How to file your online tax return

Here you will need to provide your ten digit Unique Tax Reference number (UTR), National Insurance Number or Post Code. Once you have done this HMRC will post an activation code to you which will be needed to complete the registration process. Activation codes can take up to seven days to arrive, so registration should be done as soon as possible. Once the code is received and your log in details finalised, your online tax return can be prepared be accessing the log in on HMRC’s home page (www.hmrc.gov.uk).

Be thorough

When preparing the return, guidance is given on what information is to be entered in the various boxes. Care must be taken to ensure the correct information is entered as although the return is prepared using HMRC’s online service, any inaccuracies in the return could give rise to penalties and interest at a later date. Once it has been submitted HMRC will confirm how much tax is due for payment by 31 January. Payment can be made online by debit or credit card.

Preventing expensive mistakes

Advertisement

Hide AdAdvertisement

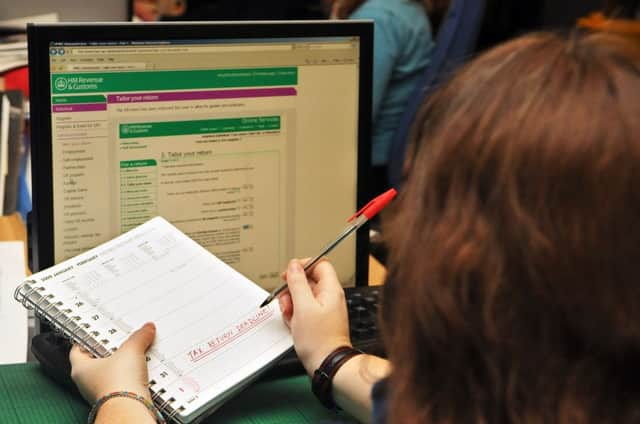

Hide AdEnsure you have all of your relevant P60, tax certificates and other information at hand. The temptation to guess or try to recall figures is all too great. Keep a pen and paper at hand in order to do any rough calculations. This will help avoid any nasty surprises once your tax liability has been confirmed. The online facility allows you to enter information and save your progress in order to re-visit at a later time. If information is not at hand, save what you have done and finish the return once you have what you need. Once you have entered all your details, save what you have done and check over the figures later before making the final submission.

Don’t wing it

Should there be any technical issues with submitting your return, don’t hesitate to contact HMRC Online Services (0300 200 3600). Please note this service cannot assist with tax queries, advice on completing your return or provide you with any password or pins. Alternatively, you could appoint an agent to take away much of the pain, and ensure peace of mind that the return is accurate.

• Neil Mitchell is a tax Partner at Mazars Scotland