Aberdeen’s swoop for Swip will be bonus for investors

The Edinburgh-based fund firm, part of Lloyds Banking Group, is being acquired by Aberdeen in a £660 million deal that will make the latter Europe’s largest listed investment house. The deal does not include Scottish Widows, the life and pensions arm of Lloyds.

The announcement last week brought an end to months of speculation, but it raised questions over the implications for the many Scots with investments or pension savings in Swip funds.

Advertisement

Hide AdAdvertisement

Hide AdThe firm has some £146 billion in funds under management, yet it has suffered significant outflows in the wake of underperformance by some its most high-profile equity vehicles.

Swip has in recent years been an ever-present name in the regular reports singling out the worst-performing funds.

Its equity offerings in particular have frequently been prominent in the spot-the-dog report by broker Bestinvest, which names and shames the funds that consistently fail investors.

Three of the firm’s funds also figured in the “relegation league” published earlier this month by Money Observer magazine, including the UK Opportunities and UK Income funds.

Patrick Connolly, a certified financial planner at IFA Chase de Vere, said: “While Swip’s fixed-interest and property investors haven’t fared too badly, many of those in their range of equity funds have suffered from sustained periods of under-performance.”

While the firm has on several occasions taken steps to improve its equity performance, he added, it has largely been unsuccessful.

“The final straw was probably the departure of their ‘star’ manager James Clunie to Jupiter earlier this year,” said Connolly.

So does the Aberdeen deal spell better times ahead for pension savers and investors with Swip?

Advertisement

Hide AdAdvertisement

Hide AdBarry O’Neill, investment director at Carbon Financial Partners, said the certainty provided by the takeover following lengthy speculation about the firm’s future would provide valuable stability.

“Although the fund management industry is renowned for being a big merry-go-round, with the average manager tenure being less than three years, the exit door at Swip has been busier than most over the years due in part to the perennial rumours that Lloyds would dispose of the entire Scottish Widows operation,” he said.

“This move should at least provide security of ownership, albeit that some funds could be merged to avoid duplication.”

Connolly agreed, suggesting that Swip investors can look forward to an upturn in performance.

“The integration with Aberdeen should be very positive for their future prospects,” he said. “Aberdeen is a more focused equity investment manager which is better able to recruit and retain talent compared with Swip, where the best people have been too regularly heading for the exit door.”

The bonus is that many Swip investors will now have a wider range of funds available to them, according to O’Neill.

“Many holders of Swip funds will have been a ‘captive market’ as customers of the Lloyds Banking Group,” he said. “The deal means that these customers will have access to the new combined Aberdeen and Swip fund range instead.”

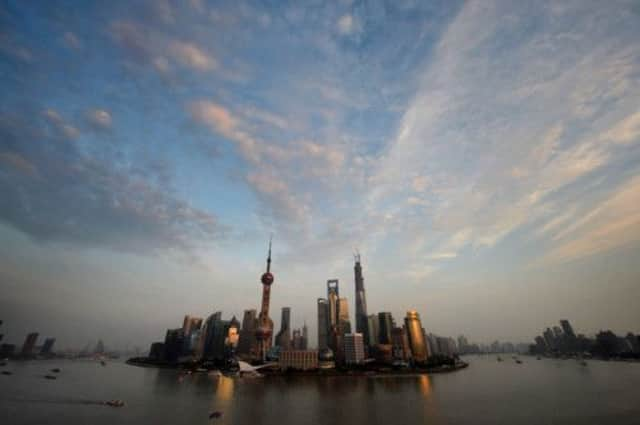

That means a greater choice of emerging markets and Asia-Pacific funds. They are an area of strength at Aberdeen, which invests some two thirds in those markets, whereas at Swip there’s more emphasis on UK and European equities, with less than £2bn in emerging markets.

Advertisement

Hide AdAdvertisement

Hide Ad“Aberdeen is particularly strong in Asian, emerging markets and Japanese equities from which Swip investors can benefit and have decent propositions in other areas such as global equities, multi manager and ethical funds,” said Connolly.

However, its performance in the US, UK and Europe “needs to improve”, he added.

And investors hoping for an upturn in fortunes under the enlarged group will need to be patient, warned Simon Lloyd, chief investment officer at Murray Asset Management, who said the “quant-based” approach to equity investment (using statistical modelling) had not worked for Swip.

“The challenge for Aberdeen will be to amend and improve those processes to lift performance, while at the same time retaining the core strengths of other asset classes such as fixed interest,” he said.

“Without these factors, the earnings enhancement provided by the deal may prove no more than temporary.”