Wealthy families settle tax bills of more than £10m as artworks 'gifted' to Scotland

Wealthy families have paid off around £10 million of tax liability in the past three years after ‘gifting’ artworks and artefacts to Scotland’s museums and galleries.

A Damien Hirst sculpture, a signed book of Robert Burns poetry and a painting by a Glasgow Boys artist are among the most recent items accepted by two Treasury schemes, which allow tax liability to be paid with items of cultural and historic value while moving them out of private collections and into public view.

Advertisement

Hide AdAdvertisement

Hide AdFigures show 17 items were allocated to Scottish museums and galleries under the Acceptance in Lieu scheme, which is used to settle inheritance tax bills, and the Cultural Gift scheme, used to pay off income and corporation tax, since 2020. The objects have a combined tax value of £9.7m.

In a recent annual report, Sir Nicholas Serota, chairman of Arts Council England, where a panel determines the value of objects used to pay down tax, said: “These schemes enable UK museums , galleries, libraries and archives to acquire significant objects, in most cases at no cost to themselves. The impact of the acquisitions, both for the institutions and their audiences is extremely positive.”

A Damien Hirst sculpture, Frank and Lorna as Adam and Eve, was acquired by National Galleries Scotland last year after its owner, Lorna Dunphy, had it accepted by the Cultural Gift Scheme, which gave the piece a tax value of £90,000.

The piece is a medical cabinet full of momentoes of Mrs Dunphy and her late husband Frank, the former manager and close friend of the artist. The couple acquired a vast collection of work from artists involved in the 1990s Young British Artist movement, with the cabinet the second Hirst piece donated to National Galleries Scotland.

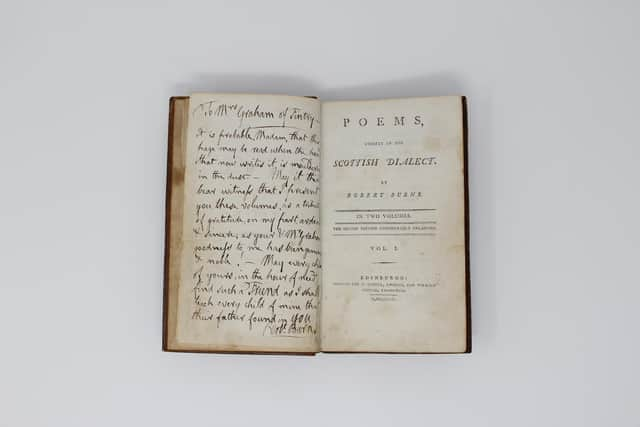

Meanwhile, Burns House Museum in Dumfries has permanently acquired a signed copy of a two-part set of Burns’s Poems Chiefly in the Scottish Dialect, published in 1793. Burns inscribed one of the pages in the first volume with a lengthy note to Margaret Elizabeth Graham, the wife of his patron and friend Robert Graham of Fintry, 12th Laird of Fintry, who helped the bard get a job as an exciseman.

The book, which has a tax value of £17,650, is a considerable coup for the Burns House Museum as the bard completed the poems while living in the property. It was accepted in lieu of inheritance tax due by the Grahams of Fintry family.

The volumes have an unbroken provenance as they have been kept in the family since the original gift by the poet.

A statement from Dumfries and Galloway Council said: "The volumes in question are a hugely significant part of the history of Robert Burns in Dumfries. They are inscribed by Burns himself and it is likely that he wrote these words in the very house in which the volumes are now on display.

Advertisement

Hide AdAdvertisement

Hide Ad

"His inscription is a dedication to his patron’s wife, giving a valuable insight into his relationships and his feelings at that time. We were delighted to be able to add this tangible link to Robert Burns to our collection and to make it available to visitors and researchers."

A painting Joseph Crawhall, a member of the Glasgow Boys, has been allocated to National Galleries Scotland after it was accepted by the inheritance tax scheme. The painting, whose donor remains unknown, has a tax value of £42,000.

Anne Lyden, director-general of the National Galleries of Scotland, said the acceptance in lieu scheme had allowed the galleries to “add several magnificent artworks” to the national collection.

"With funding particularly challenging in the arts and culture sector at the moment, schemes like this really help the National Galleries of Scotland to continue to build a wider representation of art in our galleries,” she said.

Through the scheme, owners of artworks get a financial incentive to transfer the asset to a public institution rather than sell on the open market. To illustrate, the owner of a vase worth £500,000 would attract an inheritance tax liability of £200,000. After death, if the vase was sold to settle the tax, the estate would receive £300,000. If the item is accepted under the Acceptance in Lieu scheme, 25 per cent is added to the inheritance tax payable, leaving the estate with £350,000.

In 2022, one of the most valuable items to reach a Scottish gallery through the inheritance tax scheme was a painting by Edinburgh-born artist Peter Doig.

The Scottish National Gallery of Modern Art, which had “long wanted” to secure a painting by the contemporary painter, acquired his work At The Edge of Town after it was offered “in loving memory” of the artist’s first wife, Bonnie Kennedy. The painting was given a tax value of £2.8m.

Last year, an extremely rare silver-gilt ewer and basin from the 16th century was obtained by the National Museum of Scotland. The items were acquired for the nation after being put through the inheritance tax scheme by one of Scotland’s leading aristocratic families.

Advertisement

Hide AdAdvertisement

Hide AdThe items came from the collection of the Earls of Dalhousie, whose family seat is Brechin Castle.

Ewers and basins were used for ceremonially washing hands at meals, a ritual widely practised by royalty and aristocrats in Britain during the 16th century, with the custom long observed all over the world.

The passing scent of the rosewater would have competed with the highly perfumed bodies of the diners, who relied on scented pomanders to mask their natural body odour.

Comments

Want to join the conversation? Please or to comment on this article.