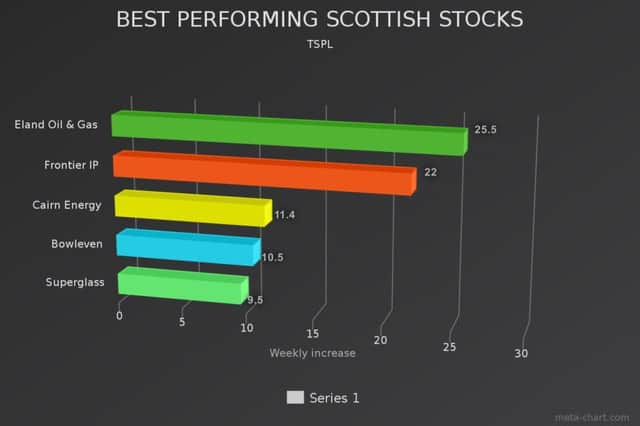

Top five performing Scottish stocks last week

Eland Oil & Gas +25.5%

Amid something of a rally for oil prices, which rose above $40 a barrel last week, the West Africa-focused producer topped the table of Scottish share risers. The Aberdeen-based firm, led by chief executive George Maxwell, recently told investors that it was confident of hitting its target of trimming operating costs by 30 per cent before the end of the first quarter as it seeks to ramp up production from the onshore Opuama field in Nigeria. Output from the field jumped more than 50 per cent to 4,500 barrels a day during the final three months of 2015.

Shares closed at 27.5p on Friday 4 March, and at 34.5p on Friday 11 March

Frontier IP +22%

Advertisement

Hide AdAdvertisement

Hide AdThe Edinburgh-based company that helps universities to commercialise their research said its revenues more than quadrupled to £992,000 during the six months to the end of December, helping it deliver a pre-tax profit of £549,000, compared with a £242,000 loss for the same period a year earlier. Frontier IP’s portfolio includes health informatics firm Aridhia – a joint venture between the University of Dundee, NHS Tayside and Sumerian Europe – and Adus DeepOcean, a spin-out from the universities of Dundee and St Andrews that delivers high-resolution sonar surveys.

Shares closed at 20.5p on Friday 4 March, and at 25p on Friday 11 March

Cairn Energy +11.4%

Shares in the oil and gas explorer jumped to a two-year high after it said it was “delighted” with the results from its latest test well off the coast of west Africa. In an update described as a “solid step forward” by one analyst, the Edinburgh-based firm said two drill stems showed flow rates of up to 5,400 barrels of oil a day ahead of the appraisal well at the SNE field being plugged and abandoned. Cairn, which has been locked in a dispute with India’s tax authorities for two years, is due to report its annual results tomorrow.

Shares closed at 174p on Friday 4 March, and at 193.9p on Friday 11 March

Bowleven +10.5%

As with fellow Africa-focused company Eland, the Edinburgh-based oil and gas explorer saw its shares gain amid last week’s improved performance for crude prices. The upturn came in the wake of Bowleven’s decision last month to ditch plans to buy stakes in two Tanzania gas projects for up to $28 million (£19.5m). The Aim-quoted company has also told investors that it is making good progress with an onshore development in Cameroon as part of plans to supply gas for a power scheme in the region.

Shares closed at 21.5p on Friday 4 March, and at 23.75p on Friday 11 March

Superglass +9.5%

The Stirling-based insulation maker cheered investors by predicting a sharp reduction in losses for the first half of its financial year, thanks to cost cuts and higher selling prices. Superglass has suffered from a lack of demand for government-backed energy efficiency schemes but is now predicting a return to profit for the full year – having racked up losses of £2.3m in the year to the end of August – after securing a number of “substantial” new customers on the back of an expanded product range.

Shares closed at 3.88p on Friday 4 March, and at 4.25p on Friday 11 March