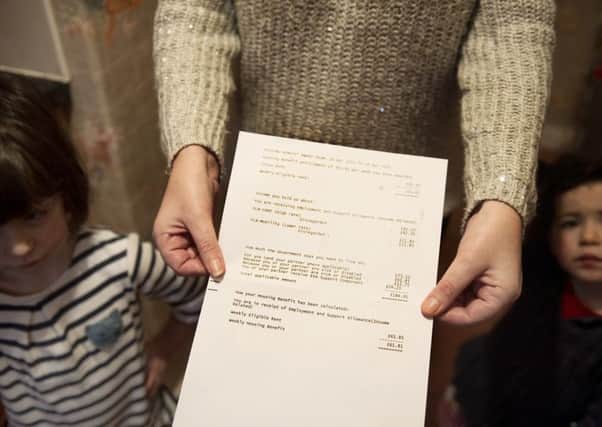

Two-thirds of UK households only just making ends meet

A total of 60 per cent of people fall into the category of “just about managing” or “Jams”, according to a study from comparison website money.co.uk, with one in six working households saying they will be forced to use their overdraft by 10 January.

Recent research estimates there are around six million “Jam” households in the UK. Whilst there is no clear definition of the term, families who are struggling to cope on limited finances tend to have at least one person working in the household and “just about manage” financially each month on an income of between £12,000 to £34,000.

Advertisement

Hide AdAdvertisement

Hide AdHowever, the survey found that even people with double that level of income said they are struggling, with 43 per cent claiming they use an overdraft every month.

In Glasgow, the only Scottish city analysed by the survey, 61 per cent of people said they were barely managing, while almost half said they regularly run out of money during the month. One in five Glasgow residents said they would access their overdraft by 10 January.

Hannah Maundrell, editor of money.co.uk, said: “For many people, ‘just about managing’ is the harsh reality of only just having enough cash coming in to cover essential bills. For others, it could simply be a case of poor money management.

“Living life in the red is both distressing and soul destroying as you never really feel you’re getting anywhere … Being in control of your finances is key for peace of mind.”

She added: “It’s surprising so many people on decent incomes are finding themselves just getting by. It just shows that how well you manage financially is really down to how tight a grip you have on your purse strings.

“Whatever your income, the best way to be better off is to check where your money is going, create a budget, and make simple switches that could quite literally save you thousands of pounds a year.”

Around 70 per cent of households that regularly run out of money typically borrow £127 each month. One in five opts to visit the “bank of family and friends” to borrow money to get them through the month, while a further 9 per cent either turn to payday loans or dip into their children’s savings accounts or piggy banks.