Scotland tax: How the changes from April 6 will affect you as SNP diverges further from UK

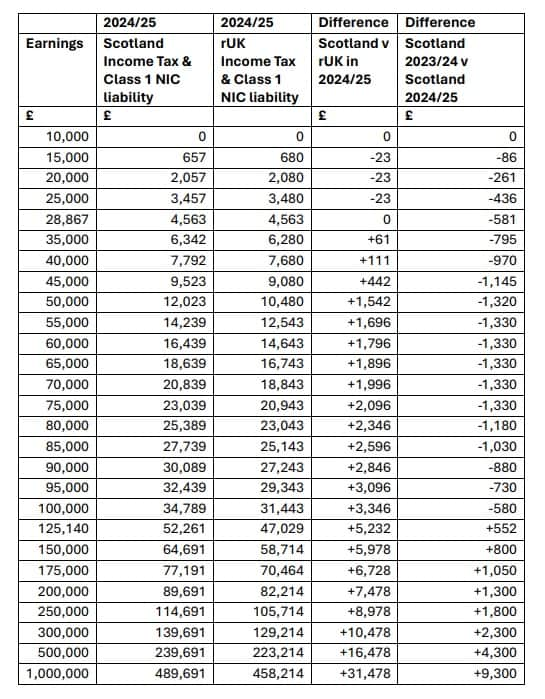

The start of the 2024/25 tax year will mean further income tax divergence for Scottish taxpayers, though the UK-wide National Insurance changes will mean an increase in the take home pay of Scots earning up to £112,900 compared with 2023/2024.

From Saturday, the level of income at which Scottish taxpayers begin to pay more income tax than someone with the same earnings elsewhere in the UK will increase, from £27,850 to £28,867.

Advertisement

Hide AdAdvertisement

Hide AdThe Scottish starter rate of tax means Scots with earnings under £28,867 will continue to pay less than if they lived elsewhere in the UK, but the introduction of a new 45 per cent tax rate on earnings between £75,000 and £125,140, as well as an increase in the top rate of tax to 48 per cent, will result in further income tax divergence for higher-earning Scots compared to their English counterparts.

But as the UK Government’s decision to reduce the main Class 1 National Insurance rate paid by employees to 8 per cent will apply in Scotland, Scots with earnings of up to £112,900 will end up paying less overall compared to their liabilities in 2023/24.

Sean Cockburn, Chair of the Chartered Institute of Taxation’s Scottish Technical Committee, said: “Although the Scottish Government’s tax choices will result in higher earning Scots paying more income tax from this month, these have been somewhat offset by the UK-wide National Insurance changes.

“It means that while Scots with earnings above £75,000 will pay more in income tax, those with earnings under £112,900 will actually end up paying less in tax and national insurance overall compared with the year just past.

“It illustrates what can happen when Scottish and UK tax choices interact with one another.”

Comments

Want to join the conversation? Please or to comment on this article.