Sipps) and Individual Savings Accounts (Isas) could be in breach of EU cross-border rules in the event of independence as administrators of these products are not allowed to be based in a “foreign” country.

Advertisement

Hide AdAdvertisement

Hide AdThis would imply a significant and costly expense for platforms based in Scotland as firms move all or part of their business to rUK.

Investment giant Investec, with offices in Glasgow and Edinburgh, is headquartered in England and clients’ holdings are held in a nominee account there. However, says the firm’s John Robertson, “complications might come in time with a new Scottish ‘FCA’ regulator and how regulating Scottish clients, their ISAs and pensions will be affected. ”.

Independent financial advisers such as VWM Wealth and the veteran Alan Steel are among those that have put arrangements in place to operate both in Scotland and rUK. I sense a small minority of IFA clients are already less than sanguine about prospects and have repositioned their investments to reduce exposure to the UK and to Scottish-based investments in particular – including Scottish investment groups.

Elsewhere, there are worries that there will be less of a “critical mass” of investor demand to support smaller, niche operators in Scotland’s fund management sector post a Yes result.

The big uncertainty remains currency – we’ve never before had to prepare for the possibility of a change in the unit of exchange that affects every person, every business, every transaction. The scale of the upheaval may be one reason why so many Yes voters just can’t believe that Westminster would deny sharing the pound with an independent Scotland.

And a close No vote by no means resolves matters. Many may feel that if a further referendum may lie ahead, they will want their savings shielded from prolonged uncertainty. As it is, for a financial sector unable to give clear and certain guidance, one referendum is already proving more than enough.