James Walker: Financial confessions help to relieve the guilt

In practice, nothing could be further from the truth! Just like most other people, I’ve got into debt, made mistakes and skipped over the small print. Indeed, as we move towards 2020, I’m flinging open the doors of the Resolver confessional. Let’s be honest about some things we do/don’t do – and how it doesn’t mean we need to do penance.

“I didn’t read the terms and conditions”

In a perfect world: You should always read the T&Cs so you know your rights.

Advertisement

Hide AdAdvertisement

Hide Ad In practice: T&Cs have become like War And Peace, particularly with insurance contracts. Yet businesses aren’t allowed to bury important things in them. If a term is fundamentally important, it should be flagged up in a key facts document.

“I borrowed some money but I can’t afford to pay it back”

In a perfect world: You’ve entered into a contract and you have to pay the money.

In practice: Life sometimes throws a spanner in the works. The rules say the lender should give you a little breathing space with interest and charges or talk you through your options. If they don’t, get in touch with Resolver.

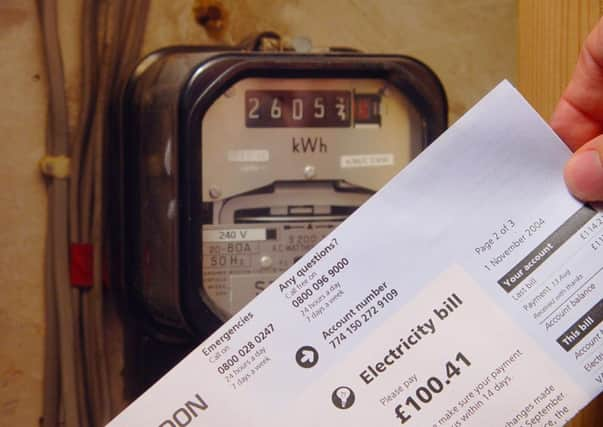

“I didn’t give a meter reading and now I’ve got a massive bill”

In a perfect word: Grit your teeth and pay it, it’ll come down soon.

In practice: Why did your energy provider leave it so long? If it’s been ages, they’re responsible too – and they might be willing to reduce the bill or tariff given their mistake. If they don’t, switch.

“I don’t look at my bills”

In a perfect world: If you don’t look at your bills, you won’t know if things have gone wrong.

In practice: Whether you’re in denial about debt or you’re assuming that everything’s okay, it’s easy to let the bills get out of control. But every three months minimum you should grit your teeth and take a look. You can ask for refunds for things like being overcharged, appeal weird things you haven’t authorised or challenge why you’re paying over the odds.

“I haven’t checked my pension in years”

Advertisement

Hide AdAdvertisement

Hide Ad In a perfect world: Your pension is so important, you can’t ignore it.

In practice: Would you understand your pension if you did check it? Pensions are complicated. So every once in a while, get your pension provider to explain what’s happening in plain English.

“I don’t update my insurer”

In a perfect world: You need to tell your insurer about “significant events” from illnesses to expensive purchases.

In practice. Insurance contracts work both ways. The insurer should give you enough information to understand your obligations. This ranges from asking you key questions when you take out the policy to making their documents and written requirements clear.

I hope you feel suitably forgiven enough to not suffer in silence. Remember, if you encounter unforgiving customer service – get in touch.