Official: snowballs are in fact cakes, says taxman

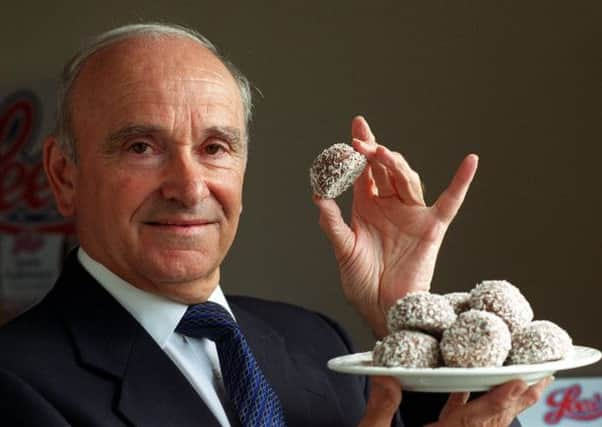

Tunnock’s and Lees had both been landed with a VAT bill on the popular marshmallow-filled sweets they make.

But yesterday, HM Revenue & Customs was ordered to return tax already paid after judges agreed the treat should be exempt from the charge.

Advertisement

Hide AdAdvertisement

Hide AdJudges Anne Scott and Peter Sheppard, from the First-Tier Tax Tribunal, tested a plate of treats including Jaffa cakes, Bakewell tarts and meringues – all classified as cakes for tax purposes – as they made their decision.

Both companies had appealed after they refused to accept the taxman’s claim that the snacks were “standard-rated confectionery”.

Now Lees of Scotland will be given £2,057,497 and Tunnock’s will receive £805,956 after they both won their appeals.

An HMRC spokesman said: “We are considering the court’s decision carefully.”

Ms Scott said: “We found that the plate looked like a plate of cakes. We were also left with samples of all of these, together with Tunnock’s snowballs.

“We tasted all of them, in moderation, either at the hearing or thereafter.

“A snowball looks like a cake. It is not out of place on a plate full of cakes. A snowball has the mouth feel of a cake.”

The judge also described snowballs, which are boiled and not baked, as “very fragile”, “very sweet” and observed that their mallow core was “similar” to that found in teacakes.

Advertisement

Hide AdAdvertisement

Hide AdShe said the tribunal was “wholly agreed” that a snowball was a “confection to be savoured but not whilst walking around or, for example, in the street”.

She said: “Most people would want to enjoy a beverage of some sort whilst consuming a snowball.

“It would often be eaten in a similar way and on similar occasions to cakes, for example to celebrate a birthday in an office.”

She went on: “Most people would prefer to be sitting when eating a snowball and possibly, or preferably, with a plate, a napkin or a piece of paper or even just a bare table so that the pieces of coconut which fly off do not create a great deal of mess.

“Although by no means everyone considers a snowball to be a cake, we find that these facts mean that a snowball has sufficient characteristics to be characterised as a cake. For all these reasons, the appeals succeed.”

Coatbridge-based Lees and Tunnock’s, from Uddingston, had insisted their snowballs should be VAT-free, in the same way as Jaffa cakes.

The judges said it was not disputed snowballs were a “sweetened prepared food which is normally eaten with the fingers” but that everyone “agreed that a snowball is certainly not a biscuit”.

A spokesman for Tunnock’s said the company welcomed the news but didn’t want to comment further because the ruling may be the appealed against by the taxman within the next 56 days.

Advertisement

Hide AdAdvertisement

Hide AdSnowballs are described by Lees as “soft fluffy mallow with a chocolate coating and sprinkled with the finest flakes of coconut to create a delicious sweet treat”. They are believed to derive from a shaved-ice New Orleans snack from the 1930s.