Week ahead: Mark Carney’s update on inflation

This document, rather than the many hints in speeches and announcements, is what really drives policymakers, and any indication that the CPI is likely to stay below target into 2016 will strengthen the perception that a rate rise will again be postponed.

Howard Archer, chief UK economist at IHS Global Insight, said: “While the Bank of England will obviously have to sharply lower its near-term consumer price inflation forecasts, absolutely key will be how quickly it sees inflation picking up over the medium term.”

Advertisement

Hide AdAdvertisement

Hide AdMonetary policy is also likely to be on the agenda at the G20 finance ministers’ meeting in Turkey this week.

Today

• Mark Carney – The Bank of England governor is on a panel discussing financial leadership at the G20 in Istanbul.

Tomorrow

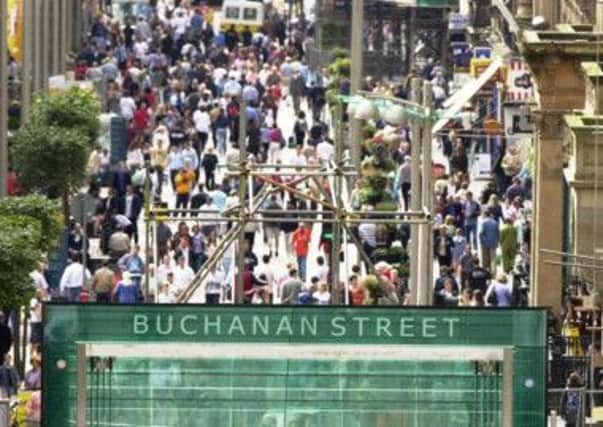

• Retail sales – The British Retail Consortium’s report will give the City a better idea of how the January sales went this year on the UK high street.

Wednesday

• Redrow – The house builder is expected to post higher half-year sales as it targets lucrative outer London developments to boost its business.

• Thomas Cook – Analysts at Numis expect the company to post a £50 million quarterly loss, little changed from a year ago, as the group traditionally makes a loss in the winter.

• Tullow Oil – Africa-focused Tullow has been one of the worst hit stocks following the oil price collapse, and is expected to announce job losses alongside a full-year loss of almost $2 billion (£1.3bn) as it attempts to stay within its banking covenants.

Thursday

• Inflation Report – For all the expectation being heaped on this document, few have been brave enough to offer firm predictions on just how far the Bank of England expects prices to fall, and how soon it sees inflation picking up again.

Friday

• Rolls-Royce – The group is set to disclose details of a difficult year in which the impact of delayed or cancelled orders forced it to announce 2,600 job losses. It has already warned that it failed to grow profits in 2014 after a fall in revenues of between 3.5 and 4 per cent.

SUBSCRIBE TO THE SCOTSMAN’S BUSINESS BRIEFING