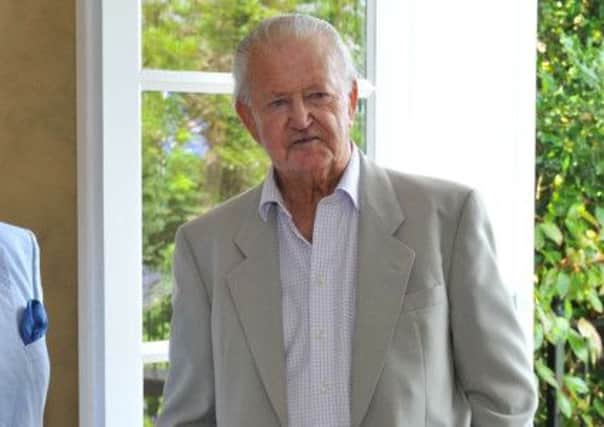

Obituary: James Farrer, businessman

Jim Farrer was one half of the duo who established Berkeley Homes, the upmarkethousebuilder that helped shape the stockbroker belt in the Home Counties, and he helped ensure that the company rode out the property crash of the early 1990s.

The firm’s success was a real rags-to-riches success story for Farrer and Tony Pidgley, who acknowledged that Berkeley Homes would not have happened without his partner – despite the company becoming more associated with Pidgley and his larger-than-life personality.

Advertisement

Hide AdAdvertisement

Hide AdBy the time Farrer retired as chairman, in 1991, Berkeley was valued at £180 million.

The secret of Berkeley’s success was simple: they wanted to create quality, not volume, and initially built in the geographic areas they knew well. Fundamentally, they knew the taste of their high-earning clientele in London and the Home Counties stockbroker belt – open fireplaces, cornicing, dormer windows and half-timber.

Berkeley homes were expensive and they refused, whatever the market was doing, to chase high volumes. They were critical of the house-building model of their large national peers, which they likened to manufacturing businesses trying to wring out the benefits of mass production.

Describing Farrer as his career mentor and the man who “took the wildness out of me”, Pidgley, like Farrer, was from working-class stock, but who found he had a flair for business.

Following his adoption at the age of four by travellers, Pidgley grew up in a railway carriage. As a teenager, he established a haulage and demolition business but sold it to Crest Nicolson, a builder of houses and yachts, in 1968, following discussions with the chairman, David Donne.

It was at Crest as directors that Farrer and Pidgley met and they could feasibly have continued there but for a disagreement with Donne. At the 1975 AGM, Donne decided that he had had enough of Pidgley’s forthright views and maverick approach, and so sacked him. Farrer decided to follow in sympathy.

Following a celebratory meal at a nearby Italian restaurant in Weybridge, Surrey, the pair decided to set up on their own and Berkeley Group was born.

The first business plan was to persuade Barclays Bank to lend them £150,000. At the interview, the manager was taken aback when enquiring what their aim was when they replied: “Our aim is to make money.” However, it almost went wrong from the outset.

Advertisement

Hide AdAdvertisement

Hide AdWith £50,000 of their own money and the loan, they purchased their first plot; they built a house with a wooden frame, to keep costs down, brass doorknobs, a patio, landscaped front and rear garden, “all the things that builders didn’t do”, and waited for the queue of buyers. The build proved unpopular with would-be buyers, who were put off by hearing a hollow sound when they tapped on the walls.

It eventually sold and Farrer and Pidgley never repeated the mistake, ensuring thereafter that they always visited their sites to gain a better overview of what was happening – something many senior executives fail to do.

They bought more land on which to build further properties, and the business thrived. Four new homes were built and sold in the company’s first year, with a turnover of £121,000 and a profit of £21,000.

Exclusivity was their hallmark and of paramount importance, and Berkeley was unashamedly upmarket.

In the mid-to-late 1980s, the majority of Berkeley’s homes sold for more than £100,000 each, £435,00 today, with some selling for more than £200,000, over £875,000 today; many sold before the foundations had even been laid. By 1988, Berkeley was building more than 600 executive homes a year.

With business going from strength-to-strength, a number of their customers became investors when Berkeley was listed on the stock exchange in 1985, with Farrer as chairman and Pidgley as chief executive.

It outperformed rivals through the 1980s property boom, and was described as having shareholders “eating out of its hand” despite frequent calls for additional capital. After the flotation, Berkeley expanded geographically to the west, the south Midlands and East Anglia; it also formed a joint venture, St George, to build in central London.

The flotation prompted The Sunday Times to comment: “Where the common herd build their mock Tudor boxes or colonial mansions in lookalike rows, Berkeley Group specialises and customises. No two houses in a Berkeley estate look the same – if the buyer wants a wall-to-wall Jacuzzi, leaded lights and a gravel drive, he gets them.”

Advertisement

Hide AdAdvertisement

Hide AdFarrer and Pidgley complemented one another, with one as the risk-taker and the other the more cautious “hand on the tiller”.

Farrer’s special skill lay in designing the most effective floorplans for their properties so that the house worked and flowed, but he also anticipated the recession of the early 1990s. He persuaded Pidgley to pay the company’s debts and sell land.

Berkeley sold off large swaths of regional land in order to focus its energies on imaginative inner-city regeneration projects in and around London.

The idea was simple: if recession hit, the capital would suffer less than the rest of the country.

The gamble paid off, with Berkeley’s London bias protecting it better than most from the worst of the property market’s volatility and keeping it in profit. However, the downturn was more severe than anyone expected.

With Farrer’s semi-retirement in 1991, Berkeley was in a position of strength to face the economic challenges of the 1990s and beyond. Its cash position was such that in the same year Berkeley purchased the Manchester-based Crosby Homes and the remaining 50 per cent of St George.

Interestingly, legendary financier, George Soros, admitted that he had a stake in the Berkeley Group following a breakfast meeting in 1992, in which Berkeley’s strategy and the prospects for the housing market were discussed.

Soros was so impressed with how Berkeley had dramatically outperformed such household names as Wimpey and Taylor Woodrow in the five years since the housing slump took hold that he decided to invest.

Advertisement

Hide AdAdvertisement

Hide AdIn short, he discovered what many British investors had known for some time: Berkeley Group is one of the class acts of the housing industry.

Born in Sunbury-on-Thames in 1930, Jim David Farrer was the son of a turner in a grinding works and from very humble beginnings.

He attended the local secondary school before completing his education at Twickenham Technical College. Upon leaving, he started working for local estate agent, Goodman & Co, at nearby Walton-on-Thames and learned everything necessary as well as understanding his cliental. Soon Farrer was selling plots of land to Bryan Skinner, an up-and-coming builder and founder of Crest Homes; shortly after their encounters, Skinner recruited him to the business in the mid-60s.

Farrer served as group chairman of Berkeley Group PLC until his retirement from full-time employment in 1992, and also served as its non-executive director until December 1999, while remaining the company’s honorary life president.

In retirement Farrer enjoyed playing golf and tennis, and was a lifelong sports fan. He and his wife, Anita (née Babbage) also bought a second home in Dorset. The couple had met at the Abbey Barn Youth Club in Chertsey, Surrey and married soon after in 1953. She recalled: “My knight in shining armour came on a racing bike and wearing pink socks.”

The Farrers lived in the nearby village of Lyne, where they supported the local church and village hall.

Over time, he gained a reputation for his cheeky sense of humour and his love of his family, and for hosting parties and his Champagne cocktails at Christmas.

Farrer is survived by his wife, son and daughter; another child died in infancy.