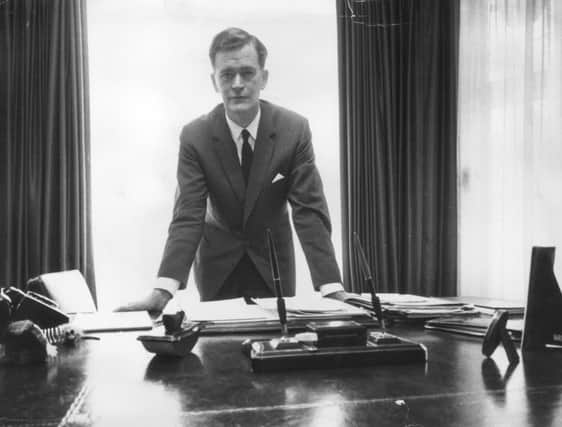

Obituary: Jim Slater, financier

At his zenith Jim Slater was the toast of the City of London. When the Stock Exchange had a huge dealing floor and gossip circulated like wild flower all you needed to hear was a whisper: “Jim’s buying” and a share price rocketed. Slater was a hard-bitten operator who was charming, debonair and very ambitious. He formed Slater Walker Securities (SW) with Peter Walker MP (who served in the cabinets of Margaret Thatcher) in 1964 and the firm became significant players in the financial industry.

In that decade the group’s market value passed £200 million and SW themselves reassessed other companies’ assets. Slater wanted to expand his company and make it worth £1 billion within ten years and, at the same time, put a bomb under some of British industry by weeding out moribund companies and sleepy directors – “It’s like a knife and butter,” Slater announced. “And we’re the knife.”

Advertisement

Hide AdAdvertisement

Hide AdHis dramatic demise after the stock market collapse of 1974 resulted in Slater licking his wounds, selling his company and declaring himself a “minus millionaire”.

James Derrick Slater was brought up in the suburbs of north London and educated at Preston Manor secondary school, where his chief interests were chess and stamp collecting – passions which were to remain with him all his life. On leaving school he worked with an accountant, did his national service in the Pay Corps and then qualified as an accountant in 1953.

Slater initially worked with an industrial entrepreneur giving him direct experience of working with troubled companies. He joined Park Royal Vehicles and such was his commercial acumen that he was promoted in 1959 to the sales division of the parent company, Associated Commercial Vehicles.

However, a few months in hospital gave him time to research the stock market – especially companies that had steady earnings and operated in an expanding field. He picked one particular company, a supplier to the motor industry called Bernard Wardle. He bought the shares and made his first financial killing.

His skills as a trader gained him renown in the City and in 1963 he was given a column in the Sunday Telegraph, written under the pseudonym Capitalist. The City editor was called Nigel Lawson.

That weekly column was to blaze a trail for Slater. His profits on the shares he tipped were phenomenal: his personal portfolio rose 70 per cent in two years compared with the index rise of just 4 per cent. The Jim magic touch was widely followed.

In 1964 Slater met Peter Walker – both barn-storming entrepreneurs –and they bought a tiny property company called H Lotery & Co. They developed a financial dealing company that acquired interests in companies with under-performing assets.

Slater would rationalise the business and sell off valuable properties and divisions that were contributing little to profits. Asset-stripping was not an ugly word, according to Slater: he argued that resources had to perform or be got rid of.

Advertisement

Hide AdAdvertisement

Hide AdAs long as there was a bull market the Slater fortunes prospered: he bought companies and issued his own shares. That worked fine as long as SW shares rose.

Traditionalists in the City were appalled that others considered Slater was galvanising a muc- needed change in UK industry. By 1972 SW was involved in property, insurance, banking and had wide interests abroad.

Such was his confidence and charisma that Slater proposed a merger with one of the great City merchant bankers – Hill Samuel.

When that did not come off – there were rumoured differences between the boards – SW suddenly looked very vulnerable. The market was collapsing and there were no buyers for the companies in which he had shares. At SW’s AGM in 1974 Slater said the company needed liquidity: “Cash you can always turn into other things.”

The situation deteriorated radically in 1975 and SW was only kept afloat from a hastily organised “lifeboat” payment from the Bank of England. Slater was replaced as chairman by Sir James Goldsmith.

Further problems arose when there were suggestions of wrongdoings in the Far East. That was proved ill-founded but the glory days of Jim Slater were, indeed, long gone.

In the financial wilderness Slater set up, with Tiny Rowland of Lonrho, a property company that invested in blocks of flats in London. He made another fortune – paying off all his debts – and wrote children’s books: his first was Goldenrod and A Mazing Monster was a best seller. In 1977 Slater published his autobiography, Return To Go.

He also conceived the idea of time-sharing salmon rivers in Scotland. In fact, Slater had purchased the 20,000 Tulchan Estate in Morayshire in 1972. Slater, so legend has it, visited the estate and in pouring rain caught an 11lb salmon and three sea trout.

Advertisement

Hide AdAdvertisement

Hide AdHe was hooked on angling and formed Salar Properties, which in the 1980s time-shared seven schemes including the legendary Lower Redgorton beat on the River Tay – for which Slater had paid £500,000. Other schemes on the Conon, Dee, Spey, Ness and Doon followed.

In his autobiography Slater wrote: “My idea of a perfect week is salmon fishing on the Spey, and whenever I am there I wonder why I spend my time doing anything else.”

Slater was a refreshing buccaneer who made the boards of companies reassess their assets.

He instructed his analysts to practice “contra-thinking” and develop new ideas: never provide the obvious solutions.

In his free time Slater had three passions apart from his family.

He was a keen angler (he returned with his family every year to the Spey throughout the 1970s), a chess player and a hugely competitive bridge player.

He married, in 1965, Helen Goodwyn. She and their two sons and two daughters survive him.