Filing a tax return need not add to gloom - Jenny Ross

But it needn’t be. While Which? estimates that Britons will collectively rack up 19 million hours filling in their tax returns this year, the good news is that, on average, you’re looking at a more manageable two-and-a-half hours.

Our survey of 4,000 people found that one in five (20 per cent) people managed to whizz through their return in less than an hour. A smaller proportion (9 per cent) said they laboured over the job for more than five hours.

Advertisement

Hide AdAdvertisement

Hide AdHowever long it ends up taking you, you’re bound to spend a lot more time worrying about filing your tax return than actually doing it.

Getting started as early as you can before the deadline is the best way to avoid soaring stress levels and some potentially hefty penalties for filing late.

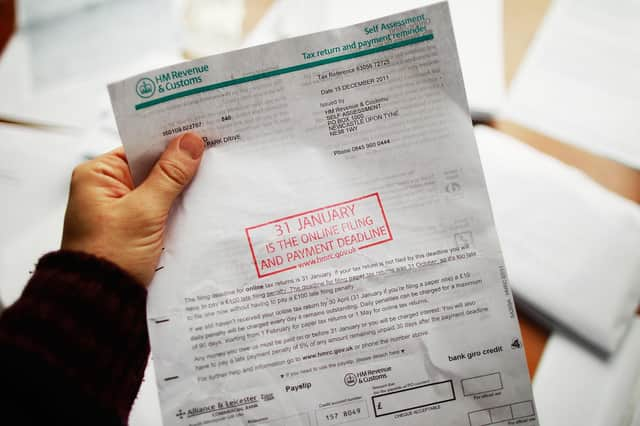

While the government has introduced various options to help spread the cost of your tax bill since the pandemic, the deadline for submitting your online tax return is the same as usual: midnight on January 31.

Filing late will land taxpayers with an immediate £100 fine, and leaving it longer will cost even more: filing three months late could land you with an extra £1,000 to pay on top of your bill.

HMRC will accept some ‘reasonable excuses’ for missing the deadline, but these have to be significant unforeseen events that would feasibly have prevented you from submitting your return on time. ‘My hamster ate the post’ or ‘my mother-in-law put a curse on me’ just won’t cut it (yes, these are genuine excuses HMRC has received in the past).

If you’re not sure whether you need to submit a return, you can double check at gov.uk/check-if-you-need-tax-return. In our survey, almost half (48 per cent) of people wrongly thought that you don’t have to file a tax return if you are taxed by PAYE. While it’s true that if you’re employed and the only income you receive is from your job, you won’t have to – if you also receive rental income, do extra freelance work or make a profit after selling an asset, you will need to declare it on a tax return.

You can streamline the self-assessment process by tracking down all of the documents you need beforehand. To file online, you’ll need your National Insurance number and Unique Taxpayer Reference (UTR) – a ten-digit number sent to you automatically when you first register for self-assessment (if you can’t find it, contact HMRC’s helpline on 0300 200 3310).

Then, depending on your circumstances and the types of income you’ve received, you’ll also need supporting documents, such as invoices and bank statements.

Advertisement

Hide AdAdvertisement

Hide AdDon’t forget to claim any expenses you’re entitled to, or you’ll end up paying a higher bill than you need to. If you’re self-employed, this can include stationery, tools, travel and accommodation for business trips. Landlords can claim for things such as landlord insurance, letting agents’ fees, ground rents and service charges, and direct costs such as advertising for new tenants. HMRC doesn’t expect you to provide proof of expenses when you submit your tax return, but you should keep hold of these records and receipts in case you’re later asked to show them.

If you’re chasing up any missing figures, you can still submit your return – just make clear that some are estimations, and you can then amend them at a later date if need be.

To help you navigate what can be a confusing process, Which?’s easy-to-use online tax calculator breaks down technical tax terms into jargon-free explanations and offers personalised tax tips, including suggestions for expenses and allowances you might have missed. You can also use the tool to file your return directly to HMRC. This costs £10 for Which? members; £46 for non-members.

Once you’ve submitted your tax return, you’ll be told how much tax you owe. Our survey in October 2020 found that one in seven people hadn’t yet planned for how to pay their 2019-20 tax bill, which could be a problem, as you can also incur fines for paying late.

If you owe less than £30,000 you can choose to spread payments out – it’s up to you how much you pay upfront and how much you pay each month afterwards, but bear in mind that taking this option means you’ll be charged interest.

HMRC accepts tax payments from personal debit cards, BACS, CHAPS, in-branch at your bank or building society, over the phone, direct debit or a cheque through the post.

Be very wary of sending money into the wrong hands. HMRC is a favourite target for impersonation scammers, who try to trick you into handing over your details with promises of tax rebates or threats relating to unpaid tax bills. These could come via email, phone or text, with copycat websites also set up to catch you out – the genuine government website where you can complete your tax return securely is hmrc.gov.uk The gov.uk website also includes a page dedicated to warnings about HMRC-related scams, so you know exactly what to watch out for.

Jenny Ross is Editor of Which? Money

Comments

Want to join the conversation? Please or to comment on this article.