Wealth funds have sought out Green Investment Bank

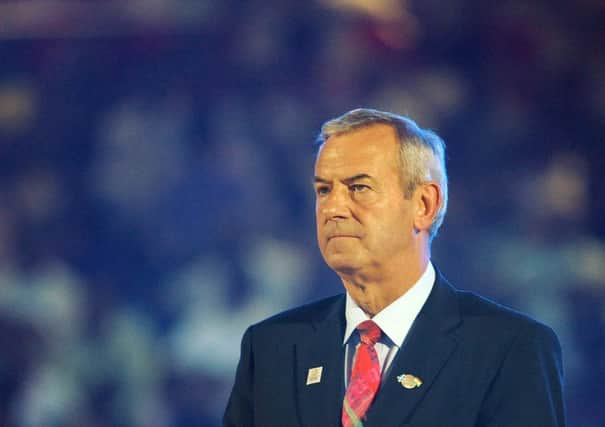

Speaking to the annual pensions industry conference in Edinburgh, he also said he would like to diversify beyond equity investing into asset management and banking.

He said that, perhaps in ten years, the board could ask the government to sell down its stake in the bank. He said the GIB would not compromise its guiding principle to invest in the low carbon economy, saying such investments are already viable and will become more attractive.

Advertisement

Hide AdAdvertisement

Hide AdHe added: “Sovereign wealth funds have approached us saying ‘can we buy equity’?”

Smith also admitted that the bank has had to be more cautious than he would have liked in its first 18 months. “I would like to be doing more tide and wave, but if we get a bad debt in these early years it would kill us,” he said.

Edinburgh-based GIB has backed 23 projects so far, bringing in three times as much money in match funding as it has committed.

Smith was speaking at the National Association of Pension Funds’ investment conference. Earlier in the day delegates heard from Roger Bootle, head of Capital Economics, who warned that higher inflation may be on the horizon if economic growth falters.

He said that inflation of more than 5 per cent would be the only way to clear government debts and resolve Britain’s “housing disaster” if the economy doesn’t keep up the pace.

But Bootle delivered a generally upbeat assessment of the economy and said the he expected that the UK will manage to sustain growth.