Why less banking jargon will help tackle financial inclusion

“One of the biggest challenges for banks is to make it easier for customers – but they aren’t helped by legal and regulatory obligations,” says Natasha Brownlee of Womble Bond Dickinson.

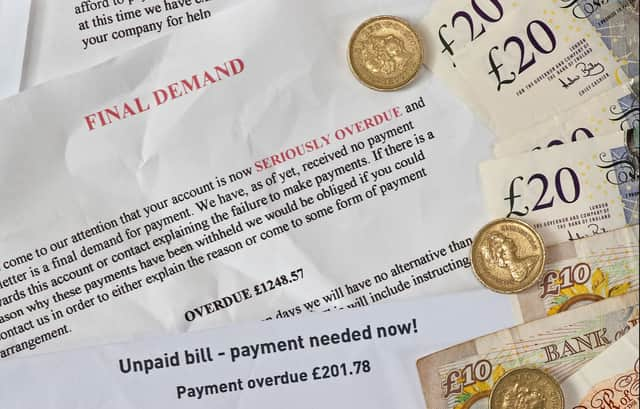

If customers miss repayments on their debt, for example, the law sets out very prescriptively what a bank must do, which includes sending complex, hard-to-understand paperwork using technical language.

Advertisement

Hide AdAdvertisement

Hide Ad“When the customer gets that complex paperwork, it’s not overly clear what they have to do to fix the situation – and that is ultimately all they want to know,” says Brownlee. “Communication is a massive issue. The FCA wants firms to understand customers’ needs and communicate with them accordingly but firms are still hugely restricted by the law.

This article appears in Talking Money - a special report and content series from The Scotsman in association with Womble Bond Dickinson

Follow @TheScotsman and @WBD_UK on Twitter for updates.

“Even the challenger banks have to provide that raft of prescribed information but they make other elements of the process super-easy like the on-boarding process with verification through selfies and the ability to sign up online very quickly.”

Natalie Ledward of Monzo Bank says this is “a big, big challenge” but one that the banks have to rise to. “We don’t want banking to be a jargon-filled world and we have writers to help us de-mystify the language around banking and provide jargon-free documents,” she says. “Our terms and conditions [can be read by someone with] a reading age of eight. We have made a real effort to simplify the language; it’s part of our whole ethos.”

Caroline Stevenson, also of Womble Bond Dickinson, argues that there is a balance to be struck: “The prescriptive nature of some communications means that there is consistency of messaging between all banks and consistency is good in one respect, but it would help if the banks were able to tailor their communications to a specific customer base.

“Right from the product design stage, banks should be undertaking due diligence on their customers so that they can design the customer journey and documentation around them.”

Yvonne MacDermid, of Money Advice Scotland, simply states: “Customers just need clear, concise information and to be told where to go for help if they need it.”